Google Vs. Amazon: Choose Your Flavor

Amazon (AMZN) and Google (GOOG)(GOOGL) are both great companies. Jeff Bezos is without a doubt one of the best CEOs in the market and seems to be capable of everything. Google has proven its value many times over and Sundar Pichai is a brilliant CEO who keeps surprising us.

So which one should you buy? It depends.

Source: Author

The Battleground

Google and Amazon are fighting many battles: Cloud Storage, Chromecast vs. Firestick, and the drone delivery business, to name a few. While it is interesting to analyze who is winning each battle, the answer is indeed not straightforward. There is not a definite winner, and the answer would not tell us which one is a better company, much less the better stock.

Source: Stonetemple

It is unlikely, if not ludicrous that one of these companies could take the other one by sheer force. Both companies have enormous moats. Instead, the battle between Google and Amazon is better compared to the Cold War.

Both companies will continue to invest heavily in protecting their respective moats, each trying to increase its edge over the other. It is not the battle for current businesses which is at risk, but the future markets, technologies, and businesses that need to be ensured. Both companies could fare well if the other one succeeds, but neither can afford to slow its pace.

Amazon´s Risks

Amazon has three risks that could trip the giant´s growth: Labor force issues, Environmental Impact, and the Debt-Growth relation.

Its labor force

It is no secret that Amazon has a labor issue. Amazon has received heavy criticism because of its wages policies. While regulation is not a concern in the US for now, it is an issue that could become a severe problem in other countries.

Future Regulation of wages and labor practices in the US and other countries could impact Amazon´s profitability. There is a possible strike right now in the eve of Amazon´s Prime day in Spain. If successful, the trend could expand to other countries and impact Amazon´s bottom line. As labor issues keep, rising Amazon could be forced to increase its wages, which would represent a significant impact on profitability and to the Amazon brand.

Amazon´s problems could be solved with Automation. Further automation of its facilities would reduce the need for employees. Amazon could even increase its profitability. However, the technology required to automate the facilities further is expensive. The capital cost of the equipment makes this an unprofitable decision, for now.

AGV´s, Cobots and automated picking solutions will reduce their cost as the technologies become more widely used. If implementing these technologies becomes cheaper than Amazon´s current labor costs before its wages become an issue, Amazon should have no problem. That is a big IF

Environmental impact

A big part of the Amazon Prime attractive is the free next day shipping. There are obvious costs to make this happen. However, reduced ecological protections allow the operation to be feasible. The growing concern for the environment could trigger regulations, and make it too costly for Amazon to continue its next day shipping practices. Again, the technology could be Amazon´s savior.

The shift to electric vehicles could reduce the emissions enough that the environmental concern is no longer present. However, once again the closest Amazon could be to electric vehicles is the Tesla (TSLA) Truck.

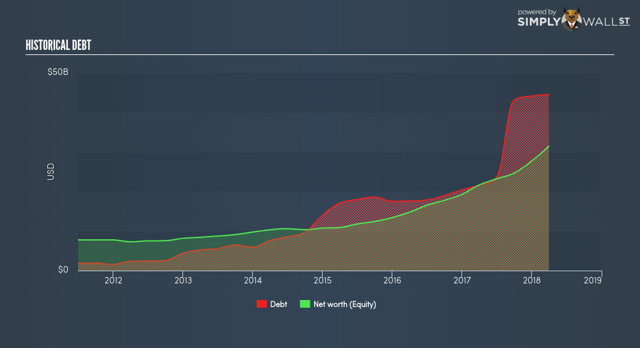

Debt and Growth

Debt is the biggest concern. Amazon will need to continue increasing its debt to grow the business. If profits stagger, the debt could become a heavy burden.

Fortunately, only a small amount of the debt is long-term debt. From the $95 Billions of total liabilities, only $38 Billions are long-term debt. Which is close to the $26 Billions in cash the company reported last quarter.

Source: Simply Wallstreet

While the amount of debt is a growing concern, the growth at which Amazon is expanding should make it possible for it to handle the debt. As long as it keeps growing.

