Goodyear Tire: Outstanding Turnaround, Decent Buy

Over the past several months, I've noticed a large number of bullish articles on Goodyear Tire & Rubber (NASDAQ:GT). (See the above video from Aug. 18.) The basic thesis is that management is strong, the company has successfully been turned around, and that it's become the most efficient tire producer in the world. The bulls view GT as undervalued at current prices with the low P/E ratio being cited as one reason to buy.

I found the bull cases compelling enough so that I thought it would be worthwhile to check it out for myself. While I'm certainly impressed with the job management has done at Goodyear, my views on the stock itself are a bit more neutral. To me, the stock looks perhaps slightly undervalued and I can see legit reasons to buy in as management continues the current transformation. Nevertheless, Goodyear lacks the "margin of safety" I personally seek out in investments.

Overview

First things first; let's summarize Goodyear's operations. As most of you already know, The Goodyear Tire & Rubber Company manufactures and markets tires. It was founded in 1898 in Akron, Ohio and major competitors include Michelin (OTCPK: MGDDF), Bridgestone (OTCPK:BRDCY), Pirelli (OTCPK:PPAMF), and Cooper Tire & Rubber (NYSE:CTB).

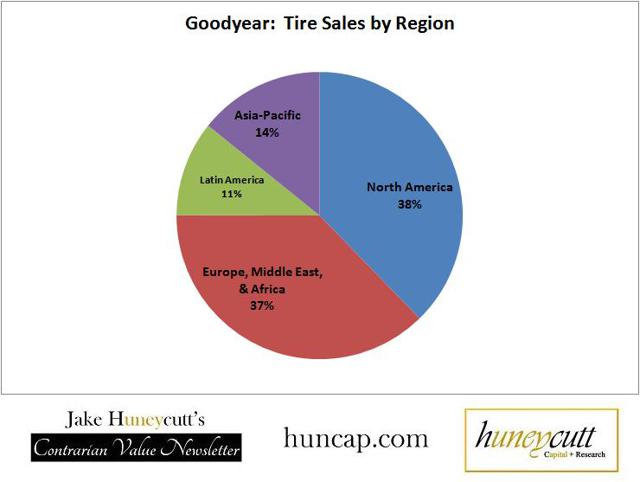

Goodyear operates globally, with about 38% of its tire sales in North America, 37% in Europe and the Middle East, 14% in Asia-Pacific, and 11% in Latin America. Latin America may provide the best growth prospects moving forward and GT is planning on opening a new factory in Mexico by 2017.

Goodyear is also one of the more surprisingly complex large cap companies I've come across that's not a bank or insurer. The reason I say that is because it consistently has a lot of oddball items in its earnings reports. It is also subject to significant foreign currency swings and has a defined benefit pension plan. All of this is on top of operating in a very cyclical industry and having a significant debt load. For these reasons, there is a lot of room for interpretation when it comes to valuing GT.

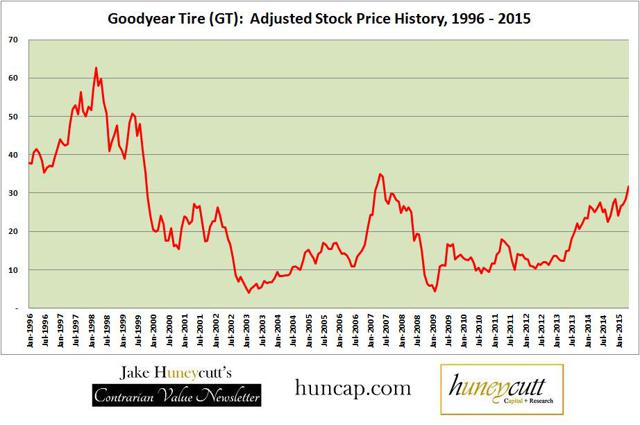

Over the past few decades, Goodyear has made a rather poor investment. It's really only in the past few years that it's started to see significant improvement. The chart below shows Yahoo Finance's "Adjusted Stock Price" history, which takes into accounts splits and dividends. As you can see, GT was a pretty big loser up till around mid 2013.

