Forget Nvidia? Why Savvy Investors Are Quietly Buying TSM Stock Right Now

Image Source: Unsplash

Over the past three decades, Taiwan Semiconductor Manufacturing Company (TSM) has grown from a behind-the-scenes chip fabricator into the world’s most valuable semiconductor manufacturer, quietly powering the devices, data centers, and AI models we use every day.

In my previous blog, ‘TSMC Stock Crashes: Here’s Why Smart Investors Are Buying the Dip Now’, we explored how short term volatility can create long term opportunity. Since then, TSMC has begun entering a new chapter, one fueled by the explosive demand for AI chips, expanding global manufacturing, and a clear ambition to become the backbone of the AI-driven world.

This isn’t just about semiconductors, it’s about controlling the infrastructure behind AI, cloud computing, smartphones, and autonomous systems. TSMC’s dominance in producing cutting edge 3nm and 5nm chips gives it a near monopoly on the most advanced processors.

Its clients? Nvidia, Apple, AMD, Broadcom, and virtually every tech company that matters. Add to that a 39% YoY sales surge in Q2 2025 and fabs booked out through 2027, and you’ve got a business quietly minting billions from the AI boom.

But this dominance comes with geopolitical weight. TSMC’s proximity to China makes it a national security concern for the West. That’s why it’s expanding fast like building factories in Arizona, Japan, and Germany to reduce concentration risk and support long term growth.

Meanwhile, its valuation still lags peers like Nvidia or ASML, trading at just 21x forward earnings despite higher growth, suggesting room for upside.

For those wondering – it is too late to get in?

Let’s revisit and have another look at TSMC using the IDDA Framework: Capital, Intentional, Fundamentals, Sentimental, and Technical.

IDDA Point 1 & 2: Capital & Intentional

Before investing in TSMC, ask yourself:

Do you want to own the company powering the AI revolution from behind the scenes?

Do you believe TSMC can maintain its edge as the world’s most advanced chipmaker, despite rising global tensions?

Are you comfortable with geopolitical risks tied to Taiwan, and confident in TSMC’s ability to diversify globally?

TSMC isn’t just selling chips, it’s enabling every device, data center, and AI model that runs on silicon. Its intentional expansion into the U.S., Japan, and Europe is a strategic masterstroke to mitigate risks while capturing demand from global tech giants. As AI becomes more embedded in daily life, TSM is building the infrastructure that powers it.

However, the risks are real. Its customer base is concentrated, Apple and Nvidia alone account for a large portion of revenue. It also faces input cost pressures and currency risks. And while geopolitical tensions haven’t impacted operations yet, they remain a dark cloud over an otherwise stellar business.

Still, for long-term investors, TSMC represents one of the most mission critical companies in the AI era. It’s less flashy than Nvidia, but arguably more essential. If it continues to grow earnings as projected, even a modest re-rating to peer valuation levels could unlock significant upside. The company may be headquartered in Taiwan but its future is clearly global.

IDDA Point 3: Fundamentals

Blowout Sales Growth: TSMC’s June sales rose 39% YoY, bringing total Q2 revenue to NT$933.8B (US$39.1B), beating estimates and pointing to a strong Q2 earnings report on July 17.

Strong Market Position: TSMC remains the global leader in advanced chip manufacturing, growing its foundry market share to 67.6% in Q1 2025.

Earnings Momentum: H1 2025 earnings are up 40% YoY, with expectations for continued profit growth and possible upward revision in guidance.

Attractive Valuation: TSMC trades at just 21x forward earnings, while peers like ASML and Nvidia trade at 26 – 28x, despite TSM’s strong performance.

Global Expansion: New fabs in Arizona, Japan, and Germany reduce geopolitical risks and support future revenue growth across the U.S., Europe, and Asia.

In summary, TSMC’s fundamentals are strong, with June sales up 39% YoY and Q2 revenue beating expectations at US$39.1B. It holds a leading 67.6% share of the global chip foundry market and saw a 40% profit jump in H1 2025. Despite this growth, the stock trades at just 21x forward earnings, which is cheaper than peers like Nvidia and ASML. Its new factories in the U.S., Japan, and Germany also reduce risk and support future global growth.

