GlaxoSmithKline: The Next Portfolio Vaccine?

Summary

- Favorable Q4 figures bring out optimism amongst investors

- New acquisitions and a new joint venture with Pfizer could lead to something huge

- Higher-than-average yield also comes with its share of uncertainty

GlaxoSmithKline (GSK) has built over the years a pharmaceutical empire. R&D numbers reaching billions, new discoveries leading to newly marketed products as well as new treatment, this goes without saying, they are a big deal. From an investor point of view, it has its ups and downs. While GSK has a higher dividend yield than its peers, it also shows no real growth in the past few quarters. The company hopes to bring out new advances with their recent joint venture with Pfizer, but only time will tell if the gamble was worth it. For readers, please note that the following figures are Pound-denominated (GBP), taken from the UK-based company’s press release.

Understanding the Business

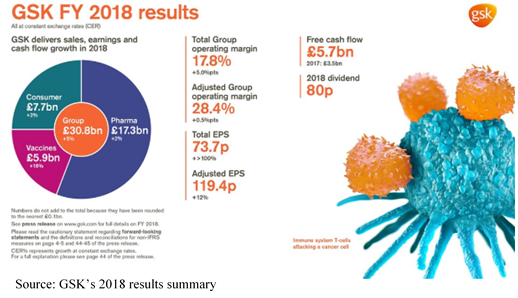

GSK is known all over the world for its intensive research-based products. In 2018, an impressive total of £30.8B sales was recorded, 56% of them coming from the pharma sector. The company splits its activities between 3 global businesses; pharmaceuticals, vaccines, and consumer healthcare. Those leading divisions brought many well-known products to the shelves. From them, consumers can find the Sensodyne toothpaste, Voltaren, the Shingrix and Infanrix vaccines and other medical treatments.

(Click on image to enlarge)

Sales are spread around the globe. In 2017, 37.3% of them were in the US, 26.3% in the Europe area and the remaining 36.4% internationally. While pharmaceuticals might be seen as “money-hungry machines” by some, GSK returned £261.6M to local communities through donated products, time, and money.

Growth Vectors

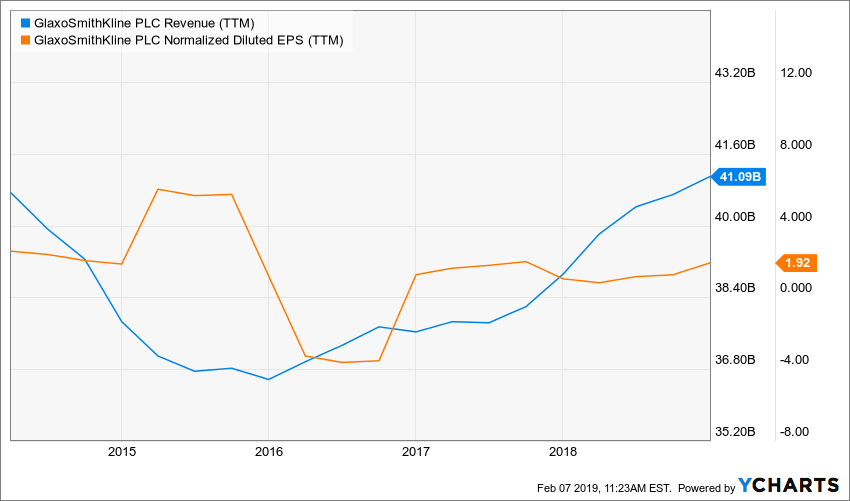

(Click on image to enlarge)

Source: Ycharts

GSK’s future growth plan relies on many important vectors. One of them is, of course, research. In 2018 alone, £3.89B was spent on R&D. This kind of expenditure shows how much it is important for pharmaceutical companies to have a good research-based business strategy. This leaves all the latitude needed by the management to bring new products to the market, not only to individuals but for businesses as well. In 2018, royalty income is just shy £300M.

