Gold Miners’ Q2’22 Fundamentals

The major gold miners just finished reporting their latest quarterly results, revealing how they are actually faring fundamentally. This Q2’22 earnings season was particularly important with inflation raging in its first super-spike since the 1970s. Traders need to know how higher prices are affecting mining costs and thus profitability, especially after a serious correction left sector sentiment languishing near bearish extremes.

The most-popular major-gold-stock benchmark remains the venerable GDX VanEck Gold Miners ETF. Launched way back in May 2006, it has since parlayed its first-mover advantage into an insurmountable lead. Even in its present battered state, mid-week GDX’s net assets of $10.7b dwarfed those of the next-largest 1x-long gold-miners-ETF competitor by a staggering 27.3x!GDX is effectively the only game in town.

While it feels like ancient history now, the larger gold miners dominating GDX were actually enjoying an excellent 2022 until mid-April. GDX had surged 27.6% year-to-date, amplifying gold’s parallel rally by a big 3.4x! That was much better than GDX’s usual 2x-to-3x leverage to material gold-price moves. But then unfortunately an unusual confluence of anomalous market events sprung the hangman’s trapdoor.

The Fed’s most-extreme hawkish pivot in its entire century-plus history ignited a parabolic US-dollar rally, catapulting its leading benchmark to an extreme 20.1-year high! That spawned monster leveraged gold-futures selling, slamming the yellow metal sharply lower. By the time that unsustainable puking exhausted itself in mid-July, gold had corrected 14.3%. GDX leveraged that by 2.8x, plummeting a brutal 39.8%!

While big volatility is par for the course in this high-potential sector, the ill timing of that epic gold-futures purge was crushing. With inflation raging in its biggest super-spike since the 1970s, gold and its miners’ stocks certainly should’ve been soaring. Even the lowballed headline US Consumer-Price-Index inflation prints during Q2 ran red-hot blasting 8.3%, 8.6%, and 9.1% higher year-over-year in April, May, and June.

The latter was the worst CPI read since way back in November 1981! During the 1970s inflation super-spikes, monthly-average gold prices from trough-to-peak CPI months nearly tripled during the first then more than quadrupled during the second! So gold’s recent correction fueled by that anomalous, extreme, and unsustainable gold-futures dumping proved extra-damaging to speculators’ and investors’ sentiment.

While that did pound gold prices 6.8% lower through Q2’22, the yellow metal was still doing quite well. Gold’s quarterly-average closing price of $1,872 in Q2 was only 0.4% lower sequentially from Q1’22, and still actually climbed a solid 3.2% YoY from comparable Q2’21 levels! So despite the psychological angst, the gold miners still had a strong gold environment to sell into. Q2’22 saw the fourth-highest average gold ever.

So the major gold miners’ latest operating and financial results from last quarter should’ve proven good. The big question requiring a deep dive into their quarterly reports was how much is this raging inflation affecting their variable input costs? While most gold-mining costs are effectively fixed when mines are being planned, once operational they still consume plenty of supplies purchased at prevailing prices.

For 25 quarters in a row now, I’ve painstakingly analyzed the latest results released by GDX’s 25-largest component stocks. These include the world’s biggest gold miners, which now account for a commanding 87.2% of this ETF’s entire weighting. Digesting hard fundamental results as they are released is essential for cutting through obscuring sentiment fogs. It helps traders rationally understand gold stocks’ real outlook.