If you had bought into GT in January 1996, even with the surge over the past few years, you still would've lost about 25%; an extremely dismal return. Nevertheless, companies change and there are reasons to be much more optimistic about Goodyear's future.

The Bull Cases

With that overview, let's now take a look at some of the more well articulated bull cases on Goodyear.

Anthony Ruben: Goodyear Has Good Tailwinds and Reasonable Valuation

Ruben makes one of the most compelling cases for Goodyear I've seen. He points out that Goodyear has an attractive niche in North America with high-value added tires, a market that's increasingly growing. He believes that Goodyear will see a lot of attractive tailwinds in the upcoming years, including lower oil prices, a stronger North American economy, improving economic situation in Europe, and tariffs on Chinese imported tires. Anthony also views GT's e-commerce site, reduced operating costs in the New Mexico plant, and a fully-funded pension as big plusses moving forward. At the current price of $30, Ruben believes GT is about 20% undervalued and has room for potential upside surprises on earnings.

Jake Hannah: Why Goodyear Tire & Rubber is a Steal at Current Prices

Hannah likes Goodyear's high earnings yield of 37% and strong return on equity of 93%. Hannah believes it's a strong buy. I tend to disagree strongly with Hannah's reasoning. As we'll explore in this article, I believe GT's earnings are deceiving due to one-time items and result in inflated stats and multiples. While earnings are strong, several adjustments are needed to "normalize" income for Goodyear and come up with more reasonable earnings and cash flow estimates moving forward.

Arie Goren: Why Goodyear Tire & Rubber Stock is a Buy Right Now

Arie makes a good case similar to Anthony Ruben. Arie views the US Dollar strength as a headwind for GT, but nevertheless thinks that growing North American and Chinese car sales will help drive revenue growth moving forward. Also similar to Anthony Ruben, Arie views the value-added tire segment as being one of the big drivers of growth. He believes the valuation is very attractive with GT selling at 5.5x EV / EBITDA and a PEG ratio of 0.88. He mentions the low trailing P/E ratio of 3.21, but once again, I view this particular metric as misleading since the "E" is inflated by one-time items.

Alpha Stars: The 3 'E' Reasons Why Goodyear Will Be Around for 117 More Years

AlphaStars focuses particularly on Goodyear's e-commerce initiatives, pointing out that online sales are expected to grow at about 9% - 10% annually for the next few years. AS also highlights excellent management which has improved margins and reduced waste. AlphaStars does not actually make a buy recommendation, however; merely insinuating that GT will perform well in upcoming years.

Those four articles provide a pretty decent overview of the bull case for Goodyear. Now, it's time for my own analysis.

