Glu Mobile – Potential Ten Bagger

Glu Mobile (GLUU) is a mobile gaming company that is witnessing growth and popularity in the COVID-19 age. The company has impressive collaborations with Disney, Kim Kardashian, WWE, and many brands that get promoted within their games. Its revenues are derived from a variety of sources such as in-game ads and product promotions, CPI, subscriptions, etc.

GLUU generates positive cash flows and is expected to clock revenues of $500 million and an EBITDA of 15+% in 2020. It is an efficiently-managed and creative company with healthy cash flows and a strong cash balance. I am bullish on the stock for the long-term and consider it a potential 10-bagger – and here are the reasons why:

Strong Game Portfolio

|

Title |

Genre |

Performance |

Notes |

|

Design Home |

Lifestyle |

Bestseller |

To be extended to desktop in 2020 |

|

Covet Fashion |

Lifestyle |

Bestseller |

To be extended to desktop in 2020 |

|

Tap Sports Baseball |

Sports |

Massive potential |

Recently launched. Has the potential to outperform |

|

Diner Dash |

Lifestyle |

Above-average |

-- |

|

Kim Kardashian Hollywood |

Casual |

Good performer |

Contract extended with Kim for 3.5 years |

|

Disney’s Sorcerer’s Arena |

RPG |

New launch |

Global and massive potential |

|

WWE Universe |

|

|

Flop |

Design Home is the current hot-performer and it is expected to rake in $200 million in 2020. Tap Sports Baseball is expected to garner $100 million, Covet Fashion about $78 million, Kim Kardashian Hollywood is at $40 million, Disney’s Sorcerer’s Arena (newly launched) at $55 million and Diner’s Dash at $30 million. WWE Universe is a flop.

GLUU also will launch the following niche games in 2020:

(a) Originals – collaborative storytelling

(b) Deer Hunter World – Hunting niche

(c) Tap Sports Fishing – Fishing Niche

(d) P3 (untitled) – details not revealed but it is for a mass audience

Financials

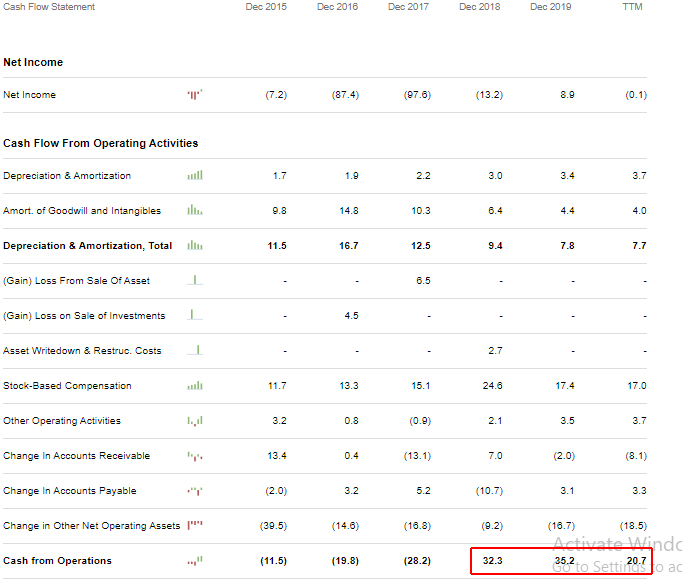

Strong and growing annual cash flows and a debt-free status make GLUU’s a very robust player. The company is expected to end 2020 with $155 million in cash. And the projections are at a pre-COVID-19 run rate – what this implies is that the projections do not include the extra attention that the company is getting because of the stay-at-home situation.

(Click on image to enlarge)

Image Source: Seeking Alpha

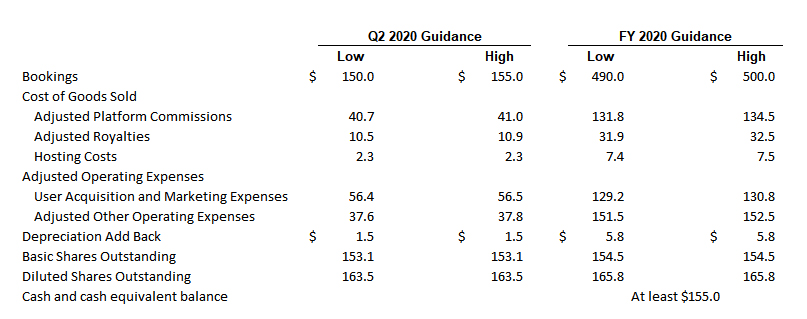

Though the second half of 2020 seems uncertain, the projections are looking very bullish:

(Click on image to enlarge)

You can refer to GLUU’s financials here.

Charts

(Click on image to enlarge)

Image Source: Investing.com

As of May 15, 2020, GLUU is hovering at around $9.40. It has weekly resistance at around $11.78 and support at $7.

Recommendation

GLUU is a buy on dips or in a SIP. It is a robust stock with a portfolio of games that have phenomenal growth potential. Moreover, the virus may hang around for many more months and by that time, many folks may develop a liking for GLUU’s games. The Disney game can become a global blockbuster and it’s already doing great business in Japan and South Korea.

GLUU can only go from strength to strength in the future. That said, the market is expected to fall because economic data is falling and the virus is not letting up. GLUU is a buy on dips and the recommendation is to accumulate it slowly.

Disclosure: I have no position in the stocks discussed, and neither do I plan to buy/sell it in the next 72 hours. I researched and wrote this article. I am not being compensated for it (other ...

more

While I like gaming stocks, especially now when so many are stuck at home, $GLUU was relatively new to me. While I've heard of the company, I've never personally played any of their games and usually stick to companies that I'm personally a fan of. But #GluMobile certainly sounds like a company worth taking a closer look at.

Thanks, Adam. You also can check out PG. It may well turn into a mini-Amazon if the virus disruption prolongs

Great article.

Thanks, Andrew.

superb Sir. The numbers look impressive.