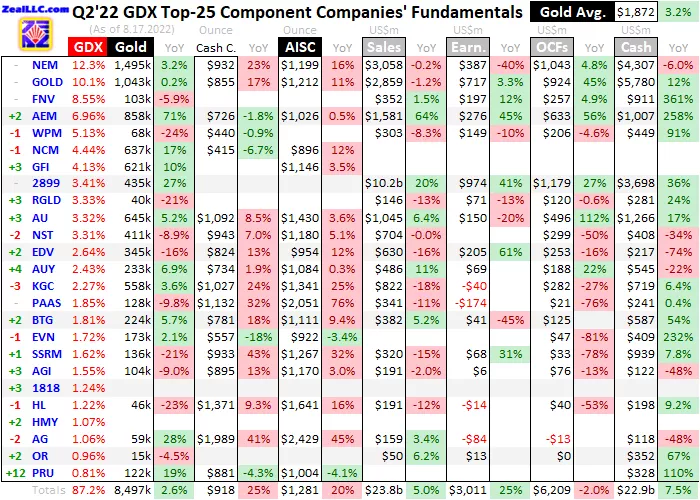

This table summarizes the operational and financial highlights from the GDX top 25 during Q2’22. These gold miners’ stock symbols aren’t all US listings and are preceded by their rankings changes within GDX over this past year. The shuffling in their ETF weightings reflects shifting market caps, which reveal both outperformers and underperformers since Q2’21. Those symbols are followed by their current GDX weightings.

Next comes these gold miners’ Q2’22 production in ounces, along with their year-over-year changes from the comparable Q2’21. Output is the lifeblood of this industry, with investors generally prizing production growth above everything else. After are the costs of wresting that gold from the bowels of the earth in per-ounce terms, both cash costs and all-in sustaining costs. The latter help illuminate miners’ profitability.

That’s followed by a bunch of hard accounting data reported to securities regulators, quarterly revenues, earnings, operating cash flows, and resulting cash treasuries. Blank data fields mean companies hadn’t reported that particular data as of the middle of this week. The annual changes aren’t included if they would be misleading, like comparing negative numbers or data shifting from positive to negative or vice-versa.

As feared, the major gold miners widely reported mounting inflationary input-cost pressures last quarter. Those certainly forced overall mining costs higher, cutting into profitability. But excluding a couple of crazy outliers, these elite GDX-top-25 gold miners still generally held the line on costs. Considered as a whole, they performed impressively given this raging inflation unleashed by extreme central-bank money printing.

The world’s bigger gold miners have long struggled with production growth. They operate at such huge scales that it’s almost impossible to replenish their gold mined. They simply can’t discover or buy enough gold deposits at necessary sizes to overcome relentless depletion. And they can’t develop the ones they do find or acquire into new mines rapidly enough. So major gold miners have long suffered shrinking output.

Thus the 8,497k ounces of gold the GDX top 25 collectively mined last quarter was a pleasant surprise. Those were the best levels since Q4’20, climbing a healthy 2.6% YoY! Shuffling into and out of GDX’s upper ranks wasn’t a material factor, with its top holdings remaining fairly static. That was even a good showing for these major gold miners compared to Q2’s world mined output per the World Gold Council.

In its latest fantastic quarterly Q2’22 Gold Demand Trends report, global mine production climbed 4.0% YoY to 911.7 metric tons. Interestingly the GDX top 25 only accounted for 29% of that output. Their share is generally shrinking as the majors struggle to fill their often-massive production pipelines with enough new deposits and mines. But they did add enough over this past year, bucking their vexing trend.

A mega-merger helped, with Agnico Eagle Mines buying Kirkland Lake Gold for $10.7b in stock. That deal was announced in late September and closed in early February. That’s the sole reason AEM has the best Q2 production growth of all the majors, soaring 71.4% YoY! Tellingly that is still 2.5% lower than the two predecessor companies’ total output in Q2’21. Mergers only temporarily mask depletion for one year.

But the sad gobbling-up of Kirkland Lake, which had been the best major gold miner by far fundamentally for many years, didn’t distort overall GDX-top-25 output much. The replacement moving up into these elite ranks was the tiny ludicrously-overvalued Osisko Gold Royalties. It only sold a trivial 14.9k ounces of gold in Q2’22, the worst in these ranks and radically not major-gold-miner material! Osisko isn’t the only one.

