General Communications - Chart Of The Day

General Communications - Chart Of The Day 0 comments

Oct 22, 2015 9:35 PM | about stocks: GNCMA

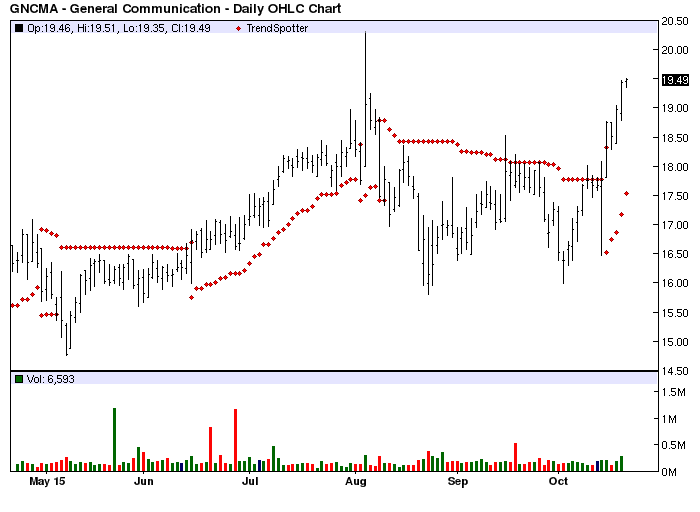

The Chart of the Day is General Communications (GNCMA). I found the diversified telephone stock by using Barchart to sort the Russell 3000 Index stocks first for a Weighted Alpha of at least 50.00+ then again for technical buy signals of 80% or better. Since the Trend Spotter signaled a buy in 10/15 the stock gained 3.47%.

General Communication, Inc. is a diversified telecommunications provider with a leading position in facilities-based long distance service in the state of Alaska and, as a result of recent acquisitions, has become Alaska's leading cable television service provider. The Company seeks to become the first significant provider in Alaska of an integrated package of telecommunications and cable television services.

(click to enlarge)

The status of Barchart's Opinion trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com web site when you read this report.

Barchart technical indicators:

- 100% Barchart technical buy signals

- 70.70+ Weighted Alpha

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 7 new highs and up 9.12% in the last month

- Relative Strength Index 70.96%

- Barchart computes a technical support level at 18.53

- Recently traded at 19.49 with a 50 day moving average of 17.42

Fundamental factors:

- Market Cap %768.10 million

- Revenue expected to grow 5.60% this year and another 6.10% next year

- Earnings estimated to decrease 305.60% this year but increase again by 391.90% next year and continue to compound at an annual rate of 16.00% for the next 5 years

- Wall Street analysts issued a hold recommendation for this stock

None of the usual technical trading strategies have been reliable on this stock so I suggest you use the 100 day moving average as a stop loss to protect your gains.

Stocks: GNCMA

Disclosure:None.

The stock is up around 48% ytd but there's precious little analyst opinions on the stock with only one opinion - a hold. With a market cap of under $1 bn, is this a gem of a stock that's too small to matter? Look out for earnings release next week Nov 4th.