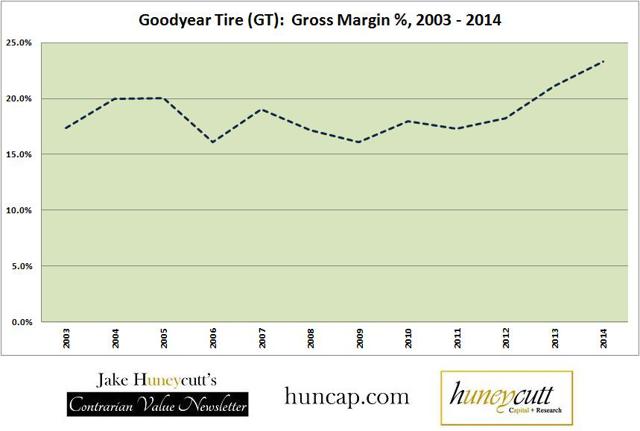

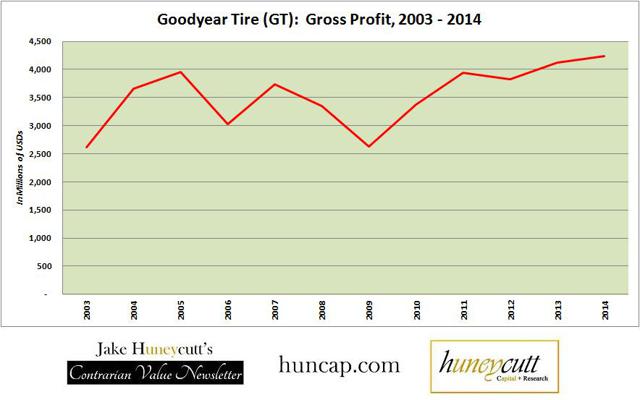

Gross and Operating Margins

The bulls are certainly right about Goodyear's management. GT's financials have improved significantly over the past half decade. The most major improvements have come on the operating side. In the charts below, you can see the evolution of GT's gross profits and gross margins over the past 12 years.

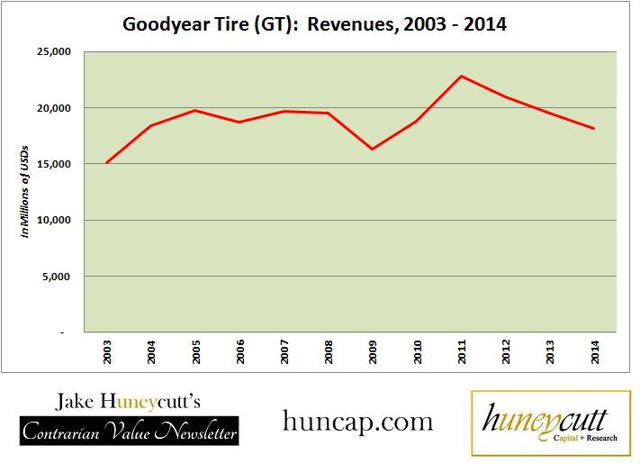

There have been some gains in this sphere with the gross margin rising to 23.3%, up over 300 basis points from 20.0% in FY 2004. However, muted revenue growth somewhat offset this margin improvement.

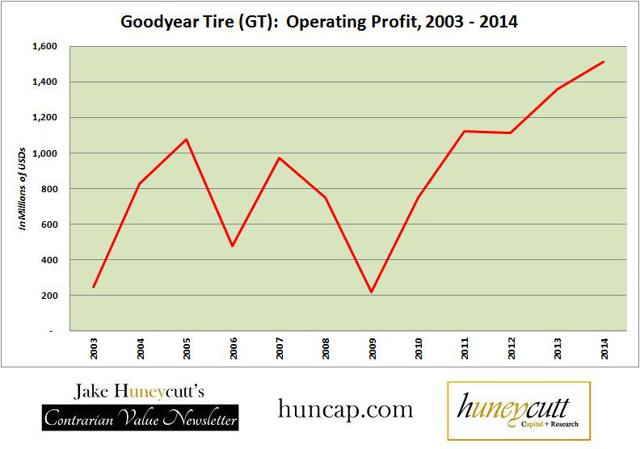

Revenues are surprisingly flat from FY 2004 - FY 2014. Nevertheless, Goodyear has made major strides on the operating front, as Operating Profit has increased from $829 million in FY 2004 to $1.5 billion in FY 2014. Much of the improvement has come over the past 4 - 5 years. The operating margin for GT increased from 4.5% to 8.3% in that timeframe, as well.