Another major vector resides in acquisitions and alliance with other pharma businesses. GSK acquired Tesaro (oncology-focused biotech), which is to be completed in 2019’s 1st quarter. The company also considers the joint venture with Pfizer, which could result in extended opportunities. 2018 also noted the development of alliances with Merck KGaA and Darmstadt in order to gather data on potential new cancer medicines.

Latest quarter in a flash

On February 6th, the company reported the following results:

- £0.312, a 14% increase from 2017’s 4th quarter, beating estimates by £0.03

- Revenue of £8.2B, a 7.3% increase, exceeding expectations by £170M

- Declared dividend of £0.23, a 21% boost from the previous quarter

Emma Walmsley, GSK’s CEO, added a few words on those results:

“GSK delivered improved operating performance in 2018 with Group sales growth, strong commercial execution of new product launches, especially Shingrix, continued cost discipline and better cash generation. “It was also a significant year for the Group strategically, with the launch of a new R&D strategy focused on immunology, genetics and new technologies […]”

Dividend Growth Perspective

GSK is not chasing after the highest dividend increase streak. They are instead looking for good, reliable dividend and value for their investors. This does not prevent the company from rewarding their investors with special dividends from time to time.

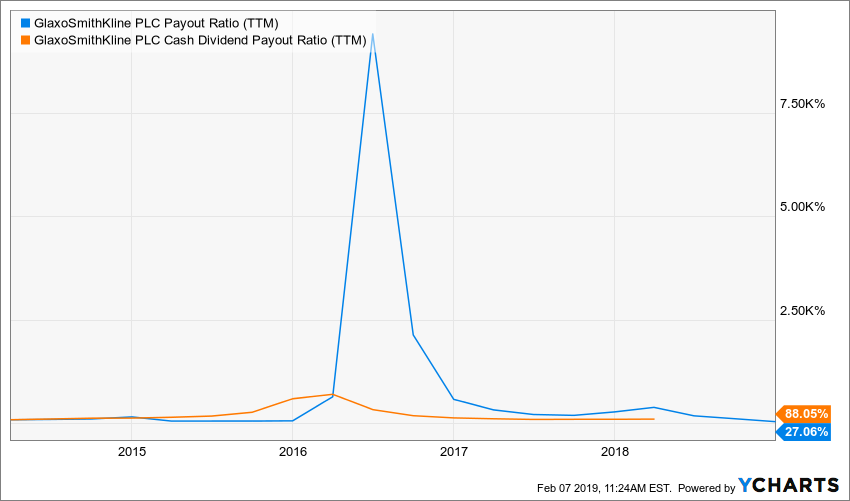

(Click on image to enlarge)

Source: Ycharts

On a yield perspective, GSK is an attractive one. With a 5.2% yield, which is more than 250bp over the industry average, income-seeking investors might want to search a bit further on the company’s financials. As previously mentioned, they are not after an increase streak; the yield can quickly fluctuate.

(Click on image to enlarge)

Source: Ycharts

The payout ratio observed with GSK is not out or the ordinary. Of course, when your net income is down 528%, handing out dividends might spike up this chart (mid-2016, I’m looking at you). At an 88% payout level, I am not too concerned. Peeking at the competitors, this payout fluctuates between 70% and 130%.

Potential Downsides

Pharmaceutical companies face a huge downside coming directly from their products. Even if thorough research and tests were performed, the patient’s safety and wellbeing remain a key risk. This risk can be exponential. As more and more patients are treated, if other diseases can be linked to GSK’s treatment or products, not only money is on the line, but also their public image and reputation could be at stake.

Other potential downsides include product quality (related to the previous paragraph), as well as commercial practices and financial risks. As GSK sells and employs workers all over the world, close monitoring of many factors must be made. This broadly includes human rights, legislation, and financial compliance and so on.

