Harvest Health Q2 Financials Show Improvements Across The Board

Harvest Health & Recreation Inc. (OTCQX: HRVSF), a vertically integrated cannabis company and multi-state operator in the U.S., today reported its financial and operating results for the Q2 ended June 30, 2021, as follows:

Q2 Financial Highlights

(Unless otherwise stated, the results are in American dollars - to convert to other currencies go here - and compared to the previous quarter.)

- Revenue: +15% to $102.5M

- Gross Profit: +9% to $52.3M

- Gross Margin: decreased to 51.0% from 53.9%

- Net Loss: -16.5% to $(19.2)M

- Net Loss/share: loss reduced to $(0.04) from $(0.06)

- Adj. EBITDA: +4% to $28.0M

- Gen. & Admin. Exp.: +26% to $33.1M

- Sales/Mktg. Exp.: +36% to $1.2M

- Compensation: -23% to $3.7M

- Cash/Equiv.: -35% to $71M

Q2 Operational Highlights

- Announced its planned acquisition by Trulieve in which each Harvest shareholder will receive 0.1170 shares of Trulieve for each Harvest share, representing total consideration of $2.1 billion and a 34% premium to the May 7, 2021 closing price of the Harvest shares.

- Reached a settlement with grower/processor permittee AGRiMED Industries of PA, LLC.

- Opened 4 new medical retail dispensaries in Florida and 1 new medical retail dispensary in Pennsylvania for a total of 42 owned, operated, or managed 42 retail locations in 5 states, including 15 open dispensaries in Arizona.

Management Commentary

Chief Executive Officer Steve White said that Harvest Health is maintaining its full-year 2021 revenue target of at least $400 million with gross margins expected to be at or above 50%.

Stock Performance

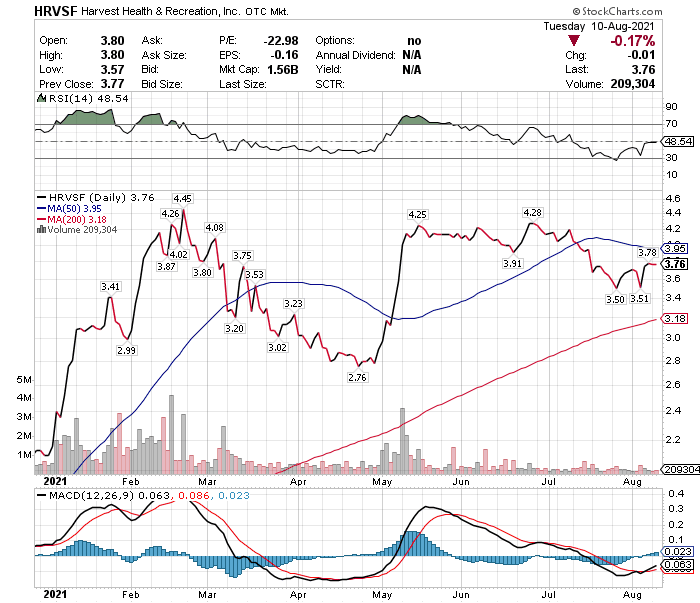

As the chart below illustrates, Harvest Health stock increased +30% over the 3-month Q2 period of April, May, and June but is down -9% since the end of June and is now +75% YTD.

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more