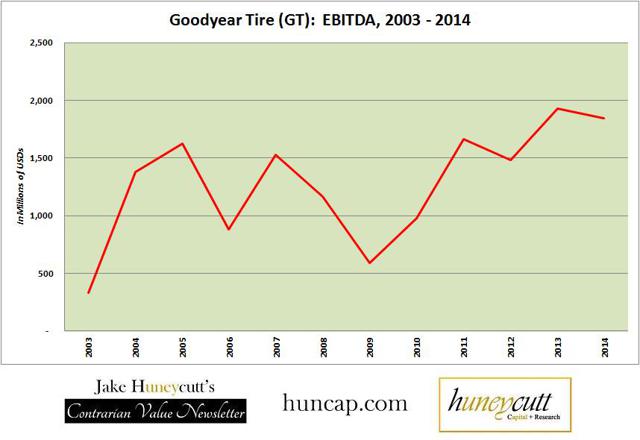

Let's also take a quick look at EBITDA. While this metric hasn't improved as much as Operating Profit, it's nevertheless jumped from about $1.4 billion in 2004 to $1.8 billion in 2014.

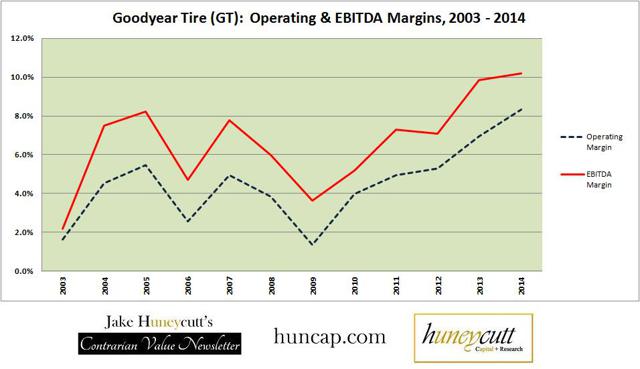

The chart below also showcases operating and EBITDA margins over the past 12 years. Both metrics have improved significantly, with operating margin jumping from 4.5% to 8.3% over the past decade.

Overall from these figures, it's easy to see that Goodyear has made some huge strides over the past half-decade and it shows in the financials.

Income and Cash Flows

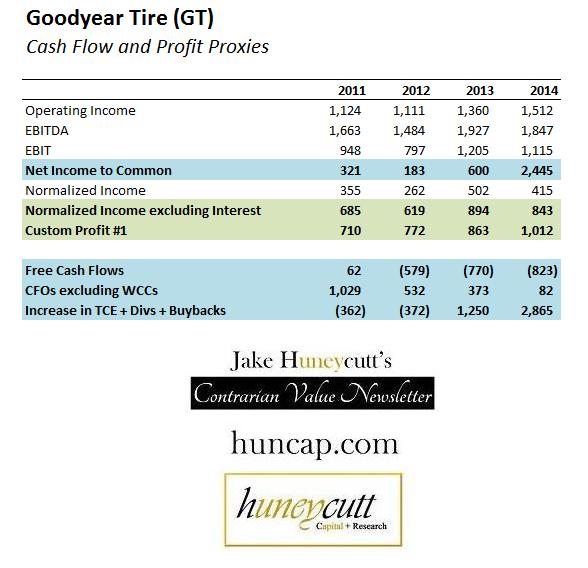

Let's take a look at income and cash flows next. For Goodyear, I encountered several issues in trying to gauge the company's "true profit level." GT seems to have an abundance of one-time and oddball items that distort results on a year-to-year basis significantly. For that reason, I'd use a lot of caution with Goodyear's net income figures.

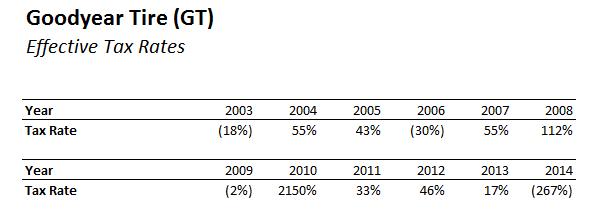

For FY 2014, in particular, Goodyear's Net Income of $2.5 billion was dramatically boosted by a huge tax benefit of $1.8 billion. In other words, the tax benefit accounts for nearly 75% of income. I've seen several articles on Goodyear that mention the low P/E ratio without pointing out that the "E" is artificially boosted by that non-recurring benefit.

