Gilead Sciences Is Now More Attractive After Showing Superior Results Of Its Newest HIV Drug

Like many other investors in Gilead Sciences (GILD) stock, I have been disappointed with the company's results and the stock performance which is down 45.2% from its all-time high of $123.37 on June 24, 2016. The big decline in its stock price has been caused by a significant decrease in hepatitis C drugs sales due to the competition from AbbVie's (ABBV) and Merck‘s (MRK) HCV drugs, and the deep discount it had to offer to maintain its high market share.

However, Gilead's stock is extremely undervalued, and I still believe in the company's growth prospects due to new revolutionary drugs in its pipeline and a possible big acquisition. As such, I intend to keep my holdings in the company's stock, and even, taking advantage of the low current price; I will buy more Gilead's stocks.

On February 14, at the annual Conference on Retroviruses and Opportunistic Infections in Seattle, Gilead Sciences presented superior results for its newest HIV drug bictegravir over GlaxoSmithKline (GSK) HIV drug.

Norbert Bischofberger, PhD, Executive Vice President, Research and Development and Chief Scientific Officer, explained:

“We are pleased with these positive Phase 2 data, which we believe demonstrate that bictegravir in combination with the FTC/TAF backbone potentially represents a potent new treatment option and an important evolution in HIV therapy. Based on the data observed in this study, we rapidly advanced the combination of bictegravir and FTC/TAF into four Phase 3 clinical trials. The studies are fully enrolled and we look forward to the availability of these data later this year.”

Although the annual number of new HIV diagnoses in the U.S. is declining, about as many as 50,000 new cases are diagnosed every year. Hence, the demand for a new HIV medications which could do less harm to HIV patients is very large, which could increase Gilead's revenue and profits significantly.

Latest Quarter Results

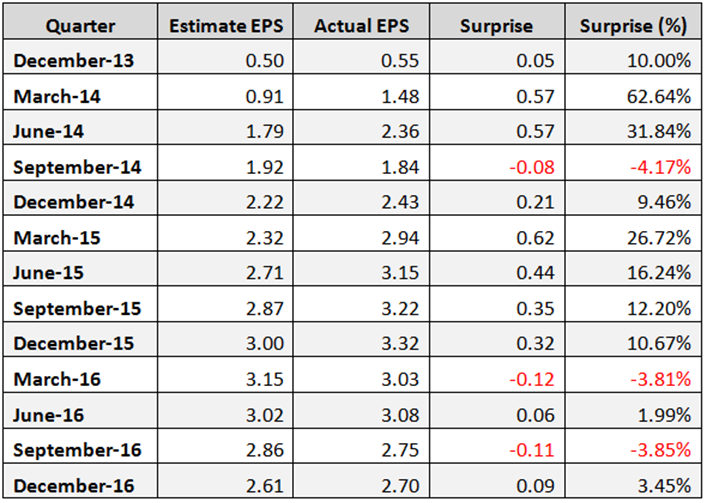

On February 07, Gilead Sciences reported its fourth quarter 2016 financial results, which beat earnings per share expectations by $0.09 (3.5%). GILD's revenues of $7.32 billion for the quarter were better than the consensus estimate of $7.17 billion. The company showed earnings per share surprise in ten of its last thirteen quarters, as shown in the table below.

