Happy Nvidia Day (For Those Who Celebrate)

Image Source: Unsplash

It sounds like hyperbole, but in this case, I believe it – the single most important company earnings release comes after the close today. Enthusiasm for artificial intelligence has been at the core of the now three-year long bull market – it literally coincides with the launch of ChatGPT – and Nvidia (NVDA) is the nexus of that theme.They helped launch the party and became the host; now let’s see if they can keep it going.

To be fair, NVDA earnings will be only one of a few important factors that investors will need to reckon with before markets open tomorrow. We get an important view on the health of the consumer when Walmart (WMT) reports tomorrow morning.Opinions are important, but results matter more.Not only is WMT relatively ubiquitous throughout the country, but it can also reveal whether high income consumers are “trading down” to WMT from higher end stores, and/or whether lower income consumers are cutting back their purchases. Dour results from Home Depot (HD) yesterday put traders on a negative footing yesterday, so it is reasonable to think that WMT’s comments could influence the vibes surrounding companies outside the tech sector.

And at the risk of burying the ledexoin – we get the long-delayed September employment report tomorrow morning.On any normal day, data on Nonfarm Payrolls and the Unemployment Rate would be the most highly anticipated because of its direct impact on the Federal Reserve’s dual mandate.Simply put, there is no better source of data about the “maximum employment” portion of the mandate than the monthly employment report.Considering that expectations for rate cuts have diminished in recent weeks – probabilities for a cut at the December 10th FOMC meeting are roughly those of a coin flip on both the CME and ForecastEx, and it is not a coincidence that the last record high in the S&P 500 (SPX) was just before Chair Powell’s comments after the last FOMC meeting – an outsized reading in either direction could have important implications for both stocks and interest rates.

But let’s get back to what appears to be the main event. Analysts expect NVDA to earn $1.25/share on sales of $54.9 billion. More importantly, they expect the company to forecast revenue of $61.44 billion for next quarter. That would accelerate sales growth from an already lofty 56% year-over-year boost that a $54.9 billion result would represent.The company is a juggernaut.The more important question is whether the world’s largest company (by market capitalization) can continue to grow at a phenomenal pace, and to what extent that growth depends on so-called “circular” deals between companies in NVDA’s orbit.

One feature that is relatively unusual for NVDA is that it is coming into today’s report on a bit of a down note.Yes, the stock is up about 2% as I type this, but it is down about 10% this month.That could mean that the stock has a lower bar to clear than normal.We have seen various times where NVDA came into earnings near its highs, gave a positive outlook, but failed to rally because that outlook was already priced in.Today we come into earnings with some concerns, meaning that the stock has a lower psychological bar to clear.

We see that options markets are pricing roughly 7% daily volatility for NVDA over the coming week.That is roughly in line with the longer-term average post-earnings move for that stock, but below the 5-quarter average of 3.89% (-0.79%, 3.25%, -8.48%, 0.53%, -6.38%).Note the lack of post-earnings enthusiasm over those quarters, which contrasts sharply with the type of substantial gains that prevailed from February 2022 through May 2024.Again, this is likely to reflect the lofty expectations that were prevailing ahead of recent quarterly results.