Indeed, Goodyear's tax situation is one of the more difficult ones to analyze. The chart below shows Goodyear's effective tax rate since FY 2003. As you can see, it's difficult to make much sense of it.

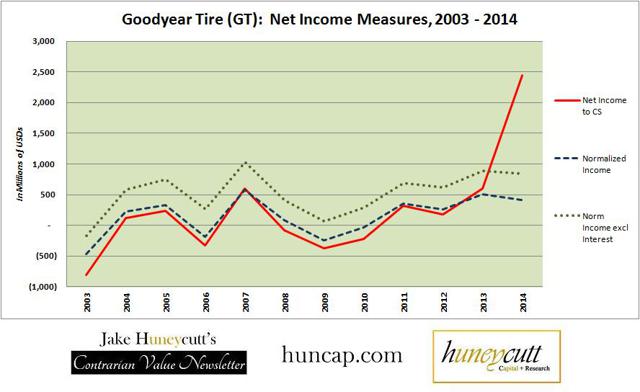

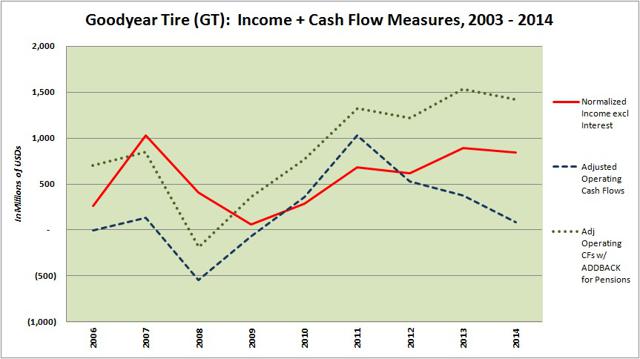

I've made an attempt to normalize earnings by removing one-time items and averaging out some lumpier items. It's certainly not perfect, but it makes more sense than the "Net Income" figure. In the chart below, you can also see the "Normalized Income" measure excluding interest expense. This is one of my favorite cash flow proxies with companies that have similar profiles to Goodyear.

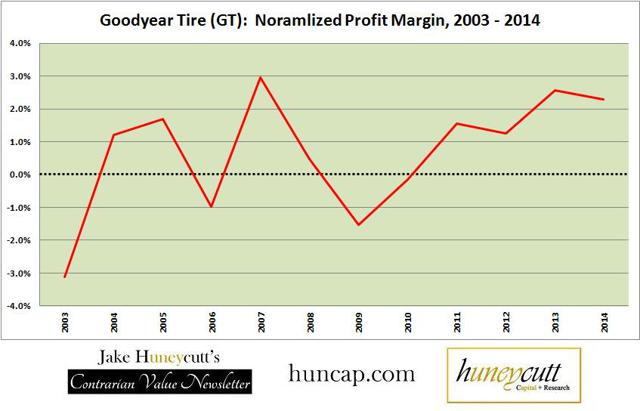

Based on this, we can see a gradual improvement at Goodyear over time. Normalized Income excluding Interest Expense has improved from $589 million in FY 2004 to $1.01 billion in FY 2014. Nevertheless, the Normalized Profit Margin is still surprisingly low at 2.3%. I have not yet looked at Goodyear's competitors, but if this is the industry norm, I have to wonder if we'll see any consolidation in the upcoming years. Certainly, Goodyear's historic profit margins are dismal and even the improved margins of the past few years still seem to be near the floor.

While some might view this as a negative, I view it as an indication that there might be additional upside here. Economically, these situations rarely continue over the long-term. Note that we saw a similar scenario in the airline industry where profit margins seemed ridiculously low for decades, before suddenly shooting upwards over the past several years.