Fundamental Risk: Medium

IDDA Point 4: Sentimental

Strengths

Explosive AI-Driven Growth: TSMC’s Q2 2025 sales surged 39% YoY, driven by booming AI demand, positioning the company for strong earnings and continued momentum.

Global Expansion Reducing Risk: New fabs in the U.S., Japan, and Europe are diversifying geographic risk and enhancing TSMC’s long term growth prospects and global reach.

Undervalued vs Peers: TSMC trades at just 21x forward earnings, well below peers like Nvidia and ASML – despite stronger fundamentals and higher market share, suggesting potential upside.

Risks

Geopolitical Risk: TSMC’s operations remain closely tied to Taiwan, making it vulnerable to U.S.-China tensions and regional instability.

Customer Concentration: A significant portion of revenue relies on a few major clients like Apple and Nvidia, creating risk if demand or relationships shift.

Input Costs & Currency Pressure: Rising labor costs from overseas expansion and the strong Taiwan dollar could impact gross margins and profitability.

Investor sentiment toward TSMC remains strongly bullish as the company is widely seen not just as a chipmaker, but as the backbone of the global AI and tech supply chain, powering industry leaders like Nvidia, Apple, AMD, and Broadcom.

Despite recent stock gains, TSMC is still perceived as undervalued compared to U.S. peers due to geopolitical concerns around Taiwan. However, its rapid international expansion into the U.S., Japan, and Europe is easing those fears and boosting confidence that the company deserves a higher valuation multiple.

With Q2 earnings expected to be strong, many long term investors are eyeing any short term dips as buying opportunities. While risks like customer concentration and supply dependencies remain, the overarching narrative is clear: TSMC is a foundational force in the future of AI, autonomous tech, and global innovation.

