General Motors Vs Coca-Cola Stock: Which Is The Better Investment As Q2 Earnings Approach?

Image Source: Pexels

The heart of the Q2 earnings season will progress next week, with several notable companies set to report their quarterly results, including General Motors (GM - Free Report) and Coca-Cola (KO - Free Report).

As iconic staples of the American economy and having an extensive global outreach as well, General Motors and Coca-Cola stock tend to draw the attention of both institutional and retail investors.

Considering such, let’s discuss which may be the better investment option to consider as their Q2 reports approach on Tuesday, July 22.

General Motors & Coca-Cola’s Q2 Expectations

Following a tougher period to compete against, General Motors' Q2 sales are thought to have dipped 5% to $45.34 billion compared to $47.97 billion a year ago. On the bottom line, General Motors’ Q2 earnings are expected at $2.45 per share, a 20% decrease from EPS of $3.06 in the prior year quarter. However, it’s noteworthy that the auto giant has exceeded the Zacks EPS Consensus for 11 consecutive quarters, with an average earnings surprise of 10.16% over the last four quarters.

Image Source: Zacks Investment Research

Pivoting to Coca-Cola, the beverage giant’s Q2 sales are expected to be up 2% to $12.59 billion from $12.36 billion in the comparative period. Coca-Cola's quarterly earnings are expected at $0.83 a share, slightly down from EPS of $0.84 in Q2 2024. Remarkably, Coca-Cola has reached or exceeded the Zacks EPS Consensus for 32 consecutive quarters, dating back to July of 2017, with an average earnings surprise of 4.93% in its last four quarterly reports.

Image Source: Zacks Investment Research

GM & KO Valuation Comparison

While General Motors’ Q2 expectations may be underwhelming compared to Coca-Cola’s, GM stands out in terms of valuation at just 5.7X forward earnings, with KO at 23.8X and roughly on par with the benchmark S&P 500. Furthermore, GM offers a significant discount to the broader market in terms of price to forward sales at less than 1X, with KO at 6.3X, which is also near the S&P 500’s average.

Image Source: Zacks Investment Research

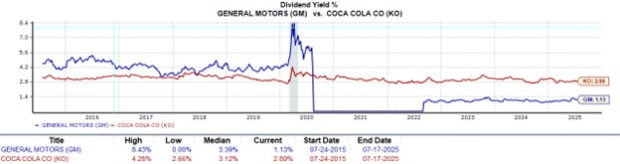

GM & KO Dividend Comparison

Somewhat turning the scale in terms of the value the stocks of these respective industry leaders offer investors, Coca-Cola’s 2.89% annual dividend yield impressively trumps General Motors' 1.13% and the S&P 500’s average of 1.18%.

Furthermore, Coca-Cola is a Dividend King, increasing its dividend for more than 50 consecutive years, while General Motors had to halt its payout during the pandemic as supply chain issues severely disrupted global auto sales and manufacturing operations.

Image Source: Zacks Investment Research

Bottom Line – Operational & Strategic Factors

Undoubtedly, in terms of valuation metrics, General Motors stock is far more appealing than Coca-Cola's. However, Coca-Cola’s compelling consistency regarding its operational performance and reliable dividend is hard to overlook, with KO sporting a Zacks Rank #2 (Buy) at the moment.

Meanwhile, despite General Motors' more attractive valuation, GM lands a Zacks Rank #3 (Hold). To that point, the expected dip in General Motors’ Q2 figures is also a reflection of a tougher operating environment amid higher tariffs, while Coca-Cola stock tends to be an effective defensive hedge against economic uncertainty due to constant demand for its beverage products. Illustrative of such, KO is up a very respectable +12% year to date, with the performance of GM shares being virtually flat.

More By This Author:

D.R. Horton To Report Q3 Earnings: Buy, Sell Or Hold The Stock?

Coca-Cola's Q2 Earnings On The Deck: A Smart Buy Before The Release?

PNC & AIR Are 2 Top Stocks To Watch After Earnings

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more