GameStop Insanity: Stock Hits $365, Then Dips After Shorts Melvin, Citron Capitulate

The "most-shorted" short squeeze, led by the infamous GammaStop GameStop, continued overnight with our basket of most shorted names...

... exploding in the early hours and pushing GME as high as a record $365...

.... before the stock slumped following a report from CNBC that Melvin Capital, the nemesis of r/wallstreetbets which needed a $2.75BN bailout from Citadel and Point72 to avoid a terminal margin call, had "closed out its short position in GameStop on Tuesday afternoon after taking a huge loss" the fund's manager Gabe Plotkin told CNBC’s Andrew Ross Sorkin. It was unclear what exactly this meant: did Melvin merely sell its now worthless puts, or did it also have associated GME shorts on the underlying stock? We assume both, although it could very well just be fake news and an attempt to deflect the relentless WSB army of daytraders. Until there is official confirmation from Mevlin, we should treat this information as suspect.

Additionally, moments after the CNBC report, short-seller Andrew Left's Citron Research fund also announced in a Twitter clip that it had covered most of its GME short yesterday around $90.

An Update from Citron Research https://t.co/ZGwLkQ4IY1 via @YouTube

— Citron Research (@CitronResearch) January 27, 2021

In the clip, Left admits his call last week for GME dropping from $40 to $20 was a mistake even though Citron Capital "is just fine", and was cautiously deferential to the meme/WallStreetBets crowd. Some of his key quotes:

"I'm doing this video because I cannot answer one more phone call..."

"I'm just fine. Citron Capital is just fine. Covered a majority of the short in the $90's..."

"I learned from Tilray, it was a killer. It went all the way back to $6. I expect the same thing from GameStop, but I have respect for the market. I also have respect for the people at the WallStreetBets Reddit message boards. Before there was WSB, there was Citron Research. We were the voice of the individual investor against the institutions."

"I never got personal, I never got nasty, I never threatened a corporate executive or their shareholders. It was always business."

"We'll become more judicious when shorting stocks. It doesn't meant the industry is dead, it means you have to be more specific."

"When you make your profits, make sure you put some away for the IRS. That money is not all your money. But at the end of the year you do owe tax money."

Left's confession comes one day after telling Reuters that he usually "does not usually smoke. But on Monday he had a cigarette to calm his nerves as shares of GameStop Corp, the stock he had shorted, continued to rocket higher."

“If I had never been involved in GameStop and came to this right now, would I still be short this stock? 100 percent,” Left, who runs Citron Research and a hedge fund, told Reuters on Tuesday. “This is an old school, failing mall-based video retailer and investors can’t change the perception of that.”

Finally, it is worth noting that late on Tuesday, investor Michael Burry - who years ago went long Gamespot precisely on the basis that he expected a massive squeeze said in a now-deleted tweet Tuesday that trading in GameStop is “unnatural, insane, and dangerous” and there should be “legal and regulatory repercussions.”

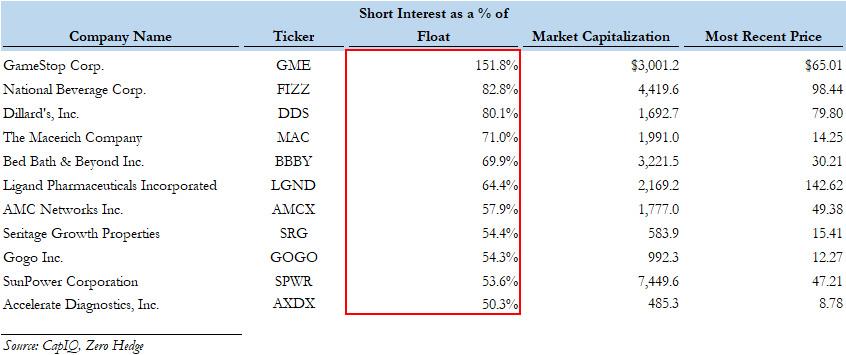

Assuming that both of these entities are indeed out of the picture, the question now is how much of the massive short overhang remains. We assume the answer is "a lot." As a reminder, just two days ago we noted that "after all the chaos", GME shorts were still a whopping 139% of the float, as new shorts came in to replace existing shorts who had covered.

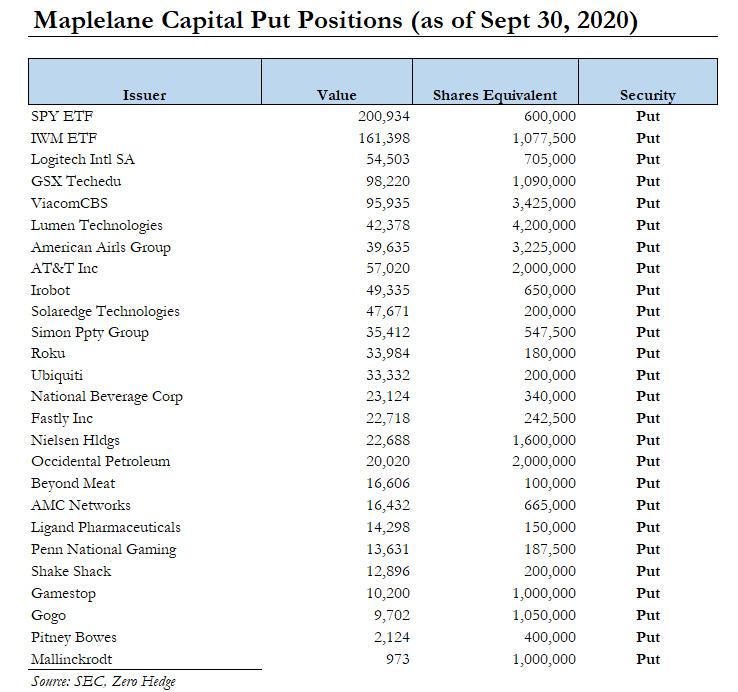

In other words, while two big shorts may be out, countless others remain, among which of course is Maplelane Capital which as we exclusively showed last night, may well be the "next Melvin", needing either a bailout or will be forced to sell its existing longs to cover margin calls.

In any case, after dropping as "low" as $180, or about half where it was just an hour earlier, it appears that the wallstreetbets crowd has renewed its effort and GME was last trading at $246, up still a whopping 65% a level which could easily go much higher once today's gamma vortex in deep OTM calls kicks in and dealers resume their delta-hedged chasing of the stock higher, while all the other shorts are forced to scramble and cover as well, a predicament which could only get worse if current longs pull their borrow.

Here's a little trick: everyone who is long GME should instruct their broker tomorrow to make their shares not lendable.

— zerohedge (@zerohedge) January 27, 2021