Health Company With A Compelling Turnaround Story: NUTR

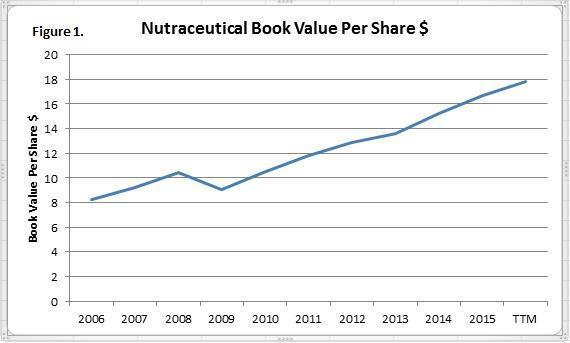

Nutraceutical International Corp (NASDAQ: NUTR) is a gem in the nutritional supplements and natural food industry and a small-cap stock that investors need on their radar. The company has a long term growth history with solid profit margins, combined with a low debt ratio over past two decades.

Nutraceutical is an integrated manufacturer, distributor and retailer of branded nutritional supplements and natural products sold primarily through domestic health and natural food stores, such as Vitamin Shoppe or Lucky Vitamin. Its products are not sold through mass market retailers like Target or Walmart, so market share is limited compared to other giant competitors like Bayer (BAYZF) or GNC.

Q2 Results

The current result of FY Q2 2016 earnings release of NUTR (Jan-March 2016) beat Wall Street expectations. Revenue grew by 7.4% to $54M , and net income increased by 12% to $4.6M year-over-year. The stock price rose from $17 per share in Mar 2016, to current levels of $24.

NUTR has maintained a high quality product line while building a loyal customer base to ensure steady revenue growth with solid profit margins. Its major brands include Solaray, KAL, Nature's Life and Life Time. In the last five years, company revenue grew at 3%-6% clip, with a net profit margin of 10%-13%. Nutraceutical has a debt-to-equity ratio of 0.29 .

The culture of the company is unique. Current CEO and Chairman of Board of Directors Frank W. Gay founded the company in 1993 and served as CEO since 1994. All the nine executive officers served the company for more than 17 years and all the six board members served in the company for more than a decade. Comparing to the high turnover rate of executive teams in the public companies, its management team is pretty stable. Employment environment has strong loyal base too. So the company's culture is clearly to create long term growth (not an M&A style company).

Expansion Strategy

Nutraceutical's expansion pace is slow but steady. It did acquire small competitors gradually to expand its footprint. In FY 2014, the company acquired 7 small competitors for $16M. In FY 2015, it acquired two companies for $1.26M. For the first two quarters of 2016, NUTR acquired Dynamic Health Laboratories and Aubrey Organics for an aggregate price of $26M.

Dynamic Health is a liquid manufacturer located in Brooklyn, New York. It offers organic and nutritional juice concentrates and more than 100 branded natural products, which are primarily sold through health food distributors and internet accounts. Its annual sales reach from $10 to $15 million. Nutraceutical will integrate the Dynamic Health with its Tulsa Oklahoma manufacturing facility over next one to two years. It expects the positive contribution to adjusted EBITA to occur in 2017.

Aubrey Organics offers more than 200 natural-ingredient hair and skin-care products with annual sales around $10-$20 million. Increasing demands for natural and organic facial care products is expected to reach $13.6 billion in 2016 from $9.25 million in 2012. This trend would continue to grow with the increasing aging population and savvy consumers including skin-conscious people. Aubrey Organics is one of prominent vendors in this industry. Nutraceutical will consolidate Aubrey Organics with its offices and manufacturing operations for the personal care business plan.

It is expected these two acquisitions will boost Nutraceutical sales around $25-$30 million per year going forward. Given its acquisition price tag of $26 million, this deal appears to strengthen the companys long term growth goal.

To fund the recent acquisition of $26M, the company net borrowed $16M, and its long-term debt reached to $48M. However comparing to its equity of $166M, the company has managed its debt-to-equity ratio successful, not exceeding 0.29%. It also invested $4M for Property Plan and Equipment and repurchased stock for $3.6M in the latest quarter. In recent years, several companies have taken advantage of low interest rates to borrow large amount of money and then buy back the stocks to lift the stocks price. The average of debt-to-equity ratio is above 0.5, meaning NUTR has modest leverage.

Accord to CEO Frank Gay "Our operating cash flow and banking relationships provide a strong foundation for future acquisitions, investments in property and equipment as well as stock repurchases."

While the company's revenue and net income growth were positive, investors should pay close attention to its increasing accounts receivable (11%) and inventory (7%) to gauge if sales revenue can monetize into cash and not bad debt in the near future. It held $4M cash reserves, which means limited capital capacity for the company to acquire other appealing candidates during the next downturn unless its operating cash flow can generate enough cash reserve. Otherwise, it either has to borrow money or raise capital for expansion. Moving forward, investors should monitor its free cash flow closely to assess the company's expansion capabilities.

Shareholders Snapshot

Nutraceutical's top shareholders are Fidelity (13.66%), Fidelity Low-Priced fund (11.08%), Burgundy Asset (6.88%), Dimensional Fund (6.29%) and Renaissance Technologies (5.46%). Fidelity is a savvy institutional investor in the consumer industry. It invested in GNC and CVS. Burgundy invested in Walgreen (WAG, now WBA) and Johnson & Johnson (JNJ). Both of them have sophisticated investment experience on consumer defensive and staple industry.

Institutions investors currently own 78.56%, while insiders own 12.24%, and CEO Frank Gay owns 7.8%. So management team has shareholders interest in mind. As of March 2016, 335,321 shares have been approved to be repurchased without an expiration date.

Far from its steady revenue and book value growth trend, NUTR stock price has displayed irrational roller coaster style fluctuations over its history. If the stock's price offers another distressed pattern, it would be a precious time for the prudent investor to initiate a purchase position.

Follow our Blog at: www.LeverageEquityResearch.com.

Compelling, I'll keep my eye on this one.