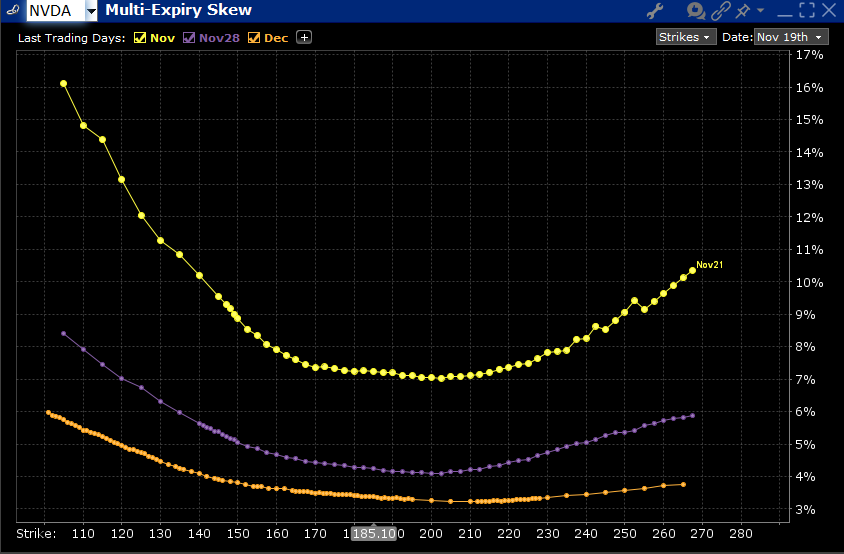

Skews for NVDA Options Expiring November 21st (yellow), November 28th (purple), December 19th, 2025 (orange)

(Click on image to enlarge)

Source: Interactive Brokers

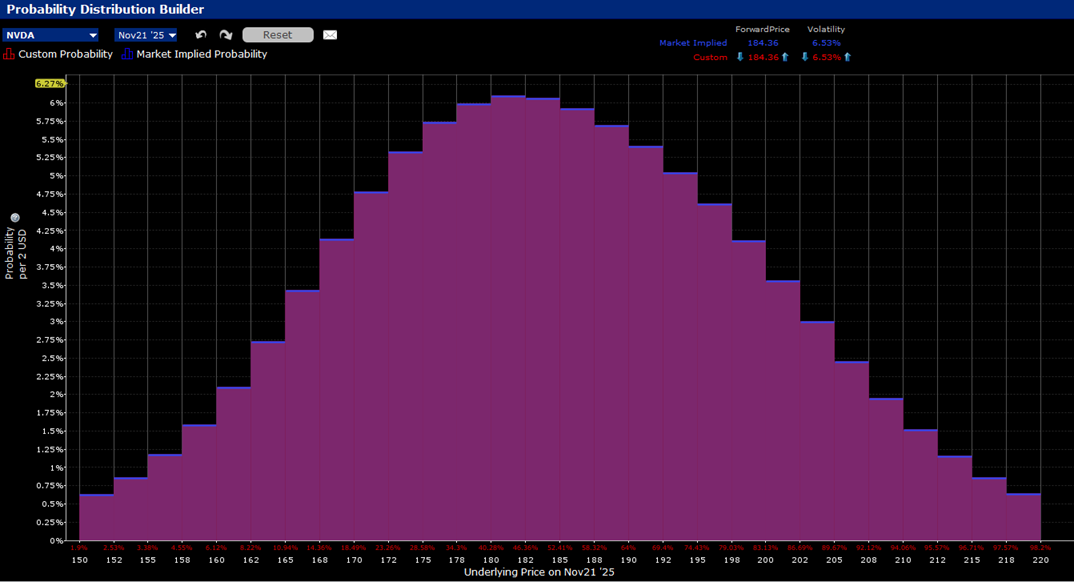

The skews are quite flat across a more than a 10% range around the current at-money level, and generally symmetrical overall.That fits with the notion that traders see the possibility that concerns are already priced in.I like to think of upside calls as “FOMO insurance”, and it is quite reasonable to think that many traders don’t want to risk missing a potential bounce to NVDA’s prior highs.The probability distribution reflects that data.It too is quite symmetrical with a peak at current levels.

IBKR Probability Lab for NVDA Options Expiring November 21st, 2025

(Click on image to enlarge)

Source: Interactive Brokers

At this point, it’s up to Jensen Huang and NVDA management to tell us whether the AI gold rush remains in effect, and for investors to decide whether NVDA and friends will continue to deliver the sort of outsized results upon which the broader market depends.And, oh, by the way, maybe we’ll also get some clues about what the Fed might do next.Stay tuned.

More By This Author:

Nvidia Earnings Test The S&P 500’s Top-Heavy RealityInvestors Bought The Rumor But Sold The News

Stocks Jump As Investors Stand To Benefit From An Imminent Reopening, Favorable Seasonals

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing ...

more