Get Ready For A Wild Ride: Here’s How S&P 500 Could Set Up For Huge Momentum Swing After FOMC

Image Source: Unsplash

Despite the bearish sentiment in the stock market, S&P 500 was oversold and should attempt to rally up according to Wyckoff’s efforts vs results.

Watch the video below to find out how the coming FOMC announcement for the rate hike could stir up a huge momentum swing. It is essential to pay attention to how S&P 500 reacts at these key levels in order to form the trading plan for short-term swing trading.

Video Length: 00:08:51

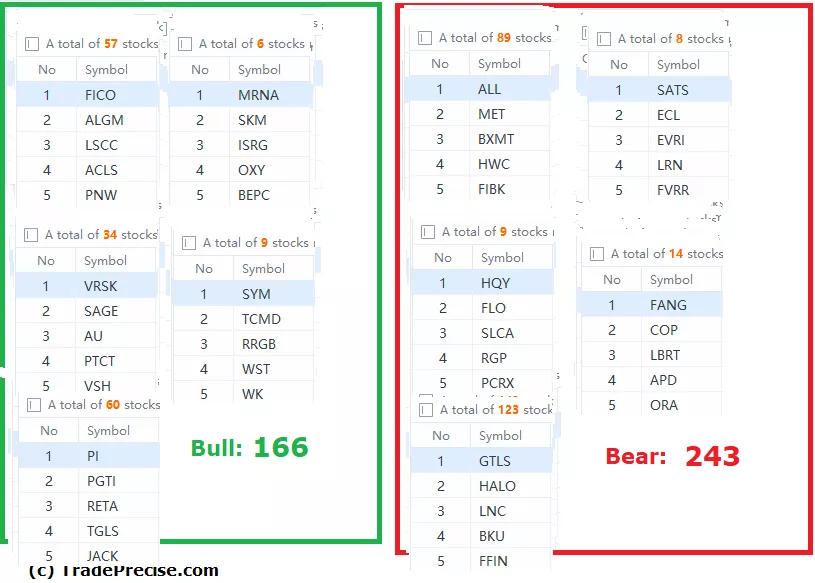

The bullish setup vs. the bearish setup is 166 to 243 from the screenshot of my stock screener below pointed still a negative market environment.

Despite the rebound in S&P 500 as anticipated, the stock market breadth is lacking behind suggested an upside non-confirmation, which is not a healthy market. The semiconductor group (SMH) remains outperformed in the short-term, medium, and longer term since Oct 2022 as discussed during the live session. The video above is part of the latest Weekly Live Group Coaching Session (1.5 hours) on 21 Mar 2023.

More By This Author:

ON Semiconductor Corp. On The Brink Of A Major Break-Out: What’s Next?

MercadoLibre (MELI) May Be Heading Back To Its All-Time High

What’s Next For Rambus In The Outperforming Semiconductor Group?

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.