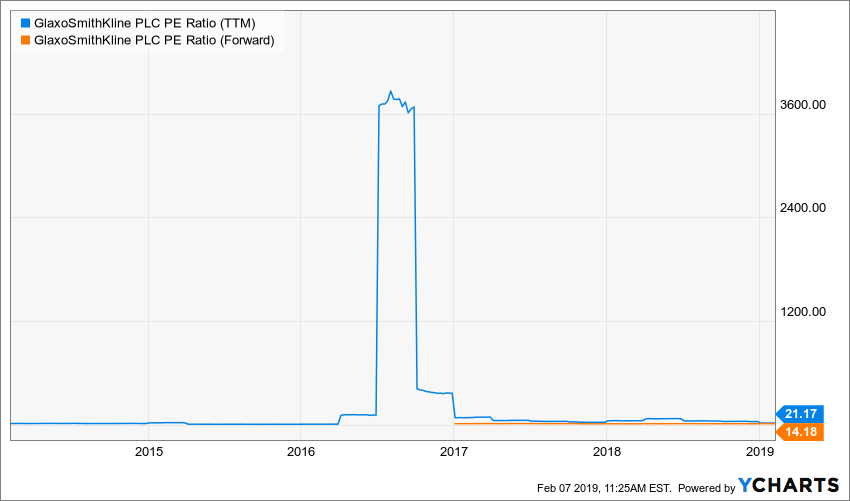

Valuation

Currently trading at around 2x its PE ratio, GSK might show some opportunity. Again, don’t stress too much on the mid-2016 spike, GSK did not have it easy on that quarter. Sterling currency did quite a hole in the figures.

(Click on image to enlarge)

Source: Y charts

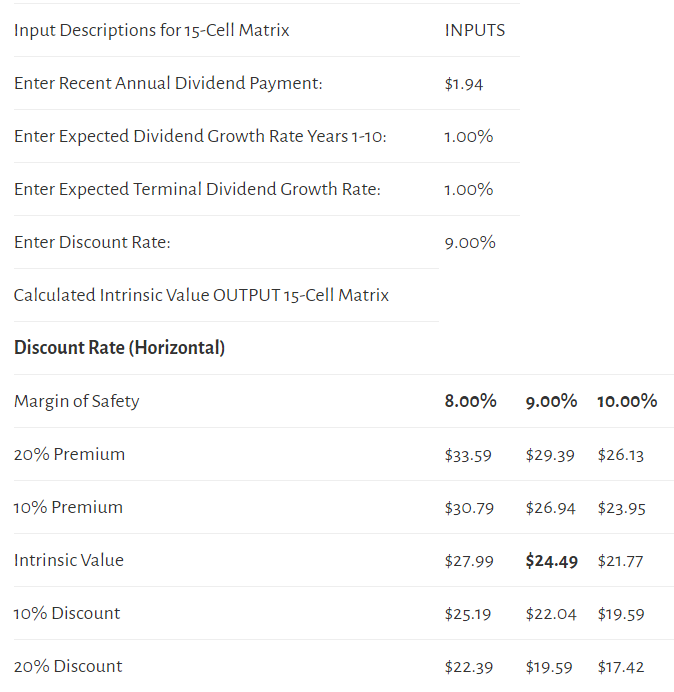

To find out if any opportunity still lies within GSK’s stock, we are using a DDM with a $1.94 annualized payment. Limited growth is expected for GSK, with 1% for both short and long term, alongside a standard 9% discounting rate.

Please read the Dividend Discount Model limitations to fully understand my calculations.

Intrinsic value from the DDM gives us $24.50 which is significantly less than the $40 level the market is currently trading at. Although this might seem like a strongly overvalued stock, remember that the model is very sensitive to its inputs. A 1% growth is fair but low. If the company manages to surpass this, the value can quickly take off.

Final Thought

GlaxoSmithKline is a well-established company in its industry. Their products are known all over the world and their R&D segment is off the charts.

While the company exposed us to their big hopes in their 2019’s guidance, so did investors last year. The current stock price is considered overpriced for the value an investor would get in return. Dividends are satisfying, but there are no growth promises in the foreseeable future. The high dividend yield also comes with a higher risk, which might frighten investors away and unfortunately, there is not yet a vaccine for that!

Disclosure: We do not hold GSK in our DividendStocksRock portfolios.

Additional disclosure: The opinions and the strategies of the author are not intended to ever be a recommendation to buy or ...

more