As a professional gold-stock speculator for decades now, I’ve never understood investors’ love affair with the tiny royalty companies. They crowd into these driving their market capitalizations up to nose-bleed extremes relative to their gold outputs and profits. Franco-Nevada has long been the third-largest GDX component, and Royal Gold is ascending. Both royalty companies have way-higher valuations than true miners.

Barrick Gold and Franco-Nevada had similar market caps this week, but the former sported a low 14.7x trailing-twelve-month price-to-earnings ratio while the latter’s was 32.6x. And Barrick produced 1,043k ounces of gold last quarter fueling $717m in accounting profits, dwarfing the mere 103k ounces sold by Franco-Nevada earning just $197m. Why pay way more for much-smaller and less-profitable gold stocks?

With inflation raging, the GDX top 25’s impressive production growth in Q2 is really overshadowed by their mining costs. In normal times, unit gold-mining costs are generally inversely-proportional to gold-production levels. That’s because gold mines’ total operating costs are largely fixed during pre-construction planning stages when designed throughputs are determined for plants processing gold-bearing ores.

Their nameplate capacities don’t change quarter-to-quarter, requiring similar levels of infrastructure, equipment, and employees to keep running at full speed. So the only real variable driving quarterly gold production is the ore grades fed into these plants. Those vary widely even within individual gold deposits. Richer ores yield more ounces to spread mining’s big fixed costs across, lowering unit costs and boosting profitability.

But while fixed costs are the lion’s share of gold mining, there are also sizable variable costs. Energy is the biggest category, including electricity to power ore-processing plants including mills and diesel fuel to run excavators and dump trucks hauling raw ores to those facilities. Other smaller consumables range from explosives to blast out ores to chemical reagents necessary to process various ores to recover their gold.

The GDX-top-25 gold miners’ Q2’22 reports had many mentions of inflationary pressures in the latter. I took notes on these while wading through the latest results, and examples were legion. Mighty Newmont Corporation, the world’s largest gold miner by far, blamed higher mining costs on “inflationary pressures, driven by higher labor costs and an increase in commodity inputs, including higher fuel and energy costs”.

Paying workers more is one of the stickier forms of price inflation, as cutting compensation later is terrible for employee morale. Thankfully Newmont was more of an outlier in that regard. The second-largest GDX component Barrick Gold was more typical, citing “the impact of higher input prices driven by energy and consumables from inflationary pressures” driving costs higher. Those costs rise and fall with market prices.

Another major gold miner AngloGold Ashanti warned due to the “resultant disruption of supply chains, certain key commodity supplies are experiencing volatility and inflationary pressures. These include oil and lubricants, ammonia-related products (explosives and cyanide) and labor.”Cyanide is an essential chemical for gold mining, sprinkled on heap-leach pads of crushed ore to filter through and dissolve out gold.

SSR Mining emphasized this price inflation infecting the variable-cost side of gold mining, writing that it is “continuing to face increased cost pressures, especially in fuel, electricity, and reagents across the business”. While there were many more inflation warnings from the major gold miners, these are a good sample. Plenty GDX-top-25 gold miners also expect inflationary cost pressures to persist in coming quarters.

Agnico Eagle Mines certainly wasn’t alone in saying mining costs going forward will be higher, “Given that inflationary pressures are expected to continue in the second half of 2022, the Company believes that total cash costs per ounce and AISC per ounce could trend towards the top end of these ranges.”Some major gold miners are shifting their full-year-2022 mining-cost forecasts to the high side of their guidances.

Cash costs are the classic measure of gold-mining costs, including all cash expenses necessary to mine each ounce of gold. But they are misleading as a true cost measure, excluding the big capital needed to explore for gold deposits and build mines. So cash costs are best viewed as survivability acid-test levels for the major gold miners. They illuminate the minimum gold prices necessary to keep the mines running.

