GLW: Ignore The Latest EU Kerfuffle And Buy The Glass Supplier

Image Source: Pixabay

Stocks jumped after Trump’s election, with the S&P 500 and Nasdaq Composite hitting record levels. Investors expect lower taxes and deregulation, but higher inflation and interest rates. Meanwhile, I want to talk about Corning Inc. (GLW) and a recent European regulatory issue.

Many investors, including me, thought the presidential race would be much closer and the process could be drawn out before a victor was declared. That was wrong, which resulted in risk-on trading last week.

One example: The small-cap Russell 2000 soared 8.5% – including a 5.8% gain on Wednesday, its biggest surge since November 2022 – to a three-year high. It is up more than 17% in 2024. Domestically concentrated stocks will benefit from easier regulations, lower taxes, and less exposure to import tariffs.

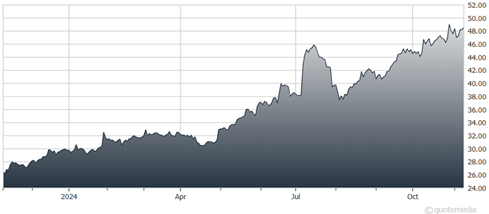

Corning Inc. (GLW)

As for GLW, it is the latest victim of the European Union’s “We’re so far behind we have to cripple American technology companies” program. The EU has opened an investigation into Corning over possible anti-competitive practices. Officials said they are concerned that Corning may have abused a dominant position for global supply of protective glass screens for handheld electronic devices – which they invented – that may have resulted in distorted competition.

The EU said Corning signed “anti-competitive exclusive supply agreements” with mobile phone manufacturers and companies that process raw glass, writing: “The Commission is concerned that the agreements that Corning put in place with OEMs and finishers may have excluded rival glass producers from large segments of the market, thereby reducing customer choice, increasing prices, and stifling innovation to the detriment of consumers worldwide.”

S-u-u-u-re.

This will turn out to be another nothingburger with a multimillion-dollar fine that is simply the cost of doing business in the EU for Big Tech. It will keep them lazy and unproductive with a really poor entrepreneurial environment. Way to go, bureaucrats.

Recommended Action: Buy GLW.

More By This Author:

Fed: Why They Will Cut Rates (But Probably Should NOT)The Good, The Bad, And The Ugly: A Recap Of Post-Vote Winners & Losers

RISR: A Unique Bond ETF With Interest Rate Protection

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more