Forecast 2021: The Stock Market

Image Source: Pexels

This will be the third part of my 2021 Forecast Series. You can read the first two parts here and here. The general theme has been “On the Gripping Hand.” Science fiction writers imagined a three-handed alien race with a left hand, right hand, and a very strong Gripping Hand. 2021 is the year of the Gripping Hand, and COVID-19 is what’s gripping us. Making a forecast without the virus at its center is pointless.

All that being said, today we are going to focus on my stock market expectations. As I promised last week, this is a “Generational Call.” For reasons we will go into below, I think we are at a pivot point for stocks, with some clear exceptions I will outline. So maybe like generational call* with an asterisk.

On The Gripping Hand, Part 3

Let’s first do a very quick virus update. By the time you read this, the US will likely have administered 20 million vaccinations. Add those who were previously infected, and maybe 40 million people should have some degree of immunity.

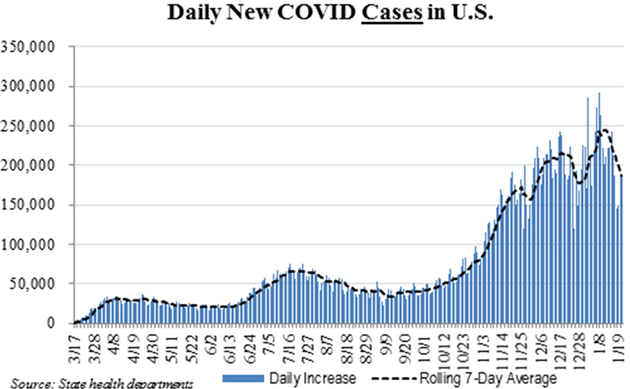

The number of new cases is dropping, as you can see in these charts from Justin Stebbing, a professor at Imperial College who sends a detailed daily COVID research summary.

Source: Justin Stebbing

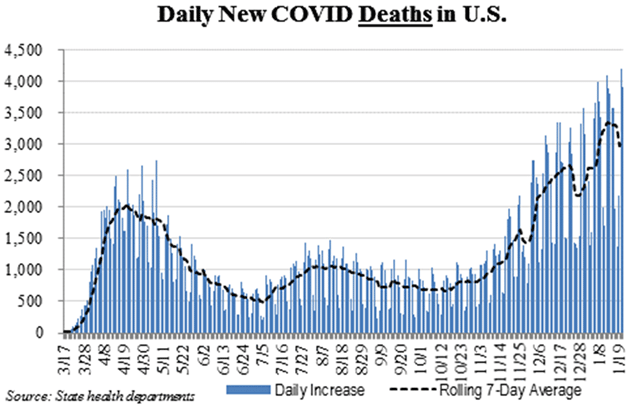

New deaths are thankfully also turning.

Source: Justin Stebbing

That’s the good part, but there’s more that is less comforting. The CDC unfortunately confirmed my alarm (described last week) about the UK (B117) variant strain. They expect it will account for 50% of US cases by March. This does not mean that the B117 variant will replace 50% of other cases. It means the significantly more contagious B117 will catch up through an exponential rise in the next few weeks.

How serious is this? It's hard to say. How seriously will we respond, in terms of social distancing, masks, etc., in a country showing virus fatigue? How much faster can we vaccinate, given that we are already having supply problems? As I said then, I see a 40% chance of a significant uptick in cases, deaths, and lockdowns, which is a nontrivial potential.

Nor is this just a US problem. The simple fact is that the world is in a race with the new B117 variant and how fast we can vaccinate the population, plus maintain safety conditions (like social distancing).

If the CDC is right about that 50% B117 prevalence, the US will face a series of lockdowns at least as intense as last spring. Do you think that is priced into the stock market? Will the stock market look past a serious uptick in cases, hospitalizations, and deaths? Along with new lockdowns? More small businesses lost?