Last quarter the GDX top 25 reported average cash costs of $918 per ounce, which rocketed up an eye-popping 24.9% YoY! Those also proved the highest on record, way above Q4’21’s $853 before central-bank-money-printing-fueled inflation really spiraled out of control this year. While that remains far under prevailing gold prices, that trend is still troubling. Thankfully Q2’22’s $918 was heavily distorted by two outliers.

If just the crazy-high cast costs of $1,132 reported by Pan American Silver and $1,989 from First Majestic Silver are excluded, the rest of the GDX top 25 only averaged $838. That would only be the third-highest witnessed after the preceding couple quarters. Most of the major gold miners are holding the line on their costs despite these inflationary pressures, which is impressive. PAAS and AG have single-mine problems.

During the long 25 quarters I’ve been doing these deep analyses, I’ve always used simple averages of costs. Until this quarter, it never occurred to me that production-weighted averages might be smarter. I’m going to think about that going forward. Should AG’s dreadful $2,429 AISCs for just 19k ounces of gold from one mine be equally weighted with Newmont’s $1,199 for 1,495k ounces across about fourteen mines?

PAAS’s anomalously-high costs resulted from a shortfall at its largest gold mine. With just a couple years left until it is depleted, ore grades diverged from drilling results. So Pan American thinks drilling got lucky, striking higher-grade pockets than the wider ore body. So it partially wrote down that old mine and made a negative inventory adjustment to account for less gold likely in ores stacked on that mine’s heap-leach pad.

AG continues to struggle to improve operating efficiencies and drive down costs at its lone primary gold mine acquired in March 2021. Plenty of improvements have been made, and management is forecasting costs falling dramatically later this year. But both the cash costs and all-in sustaining costs reported by that little gold mine in Q2 were some of the most extreme ever for a GDX-top-25 gold miner, a short-lived anomaly.

All-in sustaining costs are far superior than cash costs and were introduced by the World Gold Council in June 2013. They add on to cash costs everything else that is necessary to maintain and replenish gold-mining operations at current output tempos. AISCs give a much-better understanding of what it really costs to maintain gold mines as ongoing concerns, and reveal the major gold miners’ true operating profitability.

Ominously the GDX-top-25 gold majors’ AISCs soared 19.7% YoY to an all-time record high of $1,281 in Q2’22! Had those been righteous and not heavily skewed, the gist of this essay would’ve been different. I’d be more concerned about inflation driving up mining costs. But again just excluding those same outlying costs from those single gold mines of Pan American Silver and First Majestic Silver, things are way better.

The rest of the GDX top 25 averaged far more reasonable $1,161 AISCs last quarter without PAAS and AG. Those remain the second-highest on record after Q4’21’s $1,188, so they certainly aren’t low. But they would’ve been up a much-milder 8.5% YoY, which is excellent considering this raging inflation. My wife and I sure wish our family’s grocery bills were only surging that fast, instead of roughly tripling that.

Out of the 8,497k ozs of gold the GDX top 25 mined in Q2’22, those two troubled mines at PAAS and AG only accounted for 54k or 0.6%!Interestingly Pan American Silver clarified that without that one-time inventory charge for lower ore grades, its company-wide gold AISCs would’ve plunged from $2,051 to a way-better $1,540. First Majestic Silver sees its troubled gold mine’s AISCs falling near $1,800 in H2’22.

So the major gold miners’ cost situation mostly driven by volatile consumables isn’t as dire as feared in this inflation super-spike. And most of these surging variable costs including energy will eventually retreat as their supply-and-demand situations normalize. Electricity, diesel, explosives, and reagent chemicals aren’t going to keep surging forever. Supply will catch up with than exceed demand forcing prices lower.

But the GDX top 25’s lofty $1,281 all-in sustaining costs including all these gold miners still really cut into sector implied unit profitability. That is the difference between quarterly-average prevailing gold prices and the major gold miners’ average AISCs. By that measure including those PAAS and AG extremes, per-ounce earnings plunged 20.6% YoY to just $591. That proved the lowest witnessed since Q1’20.

