GNRC: A Promising Small Cap Play In A Rallying Market

Image Source: Pixabay

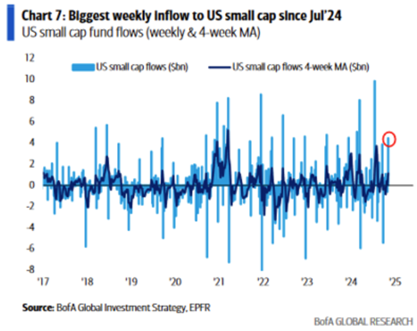

I see continued strength into year end, led by small caps in December. That should be followed by a sideways grind/consolidation in the front half of next year as policy and Trump Administration appointments crystallize. Generac Holdings Inc. (GNRC) is one favorite small cap in this environment.

I expect resumed strength in the second half next year as earnings growth is confirmed and policy fears are digested. Ultimately, pro-growth policies will confirm a continuing “Roaring 20s” theme, driven by increased productivity and Phase 2 of the Generative AI boom as regular companies’ productivity and profitability increase.

Meanwhile, margin debt levels are not yet extreme, which supports continued flows from Treasury bills, cash, and money markets into equity markets as FOMO continues. Plus: 74% of major central banks are easing now, versus only 9% in July 2023.

As for GNRC, it is up around 40% in the last three months. It should push beyond $200 in the short term and higher over time. Generac has a 70% share in the home standby generator market. With hurricane activity rising and power grid strain showing, single-digit home penetration will go up.

Recommended Action: Buy GNRC.

More By This Author:

Generac Holdings: A Promising Small-Cap Play In A Rallying MarketCopa Holdings: A Higher-Yielding Airline In A Group Not Known For Juicy Dividends

KMI & TRP: Two Energy Companies Set To Profit From LNG Exports

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more