Freeport McMoRan (FCX) Forming Worrisome Stock Price Pattern?

(Click on image to enlarge)

Copper and Gold miner Freeport McMoRan (FCX) is in the middle of all things metals. And the economy.

As the economy heats up, copper prices tend to follow. And if interest rates and / or inflation ticks higher, Gold tends to follow.

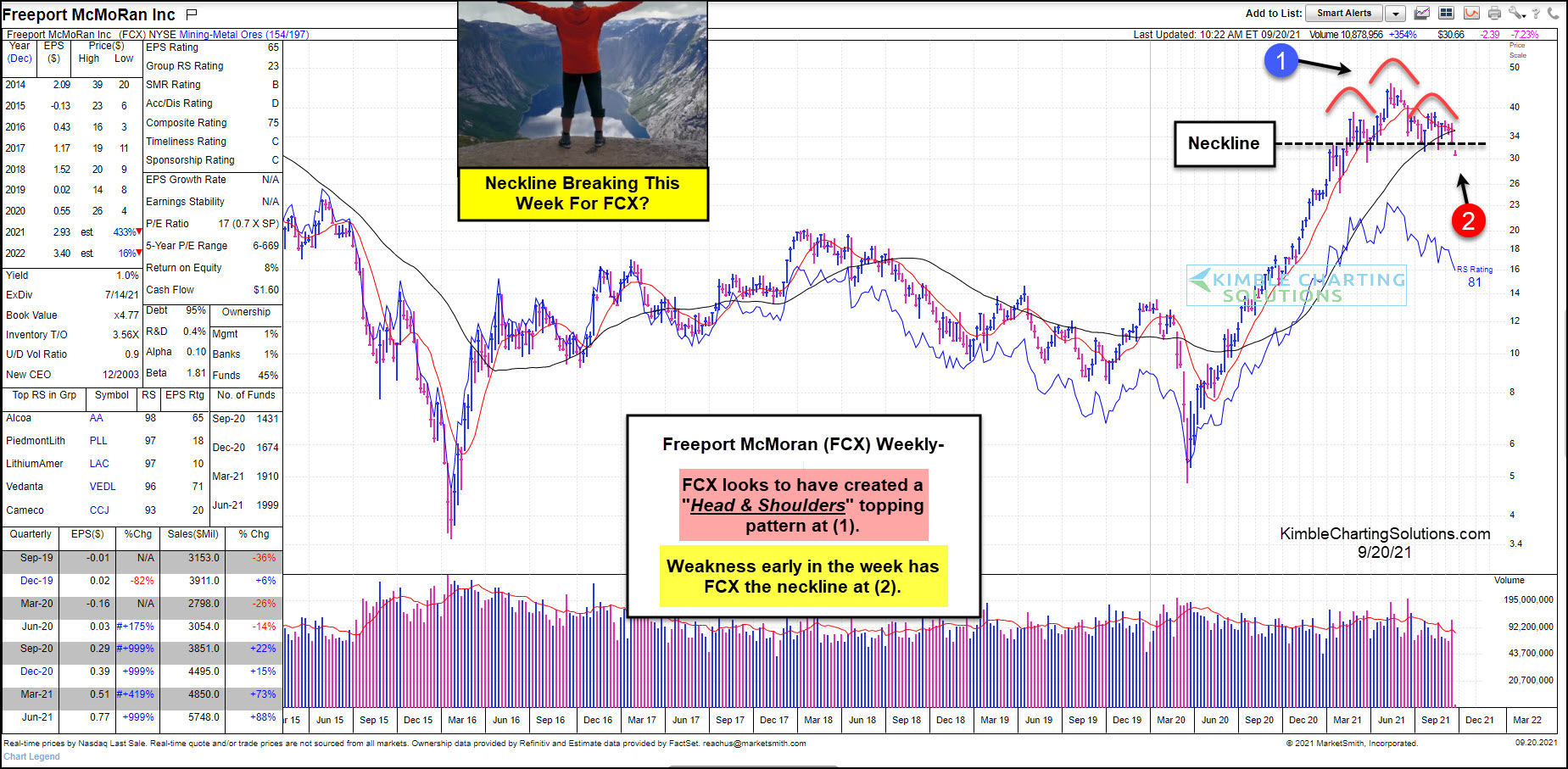

Over the past 18 months, Freeport McMoRan’s stock (FCX) has risen sharply, reflected in this chart from Marketsmith.com. This has come as the economy has picked up and an uptick in inflation has followed. But the stock’s price has begun to pull back and lose momentum. Will this be a sign of an overall slowdown?

Looking at the “weekly” chart of FCX, we can see that the stock’s slowdown has formed an ominous “head and shoulders” bearish pattern at (1). And price is now attempting to break below the neckline of this pattern at (2).

Further weakness would be bearish for FCX bulls and perhaps the broader economy and market. Will bulls step up and save FCX? Or will bears feast on this developing weakness?

One thing for sure, this isn’t a head and shoulders top, until FCX can close solidly below the neckline, on a weekly basis!

Disclosure: Sign up for Chris's Kimble Charting Solutions' email alerts--click here.