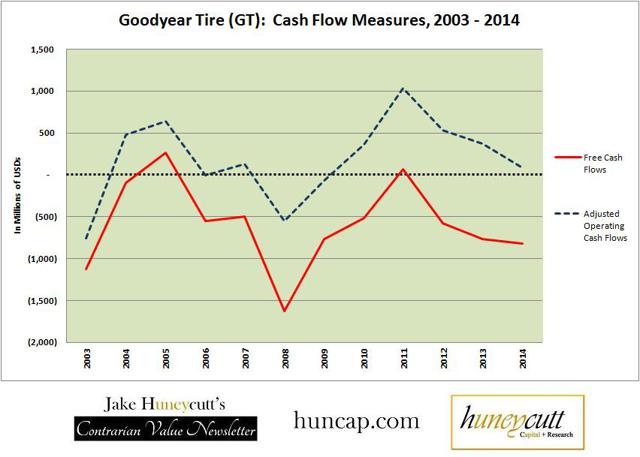

If there's one metric on which Goodyear still seems to be struggling mightily, it's free cash flows. The company has consistently been cash flow negative over the past decade, with only a few brief excursions over the black. Over the past three years, free cash flows have been in the negative $575 - $825 million range; suggesting that Goodyear still might have a long way to go.

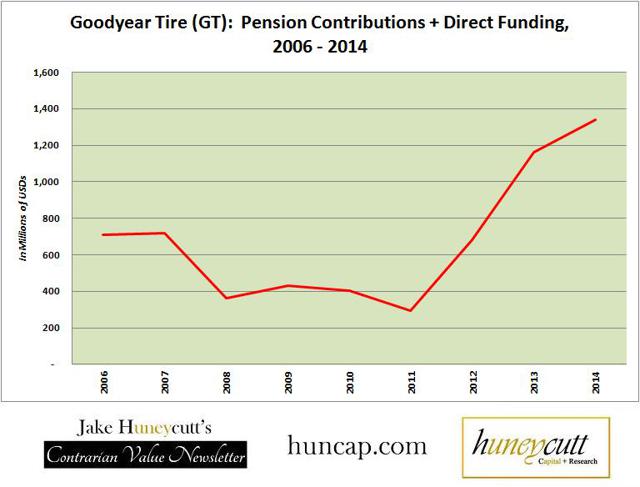

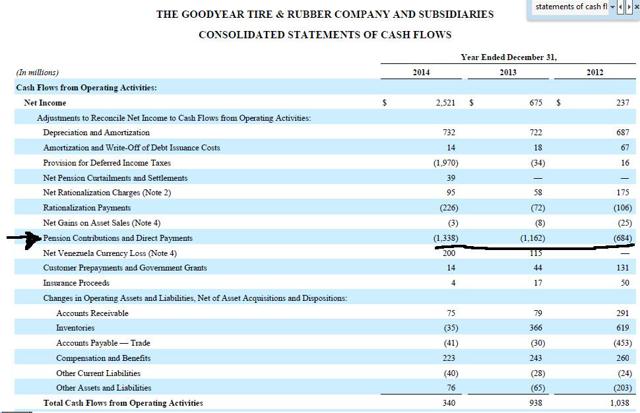

It's not simply that capital expenditures have been high. If anything, capex is about where one should expect it to be. Rather, GT's operating cash flows are the real laggard. As my brilliant MS Paint created graphic below shows, the biggest source of this appears to be pension contributions.

It's worth noting that these pension contributions have been particularly high over the past few years. In FY 2013, it hit $1.16 billion and in FY 2014, it hit $1.34 billion.

This explains the significant gap between Goodyear's "Normalized Income" metric and Operating Cash Flows. The chart below compares "Normalized Income excluding Interest" and "Adjusted Operating Cash Flows" with a new metric, "Adjusted Operating Cash Flows excluding Pension Contributions." You can see a major difference once this is factored in.

