Google Tumbles After Ad Revenue, Operating Income Miss

Image Source: Pixabay

As noted in our preview, JPM's head of TMT trading said that GOOGLE (GOOGL) is "probably the most controversial name of the group through our recent preview dinners/lunches" as it is "deemed a much lower quality play on AI" while UBS added that investors have "viewed Alphabet apathetically using it as a funding short for other mega caps." Indeed, from a positioning/sentiment standpoint, GOOGL was the lowest of the mega-cap group at just 7.

Commenting ahead of earnings, Evelyn Mitchell-Wolf, an analyst at Insider Intelligence said that “it’s been a full year since ChatGPT burst onto the scene, putting Google on red alert to defend its core search advertising business,” and added that “on the heels of a landmark antitrust trial centered on that very business, Google Search performance should be yet unscathed.”

Echoing the sentiment, Mandeep Singh, an analyst at Bloomberg intelligence wrote that “expectations have come down for growth in its Cloud segment with the trend of optimization at enterprise customers hurting its growth more than rivals such as Microsoft Azure” adding that “Google has recently announced fee cuts to lure customers to its Cloud.”

Cutting to the chase, the big question into Alphabet's earnings was what, if any, progress they had made on monetizing the AI promise without cannibalizing the company's main moneymaker - search advertising; and just how much capex they blew on NVDA chips to feed the LLM-processing beast.

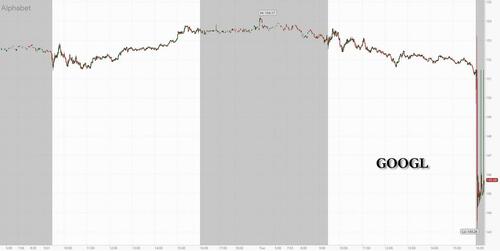

So how did Alphabet do? Well, judging by the plunge in its stock after hours, not that hot.

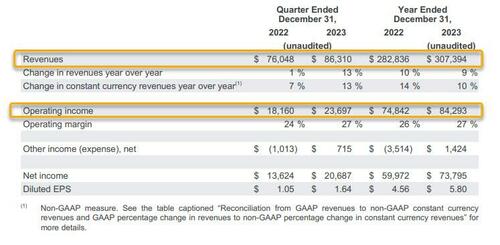

- EPS $1.64, beating the est. $1.59

- Revenue $86.31 billion, beating the est of $85.36 billion

- Revenue ex-TAC $72.324, beating exp. $70.974 billion

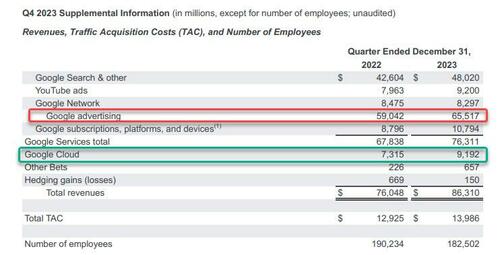

- Google advertising revenue $65.52 billion, missing exp. $65.8 billion

- Google Search revenue $48.02 billion, missing exp. of $48.15 billion

- YouTube ads revenue $9.20 billion, beating exp. $9.16 billion

- Google Services revenue $76.31 billion, beating exp. $75.97 billion

- Google Cloud revenue $9.19 billion, beating exp. $8.95 billion

- Other Bets revenue $657 million, beating exp. $298.6 million

The good news: Google beat on Cloud revenue, which came in at $9.192BN, beating estimates of $8.95BN. The bad news: it missed on Advertising, which came in at $65.5BN, below the $65.8BN expected (up from $59.0BN a year ago). And as everyone knows, when an economic slowdown hits, ad spending is the first to go...

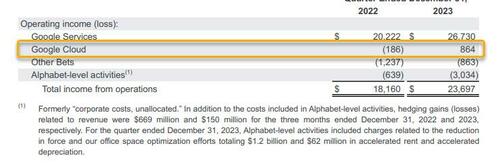

Looking below the line, we find more of a mixed picture.

- Total operating income $23.70 billion, missing estimate $23.82 billion

- Google Services operating income $26.73 billion, beating estimates of $25.75 billion

- Google Cloud operating income $864 million, beating estimates of $427.4 million

- Other Bets operating loss $863 million, beating the estimated loss of $1.26 billion

In total, Google's operating margin of 27%, missed estimates of 27.7%. Finally, the capex of $11.02 billion was more than $1 billion higher than the estimate $9.82 billion. That means less cash for buybacks.

Oh, and for those counting, the number of employees was roughly flat in Q4 at 182,502 up from 182,381 in Q3, when the number of employees slid from 186,779 in Q2.

The disappointing results come at a time of broader uncertainty for Google’s search engine, which has dominated the global internet for years and is the subject of a major antitrust case. Its leading position is threatened by new competition as the rise of generative AI has enabled companies like Microsoft and OpenAI to deliver programs that answer users’ questions in a more conversational fashion, like the wildly popular chatbot ChatGPT.

Google has scramble to incorporate the (largely useless) technology into its own products, and last month released its most powerful large language model, called Gemini. But Alphabet has been dogged by concerns that it’s been to slow to capitalize on the shift in the market and has been playing catch up to Microsoft in the AI race.

Commenting on the quarter, CFO Ruth Porat said that “we ended 2023 with very strong fourth quarter financial results, with Q4 consolidated revenues of $86 billion, up 13% year over year. We remain committed to our work to durably re-engineer our cost base as we invest to support our growth opportunities.”

As CEO Sundar Pichai plows resources into AI and other big priorities, executives have scrutinized operations to identify places where they can make cuts. Earlier this year, the company eliminated hundreds of employees in areas including hardware, engineering, and the moonshot technology lab X. More rounds of layoffs may follow this year, Pichai has said.

And while we wait to see how many times CEO Sundar Pichai will mention AI and try to capitalize on the stupidity of headline scanning AI algos, it's hardly surprising that he too was quite laudatory of his company's numbers, saying that he was "pleased with the ongoing strength in Search and the growing contribution from YouTube and Cloud. Each of these is already benefiting from our AI investments and innovation. As we enter the Gemini era, the best is yet to come.”

Well, there are at least two mentions... only this time the magic is gone, and while Sunday may be pleased, the market isn't and the stock is sliding about 4% after hours, the second consecutive quarter when GOOGL stock has dumped on earnings.

The stock may have a long way to drop from here if the AI myth ends up being just another chatbot bust: Wall Street has had high extremely expectations for Alphabet’s efforts in AI, pushing the stock up almost 60% over the past 12 months, valuing the company at nearly $2 trillion. But now investors are looking for a sense of when the technology will actually start moving the needle for earnings and revenue. For now, the answer remains elusive.

More By This Author:

MSFT Shares Unimpressed By Big Top- & Bottom-Line BeatUS Home Prices Rose For 10th Straight Month In November, But Gains Slow Significantly

Stocks, Bonds, Bullion, & Bitcoin All Rip As Catalyst-Heavy Week Begins

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more