Google Turns To Nuclear To Power Its Data Centers

Image Source: Pixabay

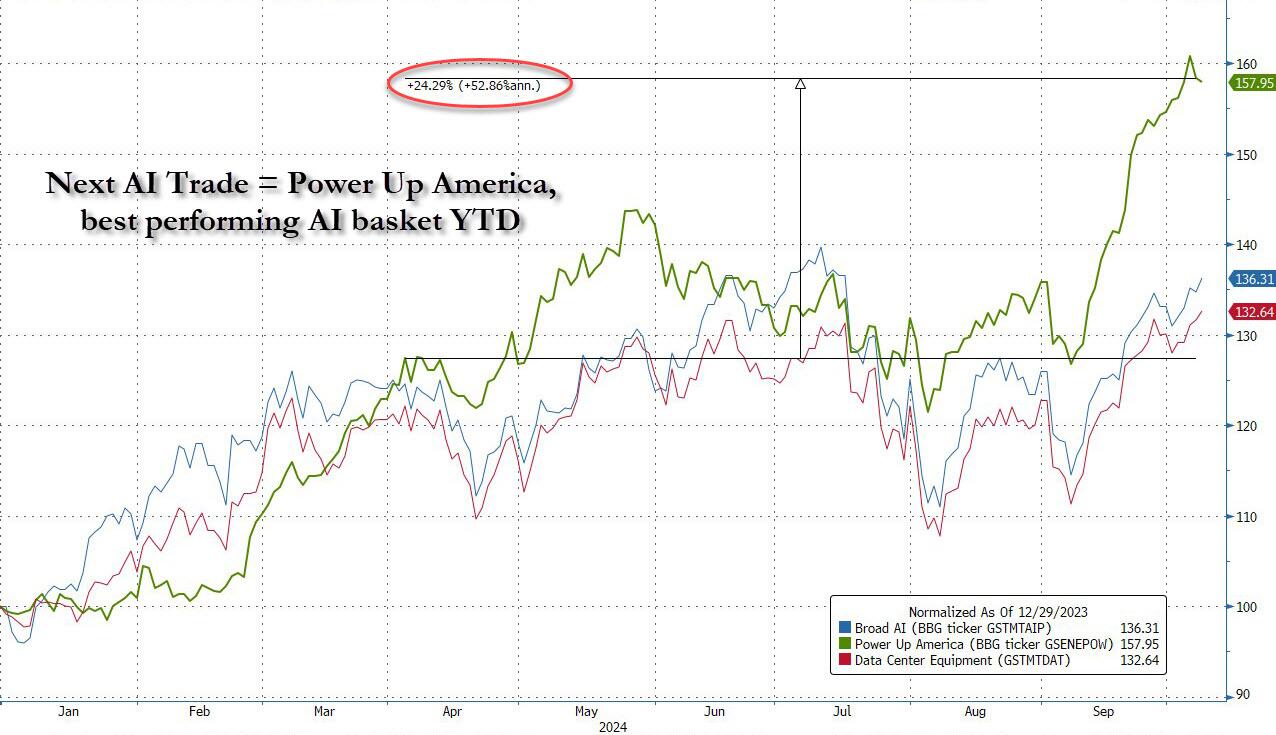

Two weeks ago, Microsoft (MSFT) set the utility space ablaze - metaphorically speaking - when we learned that the tech giant had made a deal with Constellation Energy to restart the Three Mile Island nuclear power plant, site of the worst nuclear accident in US history. Constellation CEO Joe Dominguez said: “Policymakers and the market have received a huge wake-up call. There’s no version of the future of this country that doesn’t rely on these nuclear assets.” Indeed, back in April we forecast that the "Next AI trade", i.e., going along the infrastructure that would make the AI revolution possible, would be far more lucrative than betting on the Nvidias (NVDA), Dells (DELL), and data centers of the world (which would also be a great trade, just not that great)...

The Next AI Trade https://t.co/3WxL99gq3L

— zerohedge (@zerohedge) April 2, 2024

... and so far we have been proven right: as shown below, the "Next AI Trade" as defined by us back in April, is not only up 25% in the past six months (congrats to those who put the trade on) but is the best performing AI basket YTD!

Of course: Microsoft was not the first to show that the way ahead is nuclear: back in March, Amazon Web Services acquired Talen Energy’s data center campus connected to the Susquehanna nuclear station in northeast Pennsylvania. Talen said it had sold the 960 MW Cumulus data center campus to Amazon (AMZN) for $650 million, setting the stage for countless similar transactions meant to provide power the insatiable AI sector, which gobbles up megawatts for breakfast, lunch and dinner.

Microsoft won't be the last either: according to Bloomberg, the last of the Big 3 megacaps, Google (GOOGL), is working with utilities in the US and other countries to assess nuclear power as a possible energy source for its data centers, underscoring surging interest in using atomic energy to feed the artificial intelligence boom.

“In the US, in highly regulated markets where we don’t have the opportunity to directly purchase power, we are working with our utility partners and the generators to come together to figure out how we can bring these new technologies — nuclear may be one of them — to the grid,” said Amanda Peterson Corio, global head of data center energy at Alphabet Inc.’s Google.

She also didn’t rule out the possibility of using nuclear energy in countries like Japan.

For Google, having round-the-clock energy that isn’t intermittent is “critically important as we think about long-term growth,” Corio said.

As if that wasn't enough to guarantee a new golden age for builders of modern electrical infrastructure in the US, last week energy Texas’ top electricity regulator had a message for Big Tech: If you want to build AI data centers next to power plants, you may have to build the power plant, too.

While it is no secret that AI developers are eager to build their data centers next to power plants to maximize efficiency and location, Thomas Gleeson, chairman of the Public Utility Commission of Texas, said allowing construction near existing plants threatens resource adequacy on the grid if the data centers buy all the plants’ power. Texas has at times struggled to keep the lights on as its growing economy and population strain supplies.

“We can’t afford to lose any of our resources off the system at this point, especially given those load-growth projections,” Gleeson said in an interview at the Gulf Coast Power Association conference in Austin, where AI dominated the discussion.

Gleeson said his agency is telling data center developers they will need to supply some of their own power if they want to connect to the Texas grid within 12 to 15 months. Many of the corporations involved, he said, have among the biggest balance sheets in the world and can afford to fund construction of new power plants.

“We have to look at really the co-location issue as being a new facility coming with its own new generation,” Gleeson said.

Developers, he said, could even opt to “over build” — creating power plants that generate more electricity than their data centers need and selling the rest to the grid. “We’re happy to take it,” Gleeson said.

In short, the stellar returns of the "Next AI trade" in 2024 are just the start: as more capital is allocated to "those who provide the electricity to those who sell the picks and shovels for the next gold rush", the basket will blow away every other segment of the market, and the biggest winners will be not those who bet on the revolutionary technology that is AI, but those who backed something much more promitive: the electricity needed to power it.

More By This Author:

Housing Is A Global ProblemHome Depot Hastily Exiting Warehouse Space, Scaling Back More Than 3 Million Sq. Feet In A Month

On The Jobs Report And Recession

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more