Amazon is a great company, and Jeff Bezos is a fantastic CEO. Nevertheless, every analysis, earnings forecast and even the stock price relies on the fact that Amazon keeps expanding successfully. While there are substantial elements that support Amazon´s growth prospects, its valuation could be based on the Hot-hand fallacy.

Jeff Bezos could find his Waterloo, and the stock price would suffer severely. Carrying high amounts of debt would only make matters worse.

Valuation

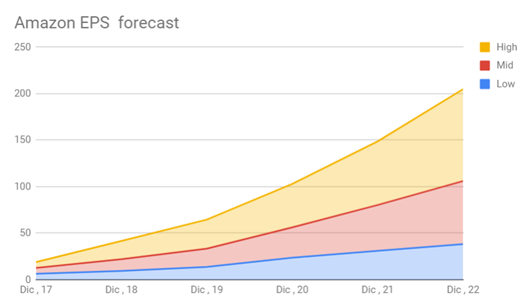

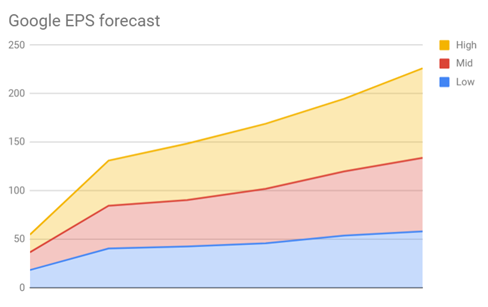

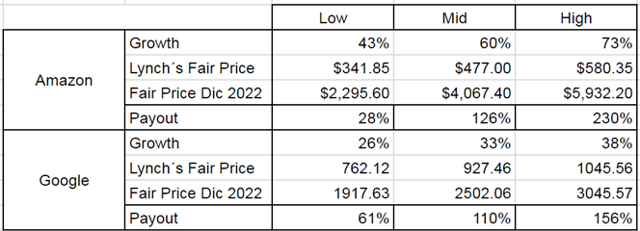

Amazon is overvalued by traditional metrics. But it still might be an excellent opportunity to buy. To explain this, let us compare Google´s and Amazon's valuations and the resulting payout.

Source: Author´s Charts with Simply-wall.st information

I like to use Peter Lynch's ratio when valuing a stock. This method uses the ratio between the expected earnings growth plus dividends and the P/E of the stock to determine its fair value. A stock that has a 1:1 ratio is reasonably priced. The higher the number, the more underpriced the stock is. Inversely, the company growth and EPS could be used to establish the fair price at any given time.

Source: Author´s Charts with Simply-wall.st information

The only valuation consideration we have to make is that Amazon´s cash is at similar levels than its long-term debt, while Google has virtually no long-term debt and has $102 Billions in cash. Which represents around $148 per share, which we will add to the current fair price.

Source: Author´s Charts

Considering the best case scenario, Google has a lynch index of around 0.88, slightly overvalued, while Amazon would have a Lynch Index of 0.32. Highly overvalued. But looking at the potential payout, Amazon comes out on top of Google in most scenarios.

It is very likely that Amazon will become a better investment than Google. While Amazon is likely to give spectacular returns, it could also brig mediocre ones. Google is a more conservative investment, that will likely outperform the market, and could even give spectacular returns.

Conclusions

Both companies and stocks are great. The best stock for you depends on your goals, risk tolerance and the needs of your portfolio. Buying both is also a good way to hedge the risk of one losing a battle over the other one while balancing risk and potential returns.

Much like Tesla and Elon Musk, some investors are overly optimistic about Jeff Bezos and Amazon. If Amazon fails to grow, at least temporarily, the stock could suffer severely.

Disclosure: I am long on GOOG, GOOGL

None.

Good article. What I find most interesting is how #Amazon and Google evolved from such different companies (Amazon a book seller vs. Google an online search engine) to going head to head in so many diverse categories. $AMZN $GOOGL