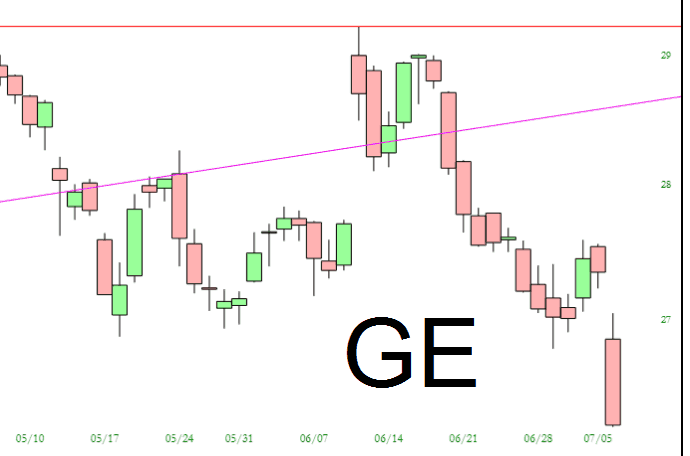

General Electric Has Plenty More Downside Potential

In case you missed it during the many instances I mentioned it here and on Twitter, I contracted a virus. Mercifully, it seems to be on the wane (hurray, Tim’s immune system!) but while I was in the throes of my illness, I did something I hardly ever do, which is turn on CNBC (the total amount of television I watch in a year is probably a few hours, at most, and I only vomit my way through CNBC viewing during Fed announcements).

Anyway, the topic of discussion was General Electric (GE), which is my largest non-ETF short position. I took this screenshot earlier today, although I think it fell lower…

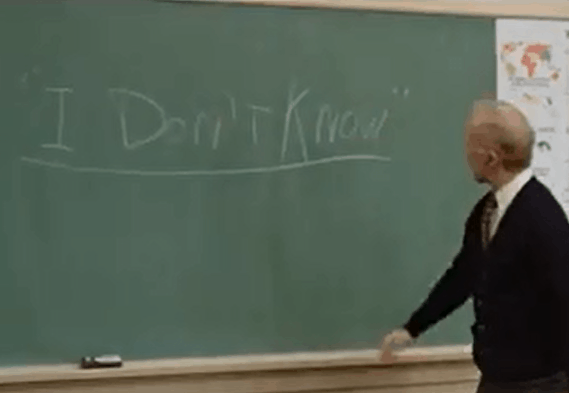

I didn’t catch the name of the segment I was watching, but it was probably Fast Money, since it was a bunch of balding, overweight white guysyammering endlessly bullish things about stocks. Commenting on the decline in GE, one of the syphilitic tubbies said, in a New York accent, “So how much downside is der in GE, huh? One dolla? Two dollas?” There was a brief moment of silence, and then one of the other tubbies said, “Why couldn’t it go lower”, to which the original fat tub said, “I don’t know.”

And that, my friends, is the entire wisdom of CNBC encapsulated in three monosyllabic words.

My answer to this putz is simple: GE has plenty more downside potential. Your indiscriminate declaration that there could only possibly be one or two “dollas” of downside risk is a ludicrous pontification, bordering on magical thinking. You deserve to be on CNBC.

Disclosure: None.

Thanks Sir