I know that the Biden pandemic relief plan has come under severe fire for being too large. Given the sausage-making process of American politics, it is not clear what will come out of Congress. But there is a real possibility we will need more. And of all that is going to merge with the other valuation/market issues we have today. Now let’s turn to the market forecast.

"Extrapolated Indefinitely"

We all know the stock market was up significantly last year, and even more so around year-end, but you may not know how historically wild this is.

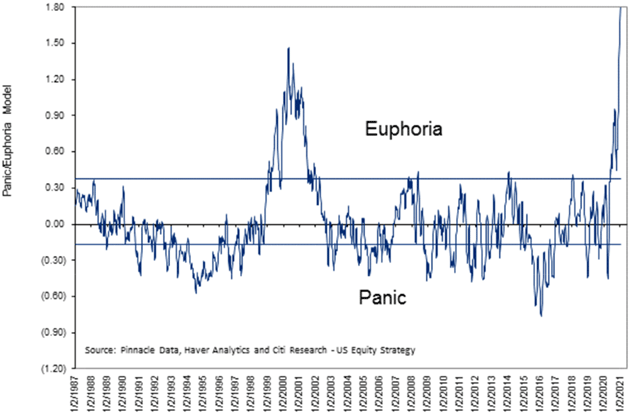

Citi Research has a “Euphoria/Panic” index that combines a bunch of market mood indicators. Since 1987, the market has typically topped out when this index approached the Euphoria line. The two exceptions were in the turn-of-the-century technology boom, when it spent about three years in the euphoric zone, and right now.

Source: Peter Boockvar

You can look at this in different ways. In terms of duration, the precedent suggests the giddiness could last another year or two. But in magnitude, the current euphoria is well above what we saw 20 years ago, and it developed a lot faster.

The legendary Jeremy Grantham of GMO recently reviewed the dramatic events he observed over a 50+-year career managing money. He describes the current bubble as one of the “four most significant and gripping investment events of my life.” The others are Japan in 1989, the 2000 tech bubble, and the 2008 housing and mortgage crisis. We are in historic times.

Grantham went on:

"The single most dependable feature of the late stages of the great bubbles of history has been really crazy investor behavior, especially on the part of individuals. For the first 10 years of this bull market, which is the longest in history, we lacked such wild speculation. But now we have it.

"The strangest feature of this bull market is how unlike every previous great bubble it is in one respect. Previous bubbles have combined accommodative monetary conditions with economic conditions that are perceived at the time, rightly or wrongly, as near perfect, which perfection is extrapolated into the indefinite future. The state of economic excellence of any previous bubble of course did not last long, but if it could have lasted, then the market would justifiably have sold at a huge multiple of book.

"But today’s wounded economy is totally different: only partly recovered, possibly facing a double-dip, probably facing a slowdown, and certainly facing a very high degree of uncertainty. Yet the market is much higher today than it was last fall [2019] when the economy looked fine and unemployment was at a historic low. Today the P/E ratio of the market is in the top few percent of the historical range and the economy is in the worst few percent. This is completely without precedent and may even be a better measure of speculative intensity than any SPAC.

"This time, more than in any previous bubble, investors are relying on accommodative monetary conditions and zero real rates extrapolated indefinitely. This has in theory a similar effect to assuming peak economic performance forever: it can be used to justify much lower yields on all assets and therefore correspondingly higher asset prices. But neither perfect economic conditions nor perfect financial conditions can last forever, and there’s the rub."

“Accommodative monetary conditions and zero real rates extrapolated indefinitely” is a phrase I wish I had coined. It’s the best, most succinct explanation I’ve seen for this euphoria. And, as Grantham says, it’s not going to end well. But the party could continue if current monetary conditions and low rates persist.

