GM Cutting Jobs Amidst "Larger Structural Overhaul" In China

Image Source: Pixabay

General Motors (GM) has been cutting staff in China and eventually will meet with its local partner SAIC to explore a "larger structural overhaul" of the business oversees.

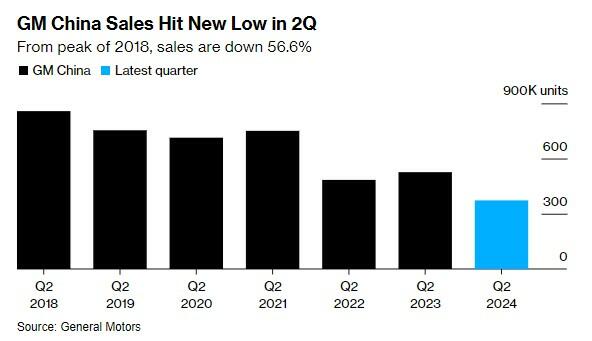

The shift indicates that GM likely won't eclipse its peak sales in the country it set in 2017, according to Bloomberg.

GM is reducing staff in its China-focused departments, including research and development. In coming weeks, GM and its partner SAIC will discuss potential capacity cuts as part of a strategic shift for American brands in China.

Bloomberg writes that this marks a significant change for GM, which once made billions in the Chinese market. The automaker is scaling back as foreign brands struggle with intense competition and overcapacity in the world's largest car market.

GM is shifting its focus to producing electric vehicles, particularly upscale models, and importing premium vehicles. The company is considering reducing factory capacity and further job cuts, though these plans haven't been publicly disclosed yet.

Despite these changes, GM will still produce affordable vehicles and EVs locally in partnership with SAIC Motor and Wuling Motors, with some of these models being exported from China, according to the report.

GM's 30-year contract with state-owned SAIC expires in 2027, and the company aims to restore profitability before then. The goal is to strengthen the SAIC-GM partnership, which produces Buick, Cadillac, and Chevrolet vehicles, so it can self-fund operations and development.

A second partnership, SAIC-GM-Wuling, which makes small, affordable vehicles, has fared better, particularly with the Hongguang Mini EV. However, GM lost $104 million in its Chinese operations in the most recent quarter, contributing to a $210 million loss for the first half of the year.

In the latest quarter, GM's China sales dropped 29% to 373,000 vehicles, with steep declines across its U.S. brands like Buick, Cadillac, and Chevrolet. In contrast, sales from the SAIC-GM-Wuling partnership fell only 12%, as it produces compact EVs that remain in high demand in China, which GM views as a stronger growth opportunity.

Chief Financial Officer Paul Jacobson commented earlier this month: “We’ve got to remain competitive and that means that we’ve got to take a look at the business with our partner to ensure that we can restore it to profitability and that we can restore it to self-sustaining cash flow going forward. China can be a good asset for us and remains a good asset for us.”

More By This Author:

Producer Price Inflation Slows As Services Costs SlumpUS Records 2nd Biggest July Deficit In History As 25% Of Tax Revenue Go To Pay Interest

Key Events This Busy Week: CPI, PPI, Retail Sales

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more