Good Prospects For Biotech Verona Pharma's Thursday IPO

Deal Summary

Verona Pharma (Nasdaq:VRNA), a company currently developing inhaled treatments for respiratory diseases, has announced its plans to IPO on the Nasdaq Stock Exchange.

The company filed confidentially on November 23, 2016 and plans to list under the symbol VRNA. Verona expects net proceeds of $77.1M through the IPO (assuming underwriting exercise in full their option to purchase additional shares). It will offer 5.768M American Depository Shares (ADS) at its converted AIM price of $13.49.

Company insiders intend to purchase 1.7M of the 5.768M shares being offered. The company plans to make its debut on Thursday, April 27. Upon completion of the IPO, the company will be listed on the Nasdaq and the AIM market of the London Stock Exchange. The company went public on the London Stock Exchange in 2005.

Underwriters to the IPO include SunTrust Robinson Humphrey, Wedbush Pacgrow, Stifel and Jefferies.

Upon completion of the IPO, Verona Pharma will have a market cap value of $163M.

We first previewed the deal on our IPO Insights Platform.

Company Overview

Founded in 2005, Verona Pharma (VRNA) is a clinical-stage biopharmaceutical company that focuses on the development and commercialization of innovative therapeutics for patients with respiratory diseases and unmet medical needs. RPL554, the company's product candidate, is a first-in-class, dual, inhaled inhibitor of the enzymes PDE4 and PDE3 that acts as both an anti-inflammatory agent and a bronchodilator in a single compound. The product candidate has undergone eight Phase 1 and 2a and is being developed for use in the treatment of Chronic obstructive pulmonary disease (COPD) and cystic fibrosis (CF).

On April 18, the company received FDA approval to initiate clinical trials in the US for its RPL554 candidate.

(Click on image to enlarge)

Executive Management Overview

Dr. Jan-Anders Karlsson has served as Verona Pharma's Chief Executive Officer and board member since joining the company in 2012. Previously, her served as Chief Executive Officer of S*BIO Pte Ltd., a Singapore-based biotechnology company (from January 2005 to May 2012). Dr. Karlsson earned his M.Sc. in pharmacy from Uppsala University and attended the University of Lund, where he received a Ph.D. in clinical experimental pharmacology.

Piers Morgan has served as Chief Financial Officer since joining the company in September 2016. Prior to this, we was an independent consultant (from November 2015 to September 2016). From May 2014 to November 2015, Morgan was the CEO of C4X Discovery plc, a biotech company. Morgan received an M.A. in law and management studies from the University of Cambridge and is a registered Chartered Accountant in England and Wales.

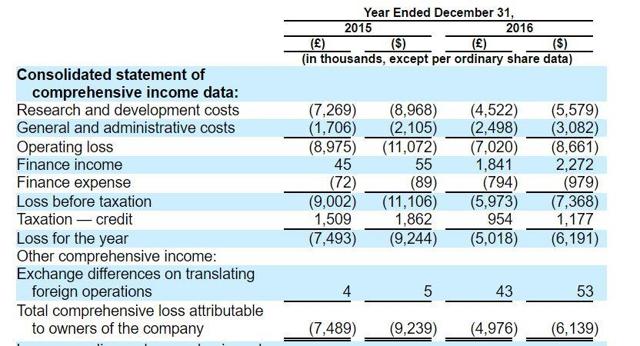

Financial Overview

Product candidates are not available for commercial sale and company is not generating revenue. Operating losses were £8.9M and £7.0M for the year 2015 and 2016, respectively and the company has an accumulated loss of £28.7M. The company reports $56.9M in total assets, $14.4M in total liabilities and $42.5 in stockholders' equity.

(Click on image to enlarge)

Competitors

Verona Pharma competes directly with pharmaceutical and biotechnology companies that focus on treating respiratory diseases. The company also faces competition from governmental agencies, academic research institutions and other types of private and public research institutions. The industry is likely to see increasingly intense competition as new technologies emerge. Verona Pharma indicates in its IPO filing that key competitive factors affecting the success of its product are likely to be dosing convenience, safety, efficacy, price, the level of generic competition and whether consumers may receive reimbursement from third-party payers.

Conclusion: Consider A Modest Allocation

Due to the increasing need for new technologies to meet the needs of patients living with respiratory diseases and illnesses, Verona Pharma has an opportunity to make a name for itself in the U.S. market, and investors should consider keeping a close eye on the upcoming IPO in the U.S.

The FDA's recent approval to initiate clinical trials in the US bodes well for the product candidate's success.

As of now, Verona Pharma seems to be moving in the right direction. We recommend investors consider no more than a modest allocation.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my own ...

more