Sentimental Risk: Medium

IDDA Point 5: Technical

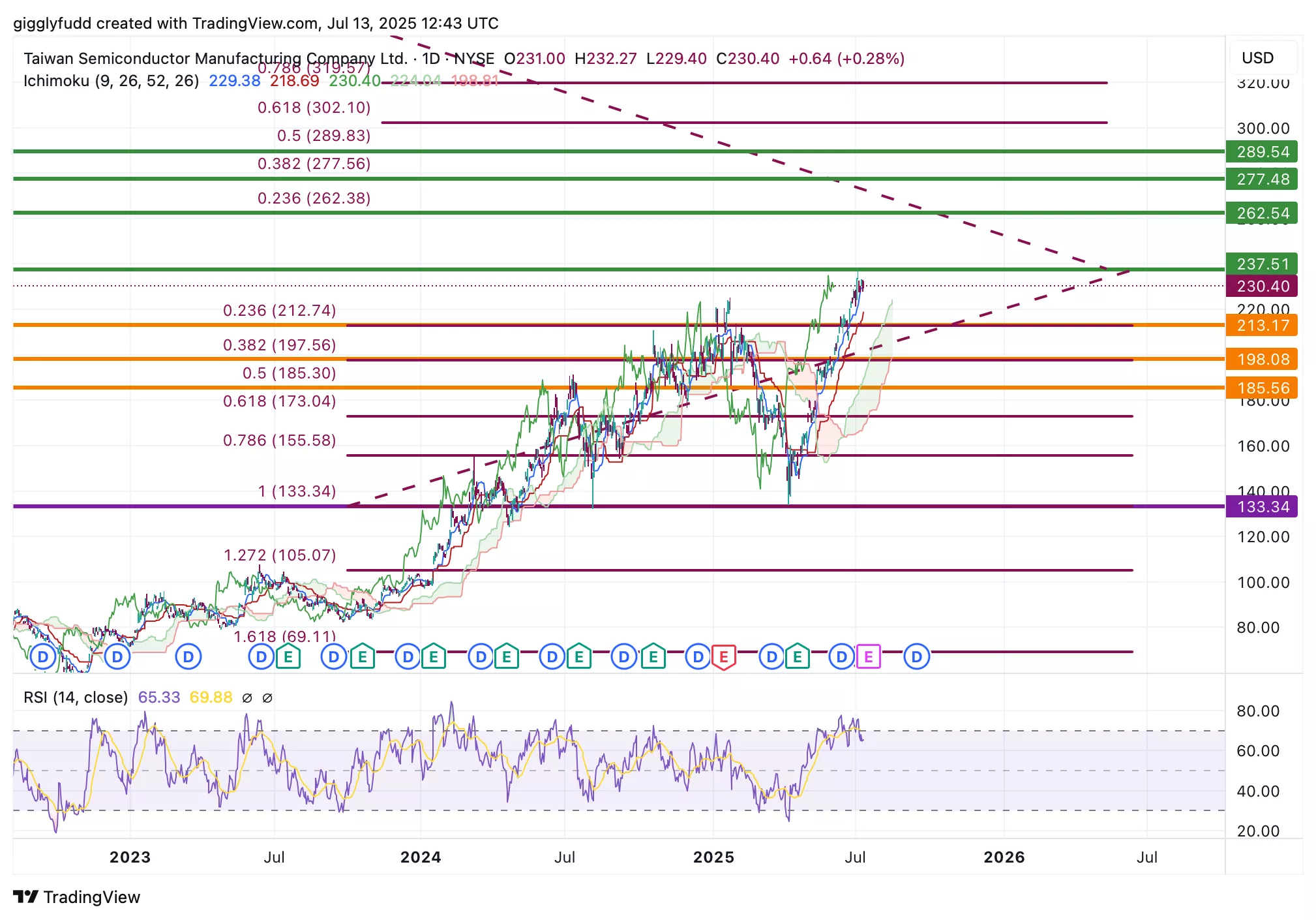

On the daily chart:

The future Ichimoku cloud is wide and bullish, signaling continued upward momentum.

Candlesticks, along with the Kijun, Tenkan, and Chikou lines, remain above the cloud, reinforcing the strength of the current uptrend.

The RSI is currently overbought at 65.13, suggesting a potential short-term pullback.

Since the pullback in April, the TSMC stock has been steadily trending upward. The bullish Ichimoku setup, with the candlesticks consistently above the cloud, supports this ongoing strength. The stock recently reached a new high of $237 and is now showing signs of a potential retracement, which could present a new entry opportunity for investors.

Investors looking to get in TSMC can consider these Buy Limit Entries:

Current market price 230.40 (High Risk – FOMO entry)

213.17 (High Risk)

198.08 (Medium Risk)

185.56 (Low Risk)

Investors looking to take profit can consider these Sell Limit Levels:

262.54 (Short term)

277.48 (Medium term)

289.54 (Long term)

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your

- CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical Risk: Medium

Final Thoughts on Taiwan Semiconductor Manufacturing Company (TSM)

TSMC continues to strengthen its position as the world’s most important semiconductor foundry, powering advanced chips for giants like Nvidia, Apple, AMD, and Broadcom. Its 39% YoY sales growth and rising market share reflect strong momentum, with Q2 earnings expected to confirm this trend.

Global expansion into the U.S., Japan, and Germany is helping reduce geopolitical risks and close the valuation gap with peers like ASML and Nvidia. While short-term risks remain, TSMC’s long term outlook points to strong earnings growth and expanding capacity.

Technically, the stock is in an uptrend, and although a short-term pullback may occur, it could offer a solid entry point. Overall, TSMC remains a key, undervalued player in the AI hardware boom.

Recommendation: Buy / Moderate Risk, High Conviction AI Infrastructure Play

TSMC offers a compelling entry point for investors seeking long-term exposure to the AI supercycle. Its unmatched scale in chip production, diversified global footprint, and mission-critical role in enabling AI make it a foundational asset. While geopolitical overhangs persist, the company’s strategic moves and earnings power provide a strong case for accumulation ahead of future highs.

Overall Stock Risk: Medium

More By This Author:

3 Strategic Shifts That Could Put SoFi Stock Ahead Of The PackFluor Stock: A Boring Business That Might Outrun The Market?

Tesla $75b Robotaxi Dream Meets ‘America Party’ Reality