General Motors Vs. Tesla Stock: Which Is The Better Investment After Q4 Earnings?

Image: Bigstock

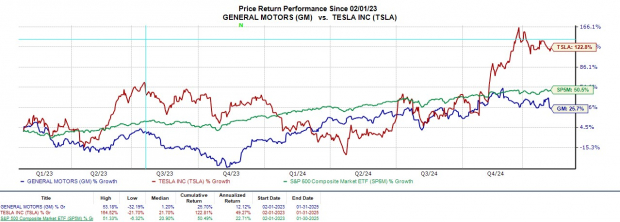

General Motors (GM - Free Report) and Tesla (TSLA - Free Report) highlighted an exciting earnings lineup this week after reporting their Q4 results on Tuesday and Wednesday, respectively.

Heading into the next trading week, investors may be pondering which of these automakers could be the better investment. That said, here’s a review of General Motors and Tesla’s Q4 reports and outlook to help get a better gauge of whether one or the other should be in an investor's portfolio.

Image Source: Zacks Investment Research

General Motors' Q4 Results

Striving to take electric vehicle market share from Tesla and Ford (F - Free Report), General Motors delivered 42,000 EVs during Q4, which is more than double from its year-ago mark of 19,305. The leap was attributed to an expanded product line of new electric models, including the Chevy Equinox EV and Cadillac Lyric.

General Motors sold a total of 1.03 million vehicles worldwide, increasing from 943,000 in Q4 2023. Quarterly sales of $47.71 billion rose 11% from $42.98 billion a year ago and comfortably topped estimates of $44.06 billion. Adjusted earnings came in at $1.92 per share, spiking 55% from EPS of $1.24 in the comparative quarter and eclipsing expectations of $1.85.

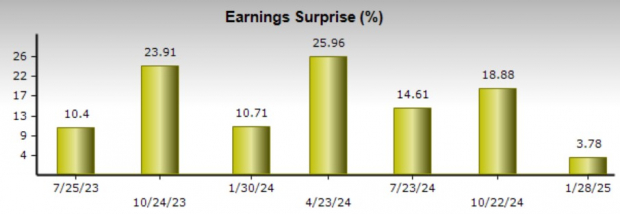

Furthermore, General Motors has surpassed the Zacks EPS Consensus for ten consecutive quarters, with an average earnings surprise of 15.81% in its last four quarterly reports.

Image Source: Zacks Investment Research

Tesla’s Q4 Results

Tesla’s Q4 deliveries were at a record 495,570 vehicles compared to EV sales of 484,507 in the prior year quarter. Still, Q4 sales of $25.7 billion missed estimates of $27.5 billion despite rising 2% year-over-year. Coming up short on its bottom line as well, Tesla posted Q4 EPS of $0.73 with expectations at $0.75, although this was an increase from $0.71 per share in the comparative quarter.

Notably, Tesla has missed earnings expectations in three of its last four quarterly reports, with an average EPS surprise of 0.79%.

Image Source: Zacks Investment Research

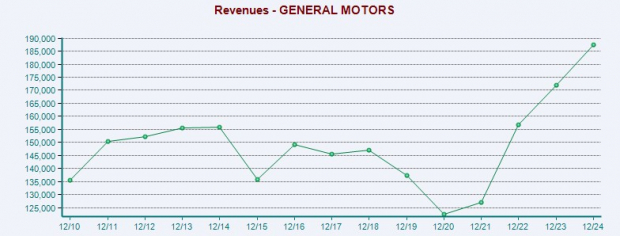

General Motors Full Year Results & Guidance

Rounding out fiscal 2024, General Motors total sales were up 9% to $187.45 billion. Even better, annual earnings spiked 38% to $10.60 per share versus EPS of $7.68 in 2023.

Image Source: Zacks Investment Research

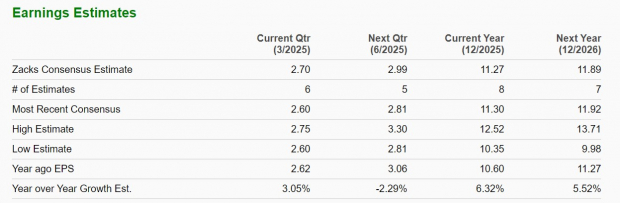

Providing FY25 EPS guidance, General Motors expects earnings in the range of $11.00-$12.00 per share with the Zacks Consensus at $11.27, or 6% growth.

Based on Zacks estimates, General Motors' bottom line is projected to increase another 5% in FY26. It’s also noteworthy that General Motors' FY25 guidance calls for adjusted EBITDA to be between $13.7 billion-$15.7 billion, with adjusted automotive free cash flow to range from $11-$13 billion.

Image Source: Zacks Investment Research

Tesla Full Year Results & Guidance

Pivoting to Tesla, FY24 sales were up 1% to $97.69 billion. However, Tesla’s EPS dipped to $2.42 from $2.60 per share in 2023. Though, Tesla did highlight that its Model Y was the best-selling car in the world last year.

Image Source: Zacks Investment Research

While Tesla did not provide specific FY25 guidance, the EV leader is aiming for 20%-30% growth in vehicle deliveries. Zacks projections call for Tesla’s annual earnings to soar 35% in FY25 to $3.27 per share. More intriguing, FY26 EPS is projected to expand another 22%.

Image Source: Zacks Investment Research

Bottom Line

At the moment, General Motors maintains a Zacks Rank #2 (Buy) rating, while Tesla landed itself a Zacks Rank #3 (Hold) rating. More upside in these popular auto stocks may depend on the trend of earnings estimate revisions in the coming weeks. In regards to holding positions in the portfolio, General Motors' consistency is appealing, and Tesla’s growth trajectory will certainly keep investors engaged.

More By This Author:

Buy Meta Stock After Beating Q4 EPS Expectations By 20%?

Bear Of The Day: Heineken

Chevron Q4 Earnings Lag Estimates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more