GEHC: A Healthcare Equipment Stock That Will Benefit From Trade Deals

Image Source: Pixabay

Stocks have rallied 30% from April’s Liberation Day low, when President Trump announced double-digit tariffs on global trading partners. Despite signs of progress, US exporters remain under pressure…and therein lies the opportunity. I like GE HealthCare Technologies Inc. (GEHC)

Japan and Indonesia just signed 15% trade deals, and Treasury Secretary Bessent’s third round of talks with Chinese counterparts bodes well. If I am right about deals taking shape in the coming weeks and trading terms being less onerous than feared, these laggards will catch up quickly.

GEHC leads the world at designing and manufacturing diagnostic radiological equipment (X-rays, MRIs, CAT-scans, Ultrasound machines). The crown jewel of Jack Welch’s legacy General Electric empire, this $20 billion business was spun out as a stand-alone company in 2022 and is now a member of the S&P 500 Index (SPX).

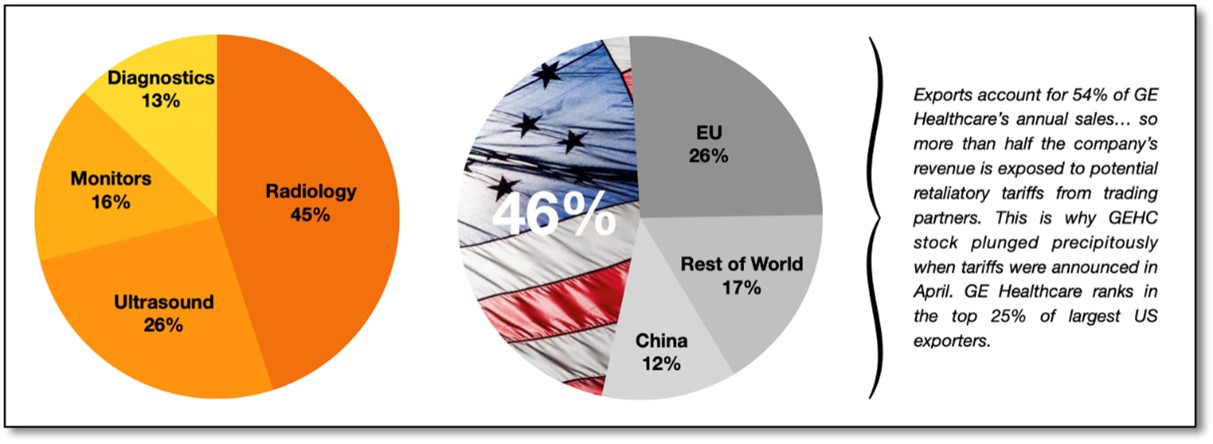

Curiously, its globally diverse customer base has gone from being an asset to a liability amid tariff uncertainty. GE Healthcare sells more than half its machines to non-US customers, and if trading partners erect retaliatory tariffs against the US, GE could see profit margins squeezed.

As a precaution, management cut guidance by 20% after the Trump Administration’s Liberation Day tariff announcement, causing the stock to fall 30%. While sobering, the CEO’s caution was probably overly reactive, and the market’s response was overly punishing. The stock has already begun to recover.

As countries hammer out trade agreements with the US, I think we’ll learn that the bark was worse than the bite, and GEHC will fare better than initially assumed. Looking forward, the stock is cheap, the business is growing, and its machines save lives. GEHC will be fine.

My $112 price target reflects the company’s historic P/E multiple of 19.5x applied to 2027 earnings estimates of $5.75. My forward EPS estimate assumes that earnings will be flat this year, then reaccelerate to the company’s demonstrated 13% growth rate by next year.

Recommended Action: Buy GEHC.

More By This Author:

CCI: A Wireless Tower Titan That Just Reported Stellar ResultsAre America’s Markets Still Exceptional? Or Is It Time To Bail?

Solid Power: A High-Momentum Battery Play For Speculative Traders

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more