Goldman Sachs To Face Litigation Over 1MDB Scandal

The resolution of the multibillion-dollar 1Malaysia Development Bhd (1MDB) scandal, in which Goldman Sachs (GS) is engulfed, seems far from over. The U.S. District Judge, Vernon Broderick, recently declined requests from the company, its former CEO, Lloyd Blankfein, and former chief operating officer, Gary Cohn, to dismiss the lawsuit filed by its shareholders. Nonetheless, the bank’s former co-CEO, Harvey Schwartz, has been dropped from the case. The news was reported by Reuters.

Shareholders, being led by the Swedish pension fund, Sjunde AP-Fonden, had sued Goldman in late 2018, alleging it of conning them about the firm’s work with the sovereign wealth fund, arranging three bond offerings raising $6.5 billion and garnering fees estimated at $600 million. Goldman has rebuffed any accountability in the scandal and put the blame on a former partner, Tim Leissner, who had pleaded guilty and collaborated with the government.

Authorities have claimed that the sovereign wealth fund’s officials and allies plundered the bond proceeds for extravagance and to finance Hollywood films, while Goldman’s bankers greased palms of Malaysian and Abu Dhabi officials to procure the 1MDB business.

The judge remarked that the shareholders had appropriately asserted that numerous statements made by the bank and its top executives on the 1MDB case were deceptive and unambiguous. Among the examples specified were Blankfein’s comment in a 2018 interview that he was “not aware” of any red flags, as well as the chairing of a committee by Cohn, approving Goldman’s 1MDB deals.

Broderick remarked, “Taking these allegations as true, I find it unlikely that Blankfein would not have been aware of any warning signs about 1MDB prior to the scandal breaking.”

Goldman had argued that the shareholders had not portrayed that the misstatements were crucial to investors, were fake or neglected information, or that the bank planned to delude shareholders or induced their losses.

Albeit the judge said that Goldman’s statement of being “dedicated to complying fully with the letter and spirit of the law, rules and ethical principles that govern us” would ordinarily be “puffery”, thereby exempting its claims from being misleading, he furthered by saying that other courts have found such statements to be subject to legal action when “paired with unlawful behavior or other actionable statements.”

Last year, the bank entered into the long-awaited settlement with the Malaysian Government. The terms included payment of $2.5 billion as penalties. Also, Goldman had guaranteed that the authorities would receive $1.4 billion from the proceeds of assets, which have been seized globally as those were related to the 1MDB scandal.

Earlier in May, 1MDB and SRC International Sdn Bhd filed lawsuits against JPMorgan (JPM) and Deutsche Bank (DB) to recoup assets worth more than $23 billion.

Bottom Line

Although Goldman has resolved quite a few litigation issues, it still faces probes and queries from a number of federal agencies, and a few foreign governments for businesses conducted during the pre-crisis period. As a result, the company’s legal expenses are expected to remain elevated, which might partially impede its bottom-line growth in the near term.

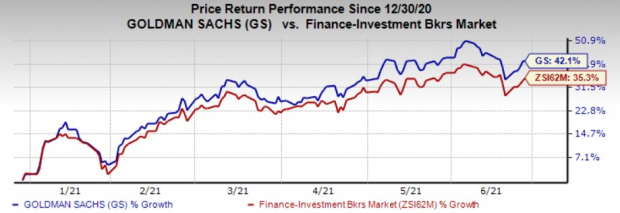

Shares of this Zacks Rank #3 (Hold) stock have gained 42.1% in the past six months, outperforming the 35.3% rally of the industry.

Image Source: Zacks Investment Research

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more