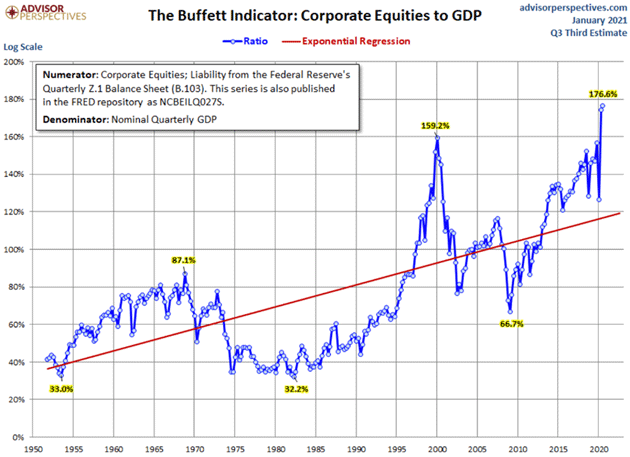

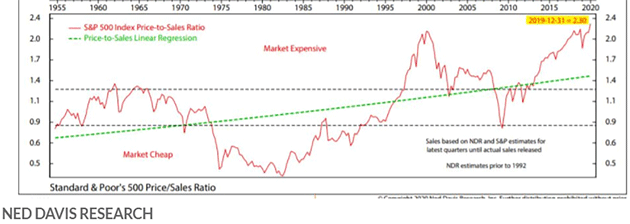

That being said, let’s look at not only the Buffett indicator (all-time highs) he mentioned but also a few more charts:

Source: Advisor Perspectives

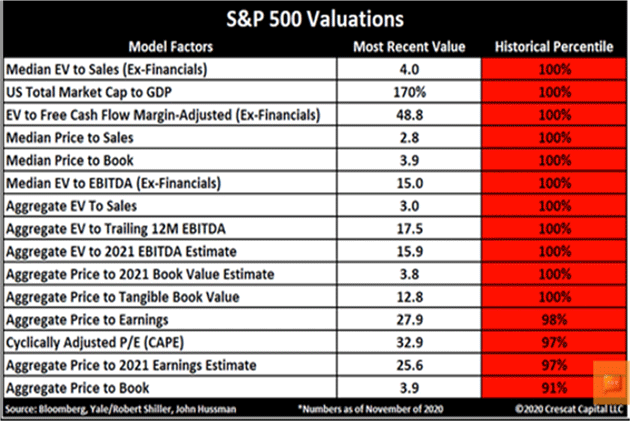

Numerous other indicators are at or close to their historical peaks. Here’s a handy list, courtesy of Doug Kass.

Source: Doug Kass

When we say that price-to-sales is at 100% of its historical percentile, that is a little misleading. It is much higher than that in actuality:

Source: MarketWatch

I could easily show you a dozen more charts, all basically saying the same thing: Valuations are at nosebleed levels. You’ve seen them elsewhere, so no need to reproduce them here.

What Were You Thinking?

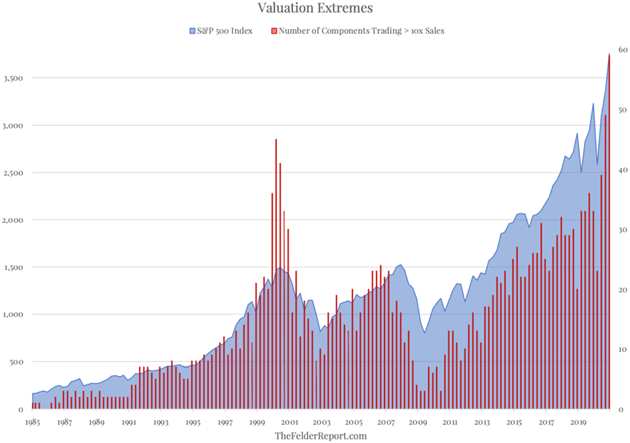

The brilliant Jesse Felder illustrates the price/sales problem this way, using Tesla.

“What were you thinking?” That is the rhetorical question Scott McNealy, CEO of Sun Microsystems, asked of investors paying a “ridiculous” ten times revenues for his stock at the height of the Dotcom Mania. The incredulity in his voice is amplified by the benefit of hindsight as McNealy gave the interview this quote was taken from in the wake of the Dotcom Bust, after his stock price had lost over 90% of its value.