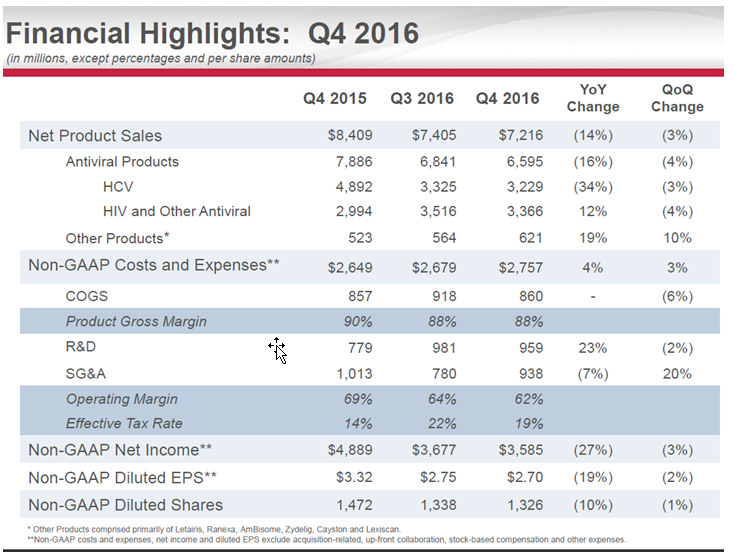

Source: Gilead's Fourth Quarter 2016 Earnings Slides

In the report, Gilead provided a disappointing guidance for the full year 2017. According to the company, revenues expected to be between $22.5 billion to $24.5 billion, and HCV product sales in the range of $7.5 billion to $9 billion. Product gross margin is expected in the range of 86% to 88%.

Gilead Stock Performance

Since the beginning of the year, GILD's stock is down 5.7% while the S&P 500 Index has increased 4.4%, and the Nasdaq Composite Index has gained 7.4%. However, since the beginning of 2012, GILD's stock has gained an impressive 235.7%. In this period, the S&P 500 Index has increased 85.9%, and the Nasdaq Composite Index has risen 122%. According to TipRanks, the average target price of the top analysts is at $84.17, representing an upside of 24.6% from its February 14 close price of $67.55, which appears reasonable, in my opinion.

Valuation

As I see it, GILD's stock is considerably undervalued. Gilead's trailing P/E is very low at 6.80, and its forward P/E is also very low at 8.25. The price to cash flow ratio is very low at 5.58, and the Enterprise Value/EBITDA ratio at 4.40 is very low as well. What's more, its current ratio is very high at 4.20, and on February 7, Gilead announced an increase of 10% in its quarterly cash dividend to $0.52 per share. The forward annual dividend yield is at 3.08%, and the payout ratio is only 18.3%.

Ranking

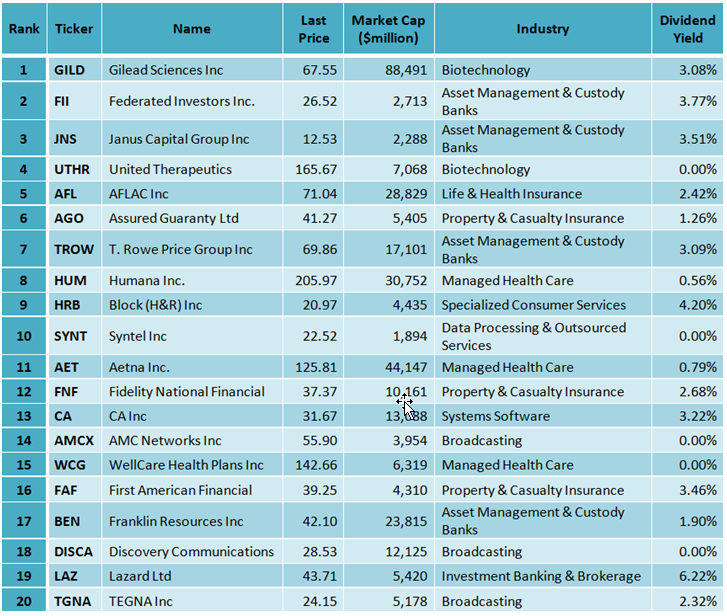

According to Portfolio123’s "All-Stars: Greenblatt" ranking system, GILD's stock is ranked first among all Russell 1000 stocks. The 20 top-ranked Russell 1000 companies according to the ranking system are shown in the table below:

The "All-Stars: Greenblatt" ranking system is taking into account just two factors; Return on Capital and Earnings Yield (E/P) in equal proportions. Back-testing has proved that this ranking system is one of the best free available ranking method. I recommend investors to read Joel Greenblatt's book "The Little Book That Beats the Market", where he thoroughly explains his system.

Summary

Gilead's stock is extremely undervalued, and I still believe in the company's growth prospects due to new revolutionary drugs in its pipeline and a possible big acquisition. The average target price of the top analysts is at $84.17, representing an upside of 24.6% from its February 14 close price of $67.55, which appears reasonable, in my opinion.

Disclosure: I am long GILD stock

Tanks for sharing