Full Cycle Bearings

Image Source: Pexels

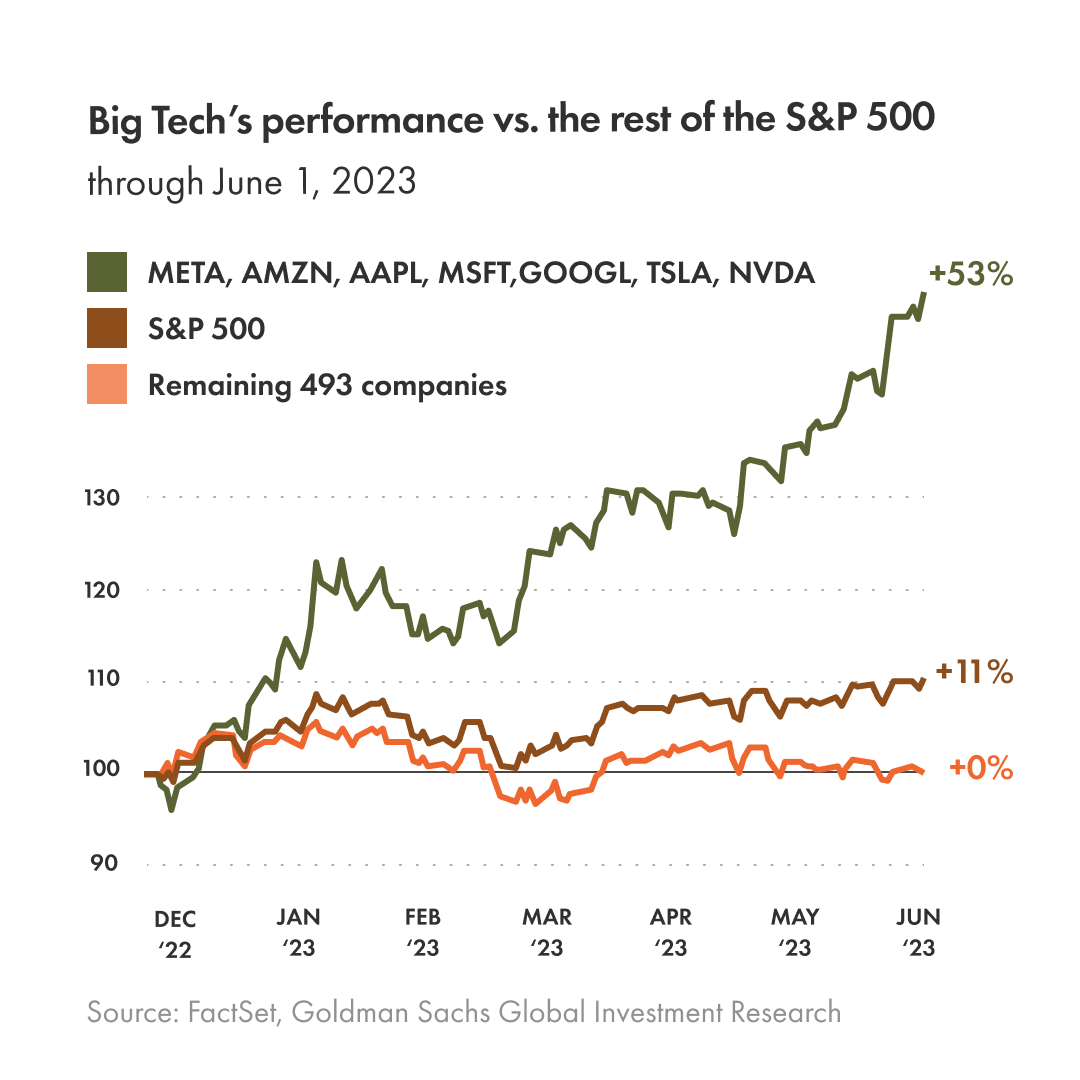

The S&P 500 is up 11% YTD (below in brown); the Nasdaq nearly 33%; and the TSX is +2.5%. Under the hood, a 53% year-to-date average gain for the seven most expensive US tech companies has done the lifting (in green below since December 2022), while the other 493 S&P 500 companies (in orange) have gone nowhere.

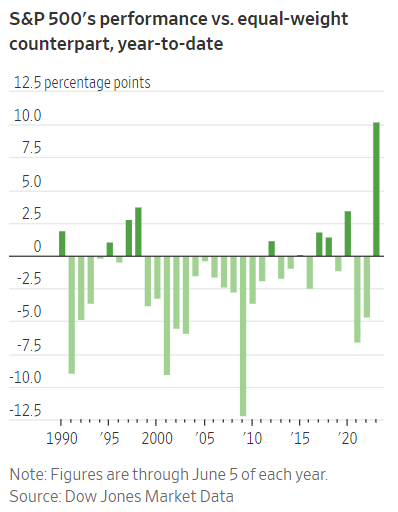

As shown below, the year-to-date market-weighted S&P 500 gain versus an equal-weighted basket is the most extreme since at least 1990.

Today, the eight most expensive tech stocks account for 30% of the S&P 500 market cap. At the March 2000 cycle peak, tech accounted for 34.8% of the index. Sixteen years and two brutal bear markets later, the sector had shrunk to 20% of the S&P market cap.

As shown below by my partner Cory Venable, the S&P 500’s 51% drop through October 2022 saw a series of sharp rebounds, including one from June to September 2000 that nearly reclaimed the March 200o top.

(Click on image to enlarge)

Sentiment and stock allocations among participants are back near record highs. The S&P 500 has rebounded within 10% of its December 2021 peak, and there’s excited talk that a new bull market has begun. History warns that we’ve not nearly earned that yet.

More By This Author:

Bank Of Canada Strikes Again

Recession Start Date And Stock Markets

ECRI: Market “O-shit” Moment Yet To Come