Goldman (GS) Ups ROE Aim, Restates 60% Efficiency Ratio Goal

Image: Bigstock

At the Credit Suisse Financial Services Conference, The Goldman Sachs Group, Inc. GS management provided an update on progress in meeting the medium-term (three-year period) and long-term financial targets set out on its investor day two years ago.

The company has increased medium-term firmwide return on equity target to 14-16% from the previous 13% and return on tangible equity to 15-17% from more than 14% stated earlier.

Also, the firm’s efficiency ratio target of 60% has been reiterated. Markedly, despite expense growth concerns stemming after the company reported a 23% year-over-year increase in fourth-quarter 2021 to $7.27 billion, the investment bank continues to aim its efficiency goals. This is likely backed by the company already having realized $1 billion of expense efficiencies from 2019 to 2021 of the target $1.3 billion.

Management has also provided a robust outlook for its asset gathering (deposits, assets under management or AUM) and fee revenue goals across transaction and consumer banking, and asset and wealth management businesses.

In the Asset Management segment, organic traditional long-term net inflows are projected to reach $350 million by 2024, up $100 billion from the previous target. Also, $225 billion worth of gross alternative fundraising is anticipated by 2024 from the prior target of $150 billion.

Goldman has announced new targets of more than $10 billion in firmwide management and other fees. Of this, more than $2 billion in alternatives management fees are expected for 2024.

In the Investment Banking segment, management expects transaction banking revenues to reach $750 million, down from the prior mentioned $1 billion. Also, deposits of more than $100 billion by 2024 are expected. Given the large addressable market in this space and the company’s scalable digital platform, there is significant upside in the transaction banking vertical.

Revenues in the Consumer segment are projected to reach $4 billion by 2024. This will likely be supported by more than $150 billion in deposits and loans/cards balance exceeding $30 billion by the same year.

The company also remains focused on capital management and aims to reduce its stress capital buffer toward 5% from the current capital requirement of 6.4%. Also, Goldman noted that the global systematically important banking buffer (G-SIB) surcharge will increase 50 basis points (bps) to 3%, effective 2023, and another 50 bps to 3.5%, effective 2024, from the current G-SIB 2.5%.

The company’s robust projections underline solid operating trends in the upcoming period. Organic strength aside, Goldman is making efforts to diversify its business mix toward more recurring revenues and durable earnings. In August 2021, the company entered an agreement to acquire Dutch asset manager NN Investment Partners from NN Group N.V. in a €1.6-billion (or $1.9 billion) all-cash transaction. This will improve Goldman’s international presence, and European retail distribution and insurance asset management capabilities. Also, in an effort to augment its retail lending footprint, Goldman entered a definitive agreement to acquire GreenSky, Inc. in September 2021. Such inorganic growth efforts will diversify the fee-revenue base and offer top-line stability.

However, Goldman continues to face many investigations and lawsuits from investors and regulators. Though the company resolved certain litigations related to the sale of risky mortgage-backed securities, many of the cases are yet to be resolved. All these are expected to lead to increased expenses and litigation provisions in the near term.

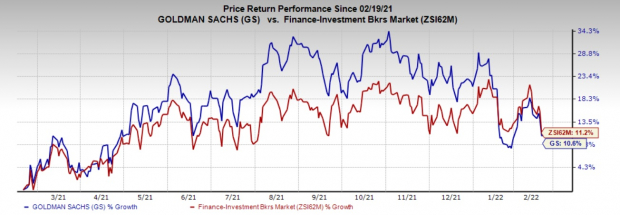

Shares of this Zacks Rank #3 (Hold) company have gained 10.6% over the past year, underperforming the industry's rise of 11.2%.

Image Source: Zacks Investment Research

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more