Growth Investing: 3 Top Stocks Worth Consideration

Image: Bigstock

All investors have their preferences within the market. Some prefer to target income, and some prefer value. Of course, some have a growth-styled approach, focusing on companies with bright prospects. It’s worth noting that many growth stocks carry high valuations, as that’s the premium investors must fork up for future growth.

And for those with this type of approach, three stocks – Meta Platforms (META - Free Report), Celsius Holdings (CELH - Free Report), and Chipotle Mexican Group (CMG - Free Report) – could all be solid watchlist considerations.

All three sport a favorable Zacks Rank paired with solid growth trajectories, undoubtedly a strong pairing. Let’s take a closer look at each.

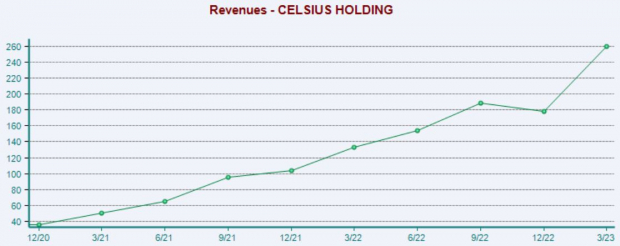

Celsius Holdings

Celsius, a current Zacks Rank #1 (Strong Buy), operates within the functional energy drinks and liquid supplement categories internationally and in the United States. Analysts have upped their earnings expectations across all timeframes.

Image Source: Zacks Investment Research

The company posted notably strong results in its latest release, exceeding the Zacks Consensus EPS estimate by more than 80%. Quarterly revenue totaled $260 million, 15% ahead of expectations and improving a substantial 95% from the year-ago quarter. CELH’s revenue growth has been rapid, as seen in the chart below.

Image Source: Zacks Investment Research

The growth is forecasted to continue, with estimates calling for 150% earnings growth in its current fiscal year (FY23) on 70% higher revenues. And in FY24, earnings and revenue are forecasted to witness an additional 65% and 35% of growth, respectively.

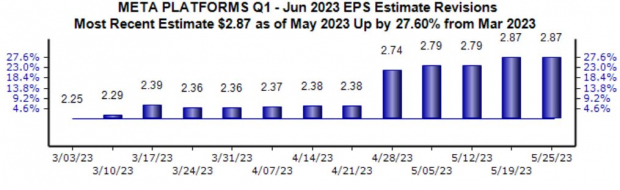

Meta Platforms

Investor favorite Meta Platforms has staged a significant rebound in 2023 so far, with shares up more than 100% and crushing the S&P 500. Analysts have become bullish on the company’s outlook, with the revision trend particularly noteworthy for the upcoming quarterly release on July 26.

Image Source: Zacks Investment Research

The company’s top and bottom lines are forecasted to recover nicely, with estimates calling for 22.5% earnings growth in its current fiscal year (FY23) and a further 23% in FY24. Regarding the top line, sales are forecasted to witness improvements of 9% in FY23 and 11% in FY24.

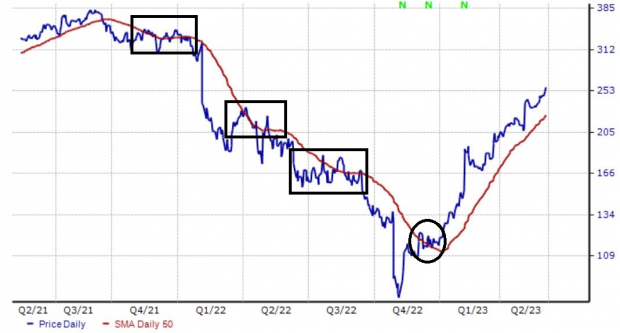

Image Source: Zacks Investment Research

META shares reclaimed the 50-day moving average in late 2022, a level that shares consistently struggled to break through over the last two years.

Image Source: Zacks Investment Research

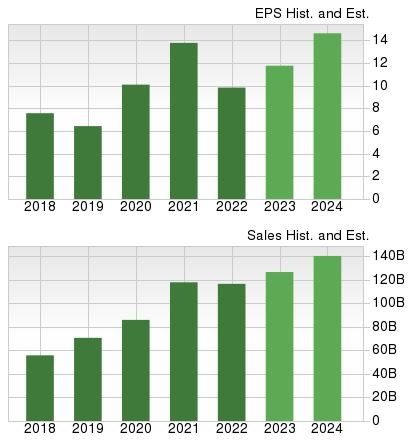

Chipotle Mexican Group

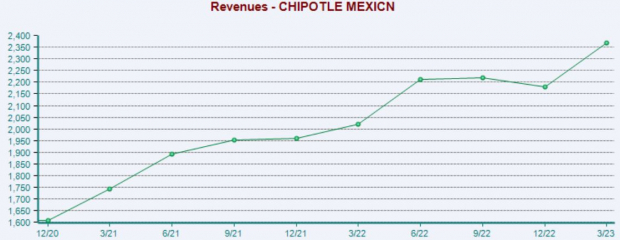

Chipotle Mexican Group shares found plenty of attention following the company’s better-than-expected results, jumping more than 12% in the following trading session. CMG posted an 18% EPS beat and reported $2.4 billion in revenue, with the latter improving 17% from the year-ago quarter.

Image Source: Zacks Investment Research

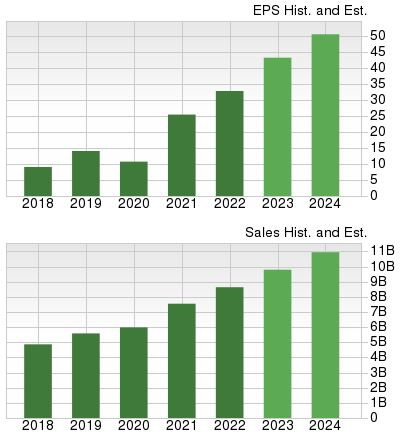

CMG’s growth profile could surprise some, with the company’s earnings forecasted to soar 34% in FY23 on 14% higher revenues. The growth cools off slightly in FY24, with the annual EPS and sales estimates suggesting improvements of 20% and 12%, respectively.

Image Source: Zacks Investment Research

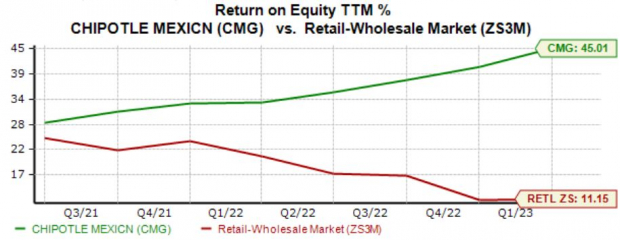

And to top it off, CMG’s 45% trailing twelve-month ROE is worth highlighting, reflecting a higher level of efficiency in generating profits from existing assets relative to peers.

Image Source: Zacks Investment Research

Bottom Line

Growth investors faced a challenging environment in 2022, with a hawkish Federal Reserve dampening the mood. However, all three stocks discussed above – Meta Platforms (META - Free Report), Celsius Holdings (CELH - Free Report), and Chipotle Mexican Group (CMG - Free Report) – have jumped back into favor in 2023, with analysts positively revising their earnings expectations.

All three are forecasted to witness solid earnings and revenue growth in the current and coming year, making them solid considerations for those with a growth-focused mindset.

More By This Author:

Tech ETFs Burning Hot On AI-Fueled Nvidia Surge2 Top-Rated Stocks To Buy After Beating Earnings Expectations

Don't Ignore The Relative Strength Of These 3 Homebuilders

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more