While it might be tempting to view these as temporary items, I'd be skeptical of that. Indeed, I wouldn't be surprised if many companies with defined benefit pension plans continue to deal with these sorts of issues over the next decade.

Central banks have beaten down interest rates to rock-bottom levels making it more difficult for pension funds to meet their targets. In contrast to defined contribution plans, which payout retirees based on returns on investment, defined benefit plans provide a guaranteed return regardless of market conditions. That's an issue because the Federal Reserve Bank has reduced long-term returns on investment with its various quantitative easing programs.

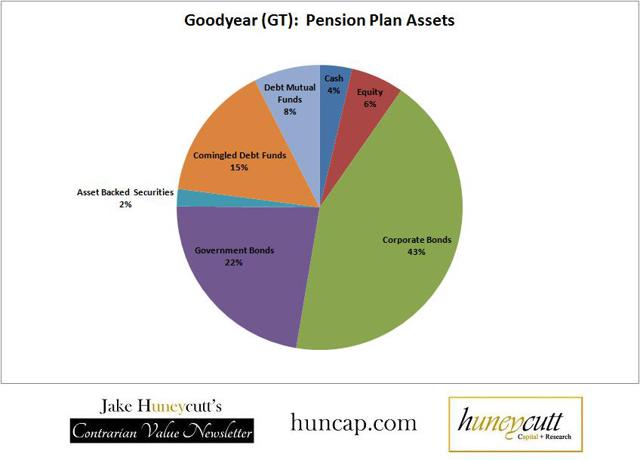

None of this is to sound alarmist. It's merely to suggest that pension costs are an under-the-radar issue that could drag down results for some firms over the next decade. Goodyear has an expected weighted-average rate of return on its assets of 5.47% according to its latest financial statements. About 90% of its plan assets are in fixed income securities, with 43% invested directly in corporate bonds and 22% in government bonds.

Given the extremely low yields on high-grade debt securities right now, 5.47% may in fact not be a realistic long-term return for Goodyear's plan assets. Consider that a 10-year US treasury bond only yields 1.91% right now, while a 10-year A-rated corporate bond will probably yield about 2.88%. It may not be a stretch to suggest that the long-term return on plan assets could fall down to the 3% - 4% level.

Goodyear has plan assets of about $9 billion as of the end of its last fiscal year. With a 5.47% rate of return, one would expect a gain of $491 million, but with a 3% rate of return, that figure falls to $269 billion; a $122 million difference. Going back and looking at our "Normalized Income excluding Interest" measure, you'll note that GT earned $843 million by this metric and that $122 million is about 14.5% of that.

Goodyear's High Cost of Debt Will Fall

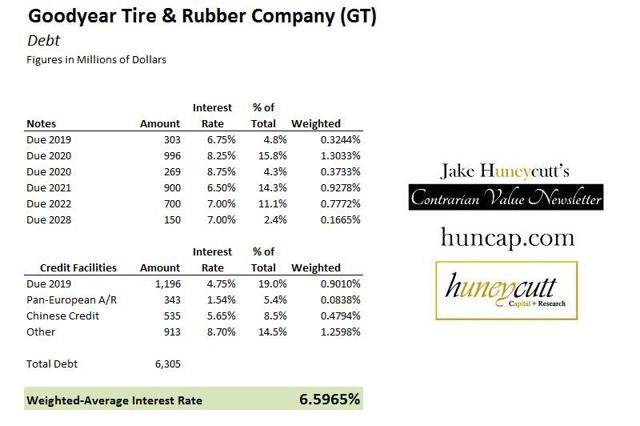

There is a plus here, however. While I suspect that GT's pension plan will be a drag on future results due to the rock-bottom interest rates, GT should be able to reduce its interest expense moving forward. Goodyear has a surprisingly high cost of debt with a weighted-average interest rate at 6.6%.

