Goldman Sachs: 3 Stellar Hedge Fund Stocks

Goldman Sachs released a very valuable report setting out hedge funds’ favorite stocks right now. This is based on just-released SEC forms filed by the funds setting out their second quarter trades. “From an implementation standpoint, the hedge fund VIP list represents a tool for investors seeking to ‘follow the smart money’ based on 13F filings,” strategist Ben Snider told clients. Plus these stocks have proved to be more resilient then the S&P 500 in recent months.

Facebook (Nasdaq:FB)

Even after the second quarter filings, Facebook remains the most popular pick for hedge fund managers. In fact, 98 hedge fund managers count the social media giant as a top 10 portfolio holding. We can also see that in Q2, 47 hedge funds initiated new FB positions. This is versus 33 funds closing out positions.

Luckily for these funds, the outlook for FB remains notably bullish. Five-star RBC Capital analyst Mark Mahaney (Profile & Recommendations) has just selected Facebook as his number 1 Top Large Cap Long. He is confident that the stock is primed for many years of growth. Even if users decline for the core FB site, the stock still boasts money-makers like Instagram, WhatsApp and FB Messenger to take up the slack.

Mahaney writes: “Over 35% Ad Revenue growth… on a ~$55B revenue run rate. We still think FB is among the Best Growth Stories in Tech despite the H2 outlook (which we view as overly conservative).” Indeed, he estimates that Messenger monetization could contribute an incremental $6-8B in Revenue and $1 in EPS to the company by 2020, based on the platform’s recent growth.

As a result, he has a very bullish $225 price target on the stock (35% upside potential). This falls notably above the average analyst price target of $205.31- which still suggests appealing upside potential of 23%. Note that in the last three months, this stock has earned a ‘Strong Buy’ consensus from the Street with 30 buy ratings, 5 hold ratings and just 2 sell ratings.

(Click on image to enlarge)

View FB Price Target & Analyst Rating Details

PayPal (Nasdaq:PYPL)

Also on the cards for hedge funds last quarter was online payments giant PayPal. This makes sense given that the company is perfectly positioned for the ongoing transition from brick-and-mortar stores to online retail.

According to the Goldman Sachs report, 31 hedge funds have PYPL as a top ten holding. And in total hedge fund holdings of the stock increased by 9.5% in the quarter to a whopping 86 million shares.

Oppenheimer’s Glenn Greene (Profile & Recommendations) is one of the top 10 analysts tracked by TipRanks. This is down to his impressive 84% success rate and 21.8% average return per rating. Back in July he ramped up his price target from $90 to $95.

“Our greater than normal valuation flexibility considers PYPL’s unique competitive position within the large online payments market” explains this top analyst. He also notes that the recent $2.2 billion iZettle deal provides significant cross-sell potential into PYPL’s existing merchant base. The company snapped up this European start-up in May in a bid to create a worldwide “one-stop solution for omnichannel commerce.”

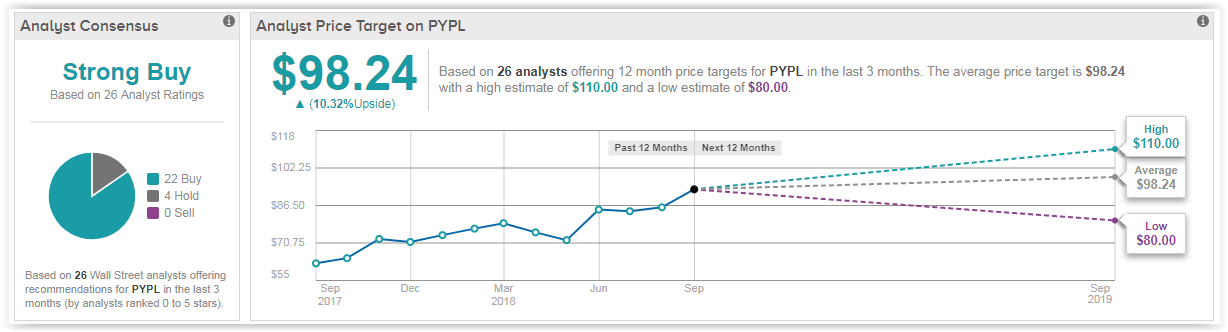

In total, this ‘Strong Buy’ stock has raked in 22 buy ratings vs 4 hold ratings in the last three months. This is with an average price target of $98.24 (over 10% upside potential).

(Click on image to enlarge)

View PYPL Price Target & Analyst Rating Details

NXP Semiconductors (Nasdaq:NXPI)

Interestingly, NXP Semiconductors is a key stock holding for the funds. As of Goldman’s report, 47 funds hold NXPI as one of their 10 biggest stocks. That makes this chip stock the fifth most popular hedge fund pick. Indeed, in the second quarter, 38 funds created new positions while only 14 funds closed out their positions.

So what’s attracting all this fund attention? The Dutch-based company is a leader in secure connectivity solutions for embedded applications, be it cars, industry or the Internet of Things (IoT). The company was in the process of being taken over by Qualcomm- but the $43 billion deal was abandoned following lack of approval by China.

Now Qualcomm has reported its first earning results in 21 months. Needham’s Rajvindra Gill (Profile & Recommendations) gave this reaction: “in our view, the mix of revenue is much healthier than it was two years ago: auto and industrial end markets account for 67% of sales and the consumer orientated SIS segment is down to 6% of sales.” Plus, the $5 billion share buyback now proposed by Qualcomm could add $1.14-$-1.34 of incremental EPS.

This top analyst has a Buy rating on the stock with a bullish $120 price target (28% upside potential). Overall the outlook from the Street is slightly more cautious. The stock has a Moderate Buy analyst consensus rating. However, this is with a $108 price target- indicating upside potential of 16%.

(Click on image to enlarge)

Disclaimer: TipRanks is an independent cloud based service that measures and ranks digitally published financial advice. TipRanks' natural language processing (NLP) algorithms aggregate and ...

more

Very interesting indeed!!