Indeed, what were investors thinking 20 years ago, not only paying 10 times revenues for Sun Microsystems but also paying that ridiculous multiple for 44 other stocks in the S&P 500 Index? It’s impossible to know for sure, but it’s a good bet they were simply counting on the “greater fool theory” or the idea that someone will come along and pay an even more ridiculous price than they did. At some point, however, the market ran out of fools and the Nasdaq fell 83%.

It’s interesting to note that we seem to have found even more fools today than we did back then. Nearly 60 of the S&P 500 Index components currently trade more than 10 times revenues. There’s no telling when the current market will run out of fools this time but, when it’s all said and done, that last buyer may justly earn the title “greatest fool” of all time. And only with the benefit of hindsight will it really feel like the abject folly it should.

Source: Jesse Felder

On Twitter, Jesse asked rhetorically what the McNealy of 20 years ago would think about Tesla trading at 30 times revenues. McNealy replied, “I want to be Elon Musk.”

Last year the S&P was up 18.4%, the Nasdaq 44%, and an equally weighted portfolio of FAAAM (Facebook (FB), Alphabet (GOOGL), Amazon (AMZN), Apple (AAPL), Microsoft (MSFT)) plus Netflix (NFLX) was up 55%. The contribution of that latter group to the S&P 500’s growth was 14.35%. The “S&P 494” gained only 4.05%.

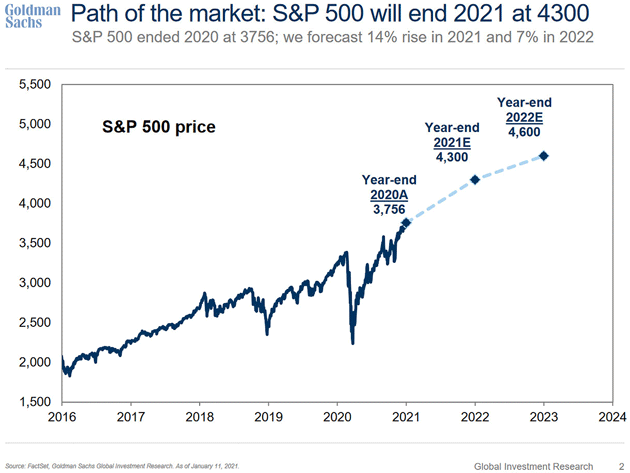

What are the chances the FAAAM+N stocks rise another 55% this year? Especially given the uncertainty and a high probability that earnings estimates will come down significantly? Yes, the Fed will be extraordinarily accommodative, interest rates will remain low, and markets will still try to “extrapolate indefinitely.” The people at Goldman Sachs have a much more optimistic scenario (15%+ this year):

Source: Goldman Sachs

I will say that such optimism reminds me of the diner scene in “When Harry Met Sally.” Wall Street wishes it could have whatever they are having. Ah, but what about earnings, you say? Think of the pent-up demand that will be unleashed on businesses when all this is over. Here are my two responses:

First, “when all this is over” is a fact not yet in evidence. The virus still has us firmly in its grip which is, if anything, tightening. Maybe it will loosen this year, maybe not.

Second, “pent-up demand” assumes people, once liberated from virus fear, will move the money they didn’t spend during this time into the same things they would have spent it on. That’s a giant assumption. The revenue lost by service businesses is permanently gone. And the propensity to save, if you believe multiple surveys, is increasing.

The simple fact is that this period has scarred a generation, and like the Great Depression generation, they will be more financially conservative. At the very least for a while.