The company currently has a Ba3 rating from Moody's, which puts it into "speculative grade." If Goodyear is able to continue operating as it has the past few years (even without future improvements), there's a good chance that it could become investment grade at some point. With low interest rates, Goodyear should be able to refinance at better rates and reduce its weighted-average cost of debt.

Goodyear has a long-term debt burden of about $6.2 billion and it had a net interest expense of $428 million in FY 2014. That puts it at an effective interest rate of about 6.9% for the past year. With 160 bps improvement to 5.3%, Goodyear's interest expense would fall by about $100 million. That should help offset some of the detriments on the pension side of things.

Valuation

With all that, let's take a stab at valuation. Due to all the factors involved with Goodyear, I would make sure to point out that the valuation here has a lot of uncertainty. That creates potential opportunities but also suggests above-average risks.

In my valuations, I always try to find a "true level of profitability." This is to say, once you strip out lumpy items, how much does a firm really earn? With Goodyear, I found this question more difficult than usual to answer. The chart below lays out several income and cash flow proxies. As you can see they vary dramatically.

The rows highlighted in green show my guesses at "normalized free cash flow", but I'm less confident in those numbers than I typically am because of the pension plan and currency translations. I'll peg Goodyear's "true profitability" somewhere in the $700 - $900 million range, with $800 million being my best guess.

If Goodyear is able to continue making operational improvements, grow revenues, and increase market share, then a $50 valuation would not be unrealistic. On the other hand, if GT's profits suffer due to cyclical factors and the company continues to find the strong Dollar and low interest rates an issue, then a valuation at $20 would be more reasonable.

Based on all factors, however, my most "Most Probable Valuation" is around $34 for Goodyear. It currently sells at $30 so it would appear slightly undervalued.

Conclusions

Goodyear is a decent buy at $30. It has too many risk factors, however, for me to consider it a superior opportunity at the current price level.

While margins could improve some more in the future, the commoditized nature of this industry might limit the upside. Moreover, I have significantly concerns about nearly all firms with defined benefit pension plans moving forward. The actions of the US Federal Reserve Bank over the past several years have reduced long-term returns and will prove to be a major headwind for companies with these types of pension plans. However, this will be partly offset with Goodyear, as they reduce their costs of debt and improve their credit rating.

I could see myself becoming personally interested in GT if the price were to fall back to the $20 - $25 range. At that price-point, it would have a greater "margin of safety." At $30, I view it as a slightly undervalued above-average dividend growth investment that can be a worthwhile buy for some investors.

Admittedly I haven't read all the other articles you link to yet, but I'm curious, and most hesitant, about the commodities aspect e.g. cost of rubber itself, which I think has been beneficial for the tire companies lately - but the fact that a few not-entirely-stable Asian countries control so much of the commodity worries me. Do you happen to know offhand how GT manages that? (owns rubber plantations etc?)

I live in Thailand Wendell and don't share your concern about the stability of Asian countries where rubber is a major commodity. Malaysia certainly is stable and despite the impression gained from the 2014 coup Thailand is very stable indeed. The other rubber producers like Vietnam and Indonesia are also very stable indeed so your concerns about Asia are ill founded. There are many farmers here in Thailand who are switching to rubber out of sugar due to falling sugar prices and poor outlook so the future looks pretty secure to me.

Interesting, thanks for sharing.

I'd never thought about the e-commerce angle, which is a very good point in market growth. So I looked on Amazon and GT has the #2 highest number of products for sale (via Amazon Prime) - Michelin being #1. The products are stocked in Amazon warehouses for quick delivery - I wonder how much that costs? On the other hand saves on warehousing etc.

This is a great article! I'm glad you focus on the margin of safety, which is always a concern of mine. One question - could you identify the 'oddball items' a bit more, if you get the chance? Thanks again.

Excellent analysis, thank you. I've added you to my follow list.