GME: A Lesson In How A Short Squeeze Works

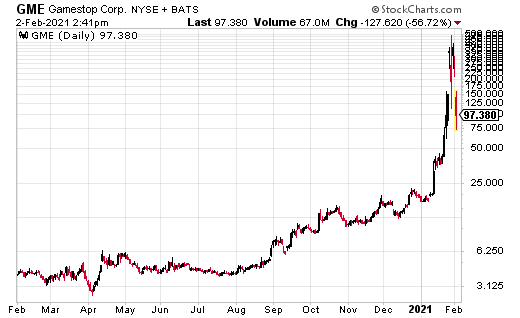

If you watch financial news, you are probably aware of the short squeeze initiated by retail traders that drove share prices of stocks like GameStop Corp. (GME) up more than 800% in a few days. It was the biggest story last week. I do not think the news reporters did a very good job explaining the mechanics of a short squeeze and why the stock price gains, in this case, were so extreme.

Going over the basics of short selling stocks and how that can go wrong will show you why it went so very wrong this time. (And also so very right for those who owned shares of GME.)

Selling stock short is a way to profit from when a share price drops. To sell short, a trader must borrow shares from his broker to sell. The goal is to buy back the sold-short, borrowed shares at a lower price, profiting by the amount the stock price fell from when it was sold short. If the stock price goes up, the short seller loses money on the trade.

Here are a couple of considerations about selling short. The strategy is widely used by hedge funds, especially those with a long-short strategy. Part of a portfolio will be in long investments, and part will be short, hoping to profit from both sides. Hedge funds typically use significant leverage or borrowed money to make the trades.

With a short sell trade, the max profit occurs if the stock goes to zero. So shorting GME at $10 per share gives a max gain of that $10. Potential losses from a rising stock price are theoretically unlimited. When GME zoomed to almost $500 per share, theory became a reality.

A final point on short selling: as I already mentioned, the trade requires borrowing shares from a broker. I saw news that 140% of the GME float had been sold short. It should not be possible for more than 100% to be shorted, and because brokers can lend only shares held in margin accounts, the percentage of shares available to short should be much lower than 100%. In the case of GME, it appears brokers for hedge fund traders lent shares they didn’t have. I think the subsequent trading halts were a way to prevent this illegal activity from coming into the light.

A short squeeze occurs when a heavily shorted stock starts to rise, and those with short positions rush to buy back sold short shares. That buying activity itself helps push the stock price higher, making the short sellers even more desperate to buy in shorted shares to close out their short positions.

The trigger for the recent short squeeze in certain stocks came after the stocks were highlighted on the Reddit as ripe for a short squeeze. The large numbers of retail traders reading the advice took it, piling into the stock and call options, putting huge upward pressure on the share prices. Massive is an understatement when shares gain almost 1,000% in a few trading days.

Many or most of the Reddit traders participated by purchasing call options. When calls are purchased, the option market makers must buy shares to cover their obligations. One call option covers 100 shares of stock, so even a small trader who buys a few calls puts hundreds of shares into play.

As it turned out, Reddit-informed retail traders put enough buying pressure on GME so that the stock price climbed by hundreds of dollars per share. For the first few hundreds of dollars of the increase, there were no buyers—I suspect because the hedge fund short sellers expected the rally to be short-lived. But they were wrong. Expensively wrong!

As I write this, there is no data on how much the short traders lost. On the long side, traders that got in early and sold after gaining a couple hundred dollars did well. Remember that as the mania increased, even options sold for over $100. As with all manias, most of the buying likely occurred at or near the peak, and the majority of Reddit traders will end up losing money.

The lesson to take away is that there is a difference between investing and speculating. With speculation, you may hit the occasional home run, but most trades end up as money-losing strikeouts. It’s okay to “play” with a portion of your investment portfolio, but keep in mind, this type of trading is closer to gambling than it is to investing.

The bulk of your investment capital should be committed to strategies that have a high probability of building wealth over the long term.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more