Goldman Projects 46-Cent EPS Gain In Q4 From Apple Card Transition

Image: Bigstock

Key Takeaways

- Goldman Sachs agreed to exit the Apple Card program, with the transition expected to take place over the next 24 months.

- Goldman expects a 46-cent EPS lift in Q4'25 from $2.48 billion releases, offset by $2.26 billion markdowns and $38 million costs.

- Goldman will keep running Apple Card during the transition and continue recording portfolio results.

The Goldman Sachs Group, Inc. (GS - Free Report) announced an agreement to end its long-standing partnership with Apple Inc. (AAPL - Free Report) and transition the Apple Card program and associated accounts to JPMorgan (JPM - Free Report). This marks a significant step in Goldman's ongoing refocus away from consumer banking and toward its core institutional businesses.

The transaction is expected to increase Goldman’s fourth-quarter 2025 earnings per share (EPS) by 46 cents. This reflects the release of $2.48 billion in loan loss reserves recorded in provisions for credit losses, partially offset by a $2.26 billion reduction in net revenues related to markdowns on the outstanding credit card loan portfolio and contract termination obligations, as well as $38 million in associated expenses.

JPMorgan expects to recognize a $2.2 billion provision for credit losses in the fourth quarter of 2025 related to the forward purchase commitment of the Apple Card portfolio.

Under the terms of the agreement, Goldman will continue operating the Apple Card program while the transition to JPMorgan is expected to be completed over approximately 24 months. Until then, Goldman Sachs will continue to record regular business results from the portfolio.

David Solomon, chairman and CEO of Goldman, stated, “This transaction substantially completes the narrowing of our focus in our consumer business.”

“Alongside Apple, we built an award-winning program and created an innovative credit card that put consumers at the center. We look forward to continuing to support our customers during the transition to a new issuer as we focus on advancing the strategy we laid out for our core franchises in Global Banking & Markets and Asset & Wealth Management,” he added.

Goldman's exit from the Apple card comes in line with the bank pulling back from its consumer lending business, as it proved to be more costly than expected. Hence, the company embarked on a deliberate transformation to exit non-core consumer banking and double down on the divisions where Goldman maintains a clear competitive advantage.

In sync with this, in the third quarter of 2025, Goldman Sachs completed the sale of its GM credit card business to Barclays. In 2024, Goldman completed the sale of GreenSky. In 2023, it sold its Personal Financial Management unit to Creative Planning and also sold all of Marcus’s loan portfolio, part of its broader retreat from consumer banking.

These moves demonstrate a well-thought-out exit, allowing the company to reallocate capital and attention toward higher-margin, more scalable businesses like Global Banking and Markets and the asset and wealth management divisions.

Goldman’s Price Performance, Valuation, & Estimates

Goldman Sachs shares have gained 70.3% in the past year compared to the industry’s growth of 43.6%.

Price Performance

Image Source: Zacks Investment Research

From a valuation standpoint, Goldman Sachs stock has been trading with a forward price-to-earnings (P/E) ratio of 16.88X, above the industry’s average of 15.35X.

Forward 12-Month Price-to-Earnings Ratio

Image Source: Zacks Investment Research

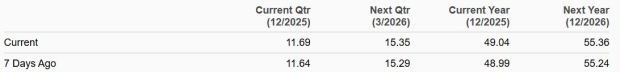

The Zacks Consensus Estimate for Goldman's 2025 and 2026 earnings implies year-over-year rallies of 20.9% and 12.9%, respectively. Estimates for both years have been revised upward over the past seven days.

Estimate Revision Trend

Image Source: Zacks Investment Research

Goldman Sachs stock currently carries a Zacks Rank #3 (Hold) rating.

More By This Author:

2 Top-Ranked AI-Powered Tech Giants To Enhance Your Portfolio ReturnsBetting On A Boom: 3 Healthcare ETFs For 2026 And Beyond

Strategic Semiconductor ETF Picks As China's Inflation Hits Three-Year High

Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific securities ...

more