Great Penny Stocks FNMFN TKOI JE FSRL ONVC

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

This week I added some penny stocks that came up on my screeners to the Barchart Van Meerten Speculative portfolio. Added were Federal National Mortgage Association (FNMFN), Telkonet (OTCQB:TKOI), Just Energy Group (NYSE:JE) , First Reliance Bank of SC (OTCPK:FSRL) and Online Vacation Center (OTCPK:ONVC).

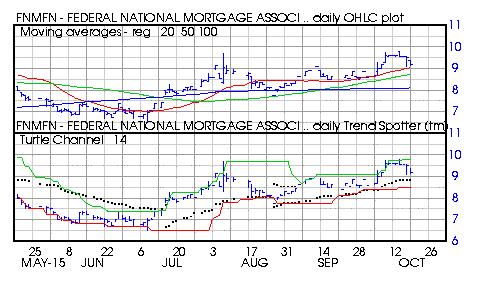

Federal National Mortgage Association

Barchart technical indicators:

- 72% Barchart technical buy signals

- 40.03+ Weighted Alpha

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 7 new highs and up 6.48% in the last month

- Relative Strength Index 54.57%

- Barchart computes a technical support level at 8.9876

- Recently traded at 9.2000 with a 50 day moving average of 8.7216

Telkonet

Barchart technical indicators:

- 40% Barchart technical buy signals

- 54.41+ Weighted Alpha

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 10 new highs and up 12.21% in the last month

- Relative Strength Index 56.82%

- Barchart computes a technical support level at .2379

- Recently traded at .2637 with a 50 day moving average of .2360

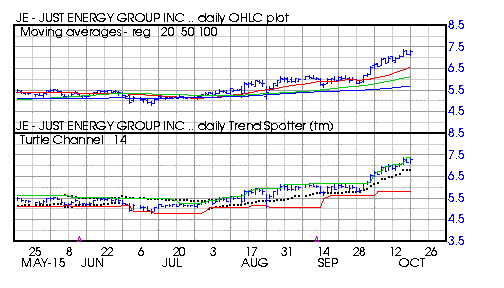

Just Energy Group

Barchart technical indicators:

- 96% Barchart technical buy signals

- 63.00+ Weighted Alpha

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 13 new highs and up 23.52% in the last month

- Relative Strength Index 69.88%

- Barchart computes a technical support level at 7.00

- Recently traded at 7.32 with a 50 day moving average of 6.13

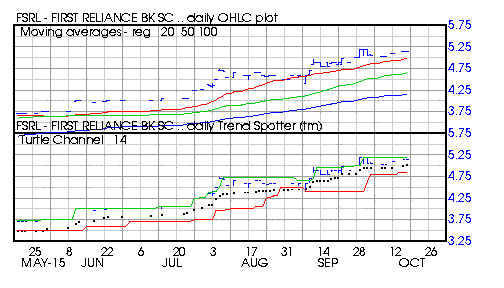

First Reliance Bank of SC

Barchart technical indicators:

- 96% Barchart technical buy signals

- 71.90+ Weighted Alpha

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 6 new highs and up 7.29% in the last month

- Relative Strength Index 68.75%

- Barchart computes a technical support leve at 5.1500

- Recently traded at 5.1500 with a 50 day moving average of 4.6512

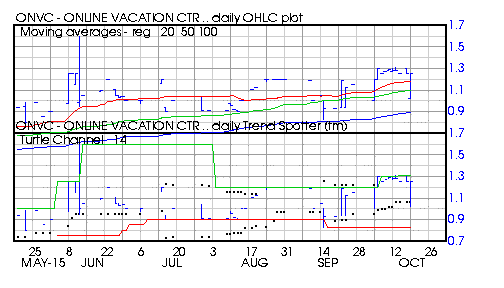

Online Vacation Center

Barchart technical indicators:

- 56% Barhart technical buy signals

- 69.71+ Weighted Alpha

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 5 new highs and up 34.41% in the last month

- Relative Strength Index 56.97%

- Barchart computes a technical support level at .9433

- Recently traded at 1.2500 with a 50 day moving average of 1.1003

Disclosure:None.