But if those are adjusted to exclude that crazy-outlying 0.6% of overall GDX-top-25 gold output in Q2’22, sector unit earnings looked way better at $711. That would’ve merely been down 4.4% YoY, which is truly remarkable given this raging inflation punishing everyone! That would even be slightly better than the preceding four quarters’ average of $700. So truly the gold miners are faring fine in this environment.

That point was driven home by the hard accounting data reported to securities regulators last quarter, under Generally Accepted Accounting Principles or other countries’ equivalents. The GDX top 25’s total revenues climbed a good 5.0% YoY to $23,834m. That sales growth was fueled by quarterly-average gold prices rallying that 3.2% from Q2’21 to Q2’22, and that impressive 2.6%-YoY production growth achieved.

Bottom-line accounting earnings really amplified those growing revenues, with the GDX top 25’s surging 24.6% YoY to $3,011m last quarter! That didn’t look skewed either, as I didn’t see any large impairments or impairment reversals in these gold miners’ Q2’22 income statements. PAAS’s writedown of that old gold mine with underperforming ore grades was only $99m, small by past gold-mine-impairment standards.

If anything, these major gold miners’ overall sales-and-profits growth over this past year are understated a bit due to a GDX-top-25 composition change. Perseus Mining displaced Centerra Gold as the 25th-largest GDX stock between Q2’21 to Q2’22. As the former is an Australian gold miner that hasn’t yet reported its latest half-year results, it didn’t add any revenues or earnings unlike Centerra in the comparable quarter.

These elite gold miners’ overall cash flows generated from operations also remained strong, just slipping 2.0% YoY last quarter to $6,209m. That’s on the high side of all totals from the last 25 quarters. If this raging inflation was heavily impacting gold miners’ operations, it would certainly filter through to lower operating cash flows. Once the Australian gold miners report H1’22 results, GDX-top-25 OCFs should rise.

And the overall corporate treasuries reported by these elite major gold miners actually surged 7.5% YoY at the end of Q2’22 to hit $22,880m. That not only reveals their underlying operations are healthy, it is the highest cash balance reported in the last 25 quarters and almost certainly ever! That’s a stark contrast to the big US general stocks, which I analyzed last week looking at the S&P 500’s top 25 stocks’ Q2’22 results.

Those gigantic American market darlings everyone knows saw their cash hoards plunge 17.0% YoY as of the end of last quarter! So the major gold miners are doing comparatively well in these challenging inflationary times. Their big cash war chests will likely be used to accelerate mine expansions and buying new mines outright. That makes the smaller mid-tier and junior gold miners prime targets for majors to acquire!

I’m going to analyze their latest quarterlies in next week’s essay on the GDXJ-top-25 gold mid-tiers Q2’22 results. These smaller gold miners have superior fundamentals and much-greater upside potential than the majors. Operating at smaller scales they can more easily consistently grow their production, while their lower market caps make them easier to bid higher. I’d avoid most of the underperforming major miners.

The bottom line is the major gold miners just reported an impressive quarter. They actually managed to grow their collective production, which is unusual at their huge operational scales. And while central banks’ raging inflation did force mining costs higher, excluding a couple tiny extreme outliers the great majority of major gold miners didn’t suffer soaring costs. They are managing these inflationary pressures quite well.

Better output along with Q2’s higher average gold prices fueled good revenues growth. And that helped bottom-line accounting earnings surge nicely despite higher costs. The major gold miners’ profits are still destined to skyrocket in coming years as gold powers much higher to reflect recent years’ epic money-supply growth. That portends massive upside potential in this sector’s temporarily-battered stock prices.

More By This Author:

Big U.S. Stocks’ Q2’22 Fundamentals

Gold Stocks Deeply Undervalued

Gold Stocks’ Autumn Rally 7