Health Insurance Merger Mania: Who's Next ?

Healthcare reform has significant impact in the entire health care sector. The Affordable Care Act was intended to cut healthcare costs, and the Supreme Court recently removed much of the remaining uncertaintiees. Obviously health care providers including hospitals and insurance firms need to improve operating efficiency and cut the costs. ACA kick-started industry consolidation from hospitals to Health insurance companies.

Last week Centene (CNC) announced an offer to acquire Health Net (HNT). Centene provides services to under-insured and uninsured individuals. Its managed care segment offers Medicaid related coverage to individuals through government subsidized programs. Its specialty services segment provides services to behavioral healthcare programs.

Under the terms of agreement Centene is going to pay 0.622 shares of Centene plus $28.25 cash per Health Net common stock. Based on the July 1 closing stock price it is valued at $78.57 per share. (0.662 X $80.90 = $50.32, plus $28.25 = $78.57 / share)

Net Purchase price = $78.57 * 77.14 million shares = $6.06 Billion and $500 million debt. It is estimated that the total acquisition cost is $6.8 Billion.

With the Health Net acquisition Centene going to add 6 million new members, out of them 1.6 million Medicaid members. Pro Forma revenue for the year 2015 is going to be $37B. Centene is estimating $75m synergies in the first year, $150m by end of the second year and 20% accretive Earnings per share in the first full year.

On Friday July 3, Health Insurer Aetna (AET) announced it is acquiring another Insurance firm Humana (HUM) for $37 billion in a combination of stock and cash. Humana shareholders get $125 in cash and 0.8375 Aetna common shares for each Humana share, or $230 per share. This will add additional 14 million members to Aetna’s health insurance portfolio and is projecting $1.25B in annual synergies in 2018.

As consolidation in healthcare insurers keeps happening, the five biggest insurers - UnitedHealth (UNH), Anthem (ANTM), Aetna, Humana and Cigna (CI) - will become eventually, I believe, a big three of firms. As many experts in the health insurance industry are speculating, I am also expecting the next low hanging fruit for acquisition to be Cigna Healthcare. Cigna, based out of Bloomfield, Connecticut, collected $31B in insurance fees and premiums last year and had approximately $35B total revenue. Last year Cigna grew its premiums by seven percent and its global customers to 14.5 million.

Last month, Cigna rightly rejected an acquisition offer from fellow insurer Anthem at $47.5B, or $184 for each Cigna share. Probably that is very low acquisition price for such a firm like Cigna. If it is too low, what is the appropriate target price for Cigna?

Here is my estimate of appropriate value of Cigna if any rivals like UnitedHealth or Anthem attempts to acquire Cigna. Here I used relative valuation data from Health insurance industry data prior to merger activity announce; that is, from July 2 data.

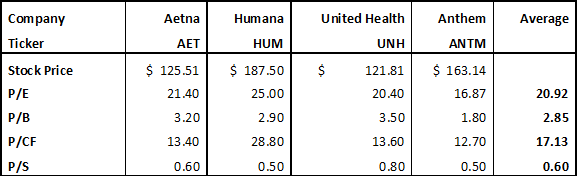

Comparable market data:

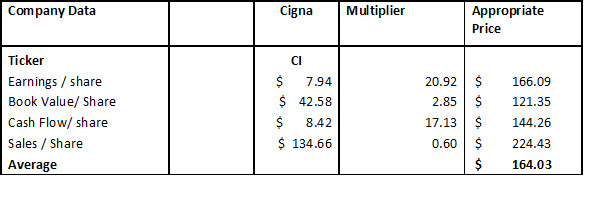

Here I calculate average Price to Earnings, Price to Book, Price to Operating Cash flow and Price to Sales for all Cigna’s four major competitors. I used the averages from this table and multiplied with Cigna’s actual trailing twelve month earnings, book value (current), and cash flow per share and sales per share data. Now I averaged appropriate price obtained from these metrics in the below table.

These above calculations came out with Cigna’s appropriate value, using relative valuation metrics, as $164.03, which is very close to Cigna’s market price of $161.29 on July 2.

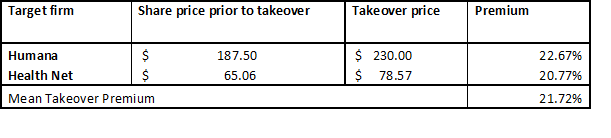

Now let me estimate the appropriate target premium Cigna should get given the data of the two acquisitions recently announced in the Health Insurance industry.

Takeover Premium Measure:

With an average takeover premium of 21.72% from the pre-acquisition price; Cigna should only accept any offer that is more than $199.66 based on Cigna’s estimated price of $164. With all the mergers and acquisitions and dire need to cost cuts and to realize synergies among companies, Cigna is the right candidate in the Health insurance industry consolidation. If there is any acquisition announcement from Anthem or United Health in near future I am estimating the appropriate target price for Cigna should be $200 or above.

Disclosure : Long on Cigna

Excellent analysis. Thanks for posting.

Excellent analysis, thank you.

Thanks for sharing, I've added you to my follow list.