Forecast: When Companies Will Reach $5 Trillion In Market Cap

(Click on image to enlarge)

Key Takeaways

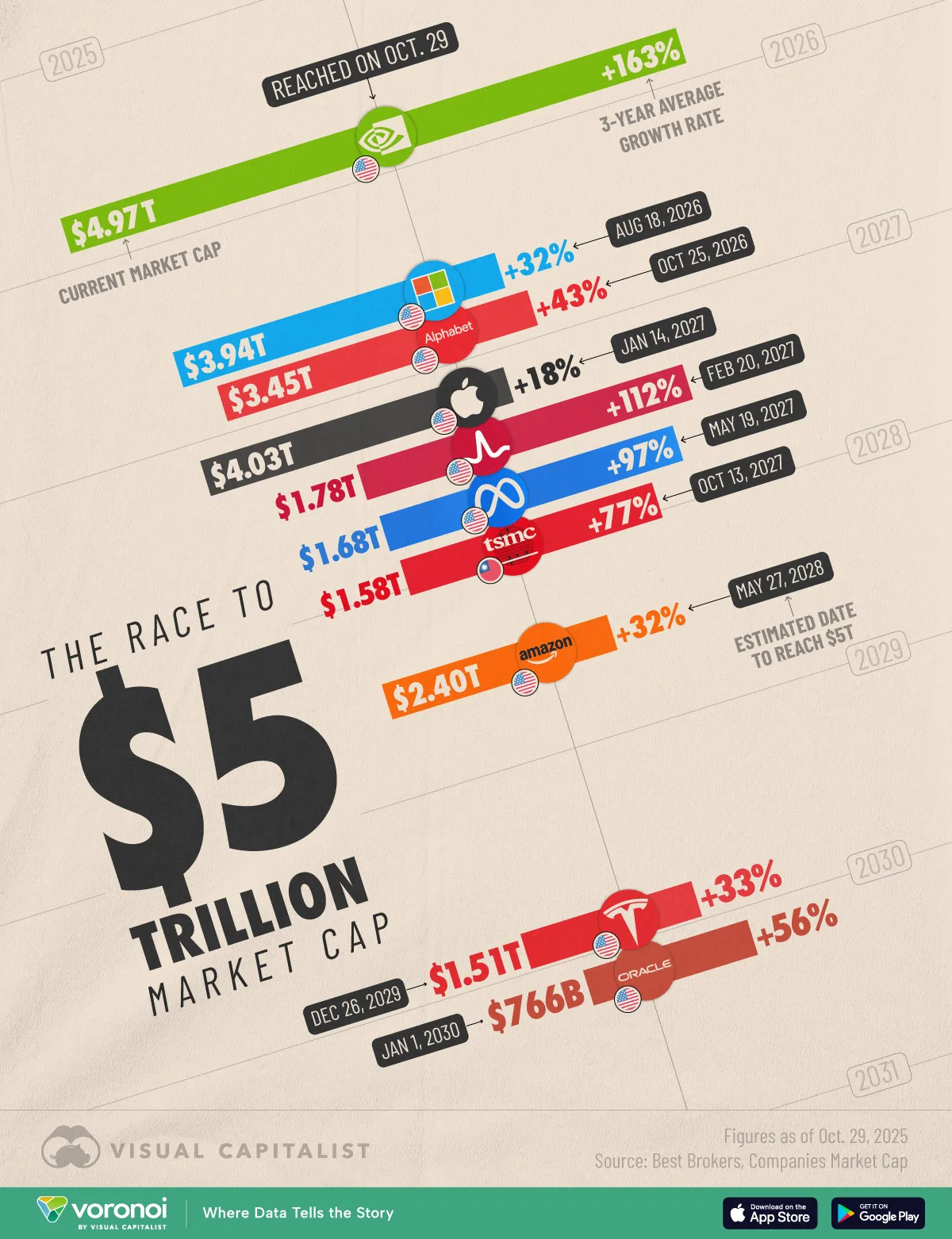

- Data from BestBrokers.com estimates when the next $5 trillion companies will emerge, based on their historical 3-year average growth rates.

- If these estimates hold up, Microsoft MSFT could be the next company to hit the $5T milestone, followed shortly after by Alphabet GOOGL.

After Nvidia NVDA became the world’s first $5 trillion dollar company in October 2025, investors are left wondering which tech giant will reach the milestone next.

To find out, we’ve visualized forecasts that estimate when various companies could reach a $5 trillion market cap based on historical growth trends.

Data & Discussion

The analysis from BestBrokers.com is based on each company’s 3-year average growth rate.

It projects that Microsoft and Alphabet could reach $5 trillion sometime in the second half of 2026, while others, including Apple AAPL and Meta Platforms META, could follow in 2027.

| Company | Market Cap | 3-Year Average Growth Rate |

Estimated Date to Reach |

|---|---|---|---|

| NVIDIA | $4,970,000,000,000 | 163% | Reached on Oct. 29 |

| Microsoft | $3,940,000,000,000 | 32% | Aug 18, 2026 |

| Alphabet | $3,450,000,000,000 | 43% | Oct 25, 2026 |

| Apple | $4,030,000,000,000 | 18% | Jan 14, 2027 |

| Broadcom AVGO | $1,780,000,000,000 | 112% | Feb 20, 2027 |

| Meta | $1,680,000,000,000 | 97% | May 19, 2027 |

| TSMC TSM | $1,580,000,000,000 | 77% | Oct 13, 2027 |

| Amazon AMZN | $2,400,000,000,000 | 32% | May 27, 2028 |

| Tesla TSLA | $1,510,000,000,000 | 33% | Dec 26, 2029 |

| Oracle ORCL | $765,970,000,000 | 56% | Jan 1, 2030 |

Hyperscalers Could Hit $5 Trillion Soon

Microsoft is expected to be the next company to reach $5 trillion if its 3-year average growth rate of 32% continues. While Microsoft generates a majority of its revenue from cloud services, other segments like gaming are growing at an impressive pace.

Alphabet, which has an average annual growth rate of 43% over the past 3 years, could follow soon after. Google’s flagship ad business continues to drive massive revenue, allowing the company to pour billions into its AI initiatives.

Alphabet shares have also received a boost after Berkshire Hathaway revealed its $4.9 billion stake in the company.

More By This Author:

Visualizing All Of The World’s Data Centers In 2025

Ranked: Countries With The Most GDP Per Capita Growth (2020-2025)

Ranked: The Most Valuable Startups Of 2025