Goldman Prime: Massive Short Covering Leads To Biggest Hedge Fund Rout Since March

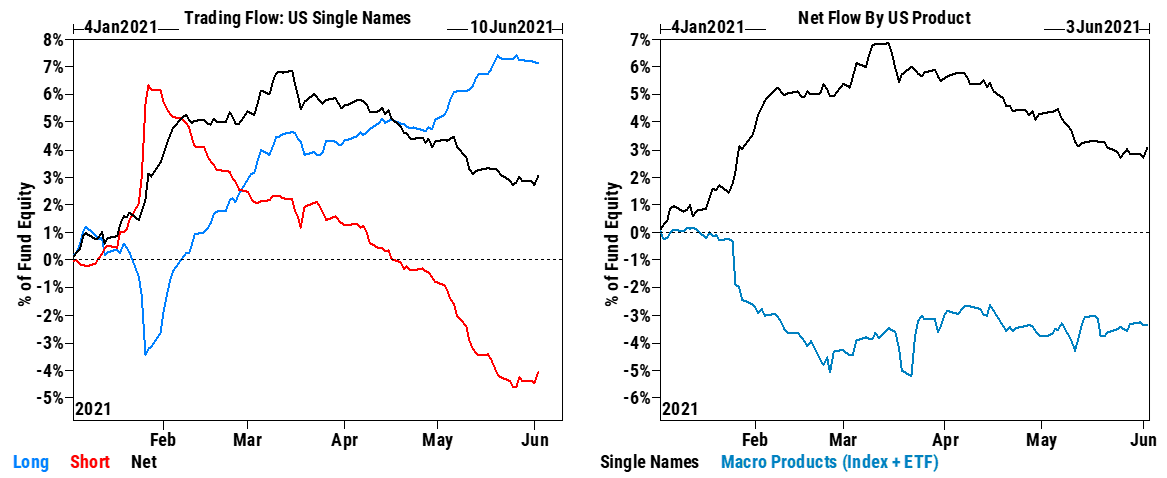

This will hardly come as a surprise to anyone who followed the manic reddit-driven action over the past 48 hours: according to Goldman's Prime Brokerage, we just witnessed the "largest US single stock short covering since mid-March amid a sharp rally in High Retail Sentiment stocks" and while US stocks saw modest net buying yesterday, it was driven by risk-off flows "with short covers outpacing long sales 3 to 1."

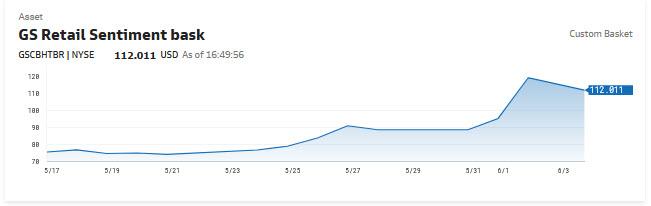

The catalyst is well known: a furious, face-ripper of a rally in the heavily-shorted meme stocks, which pushed the Goldman Retail Sentiment Basket, (GSCBHTBR) i.e., the retail favorite stocks up +25% yesterday and up +61% over the last 7 sessions!

Some more granular details as GS Prime saw them:

- 10 of 11 sectors saw net covers (Real Estate the sole exception) led in $ terms by Comm Svcs, Consumer Disc, Info Tech, Health Care, and Energy.

- US Single Stock shorts are now down -1.6% week/week but still up +6% month/month and up +3.4% YTD.

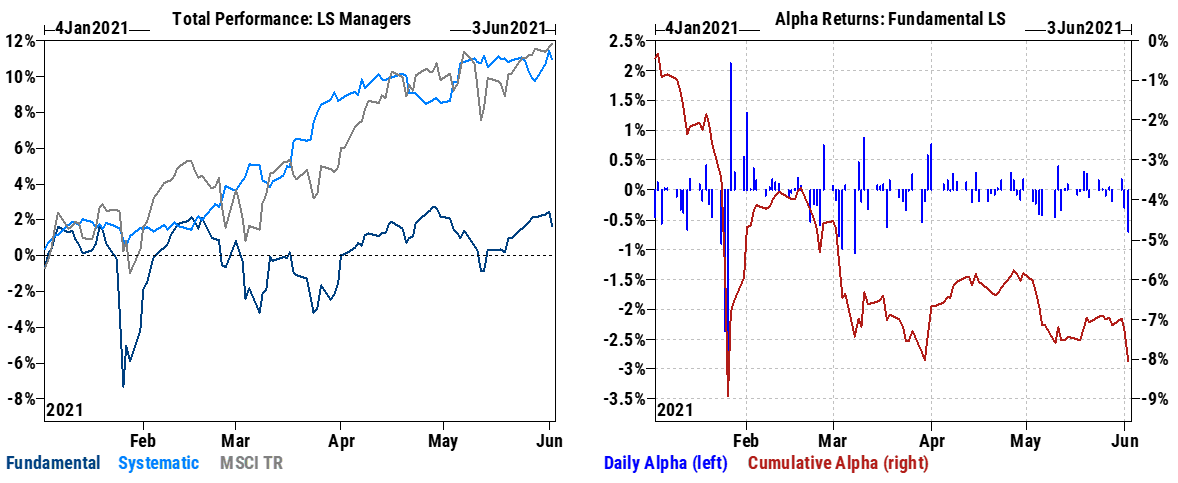

It will also not come as a surprise, that most long/short managers underperformed yesterday, in what Goldman said was the "Worst Fundamental LS alpha day in nearly three months"

Yesterday (June 2nd)

- Fundamental LS -0.8% (alpha -0.7%) vs MSCI TR +0.1%.

- Fundamental LS managers experienced the worst 1-day alpha drawdown in nearly three months, driven by losses from Size, Momentum, Concentrated Longs, and Asset Selection on the short side.

- Systematic LS -0.5% driven by losses from Momentum, Volatility, and Crowded Longs.

June MTD:

- Fundamental LS -0.6% (alpha -1.1%) vs MSCI TR +0.4%

- Systematic LS +0.2%

2021 YTD:

- Fundamental LS +1.7% (alpha -8.0%) vs MSCI TR +11.8%

- Systematic LS +10.9%

And here's the kicker: yes, yesterday was a massive short squeeze, and yes it hurt hedge funds a lot... but compared to what happened at the end of January, it was a walk in the park: as Goldman Prime notes, "for perspective, the large single stock short covering that took place back on Jan 27th was a 10.6 SDs move (vs. 1.5 SDs yesterday)."

This means that if we get a squeeze that is similar to the January frenzy, it would be roughly 7 times stronger...

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more

Once again proof is delivered that not all gambles result in winnings. And so that ancient advice still holds, to not wager more than you can afford to lose. But folks driven by greed and a stampede seem to always believe"This time it will be different", while the boring truth is that it will never be truly different, except for the names of the players.