Gold Miner Q4 Earnings: Worth Waiting For

We still have a while to wait for the gold/silver miners’ Q4 and full-year 2025 earnings. Newmont, one of the early reporters, is scheduled to release its results on February 19.

But after that, the deluge.

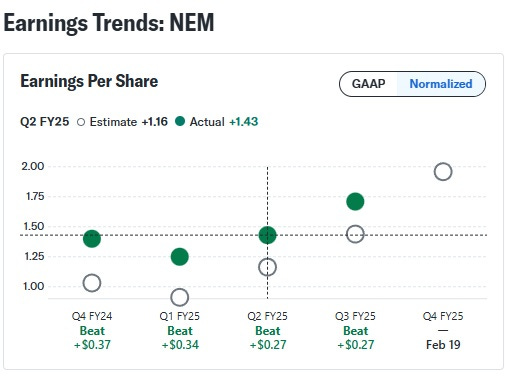

And a fun deluge it’s going to be. Sticking with Newmont, here’s a chart of its past year’s earnings versus analyst estimates. Note that, thanks to a combination of rising gold prices and management’s attention to cost control, the miner has consistently beaten expectations.

Now look at the Q4 2025 estimate. It’s up big, as analysts try to keep up with gold’s steady price increase. But if Newmont just matches this estimate, that would be 33% year-over-year and sequential growth, with correspondingly high free cash flow.

This, in turn, makes many things possible for Newmont and its peers, including debt reduction, dividend increases, and opportunistic acquisitions. In other words, a big Q4 earnings gain is just the first in a series of interesting developments/announcements.

More By This Author:

Two Great Policy ChangesSilver's 2026 Open: Irresistable Force Meets Immovable Object

Time For A Silver Volatility Spread?