GE: Q1 EPS Tops Forecasts, Management Talks Tariff Plans

Image Source: Unsplash

Management emphasized the company had a strong start to 2025 with orders and revenue up by double digits. That strength was driven by commercial services and improvements through its Flight Deck platform, which should enable GE Aerospace (GE) to tackle supply chain constraints and accelerate deliveries throughout the rest of the year.

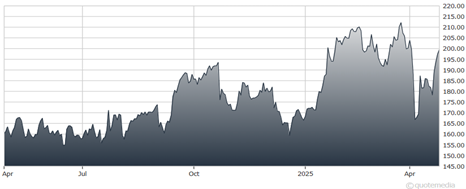

GE Aerospace (GE)

The company guided for low double-digit revenue for full-year 2025 and for earnings to increase nearly 20%. GE said it’s offsetting the effects of President Trump’s tariffs by cutting costs and adjusting prices. While GE officials cautioned that the “tariffs will result in additional cost for us and our suppliers,” they said they were “optimizing operations and leveraging existing programs and strategies to reduce the impact from tariffs.”

According to Seeking Alpha, the top brass also “raised the tariff issue” directly with the president during a recent meeting, which said GE’s stance was “understood” by the administration. A Reuters report last week also noted that CEO Larry Culp has called for a revival of the 1979 Civil Aircraft Agreement’s tariff-free provisions, which he says once served as a key driver of US aerospace dominance.

Recommended Action: Hold GE.

More By This Author:

Could Bonds Be A Portfolio Savior In These Volatile Times?BA: Q1 Results Signal Turnaround Is On The Right Track

Housing: Solid March...But Supply And Rate Concerns Now Rising

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more