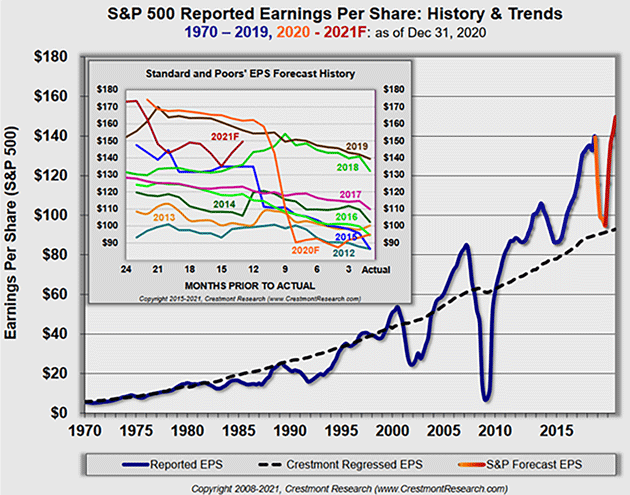

Nonetheless, at some point even zero real rates don’t justify holding stocks unless they produce sufficient earnings. I don’t know where that point is (none of us know the future). But we do know where earnings are. Here’s a chart from Ed Easterling of Crestmont Research.

Source: Crestmont Research

Look at the inset chart first. It shows the progression of earnings estimates beginning two years ahead of a year-end. You see they mostly started optimistic and gradually came down (though 2012 and 2018 weren’t far off).

But look at the orange line labeled “2020F.” It was gently declining like other years, then plunged when COVID-19 hit as analysts sliced estimates. Yet stock prices went the opposite direction, for the aforementioned monetary reasons. Now look at 2021F. Projected 2021 earnings are almost back where 2020 was, pre-pandemic. That means analysts project US public companies will, less than 12 months from now, have fully recovered from this plague. Possible? Yes, but I think highly unlikely.

But if you believe both a) earnings will recover this year and b) the Fed will keep stimulating, or at least not withdraw what it injected, then today’s stock prices possibly make sense. That’s an ideal, once-in-a-lifetime scenario. Again, I think it’s very unlikely, but it isn’t impossible.

Decision Time

So what is an investor to do? As always, it depends on your personal circumstances. A 30-year-old with steady income and little or no debt might ride the wave for a while longer. But I think anyone in or near retirement should think very hard about how aggressive they want to be. I know it’s a tough spot. You certainly won’t make much in bonds or bank savings.

So, let me make an actual market call. With some significant qualifications. First, anybody over 50 with substantial amounts of money in passive index investing should probably step to the side. Especially if that is your retirement money. Take profits. Go to cash.

I see too many parallels between market valuations and exposure between the year 2000 and today. Note that both in 1999/2000 and in 2006–07, I called the bear markets early. Maybe I’m early again. But I will note that my good friend Doug Kass of Seabreeze Partners issued a bear market warning this week: “My message is simple. Sell Stocks Now.” And he is a much better market timer than I am.

Jeremy Grantham points out, in the report quoted above, how investment professionals have to think not only of market risk, but career and business risk, too. They have strong incentives to stay bullish at all times. If your investment advisor has you in a traditional 60/40 portfolio using passive indexes, then you should consider other options.

Now, let me note the exceptions. If you are young and have time, as in more than 20–30 years, and can deal with the drawdown or small returns for 10 years, then be my guest.

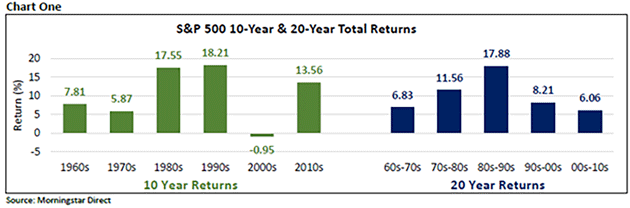

Let’s look at this chart from my friend and business partner Kevin Malone at Greenrock Research. Note that the decade of the “aughts” had a negative (almost -1%) return. (As predicted here at the beginning of that decade, based on historical market returns from extraordinarily high valuations.)

Today’s valuations resemble those of the year 2000. Why should we expect different results? The 2010's were an extraordinary bull market. You were more or less rewarded for staying in the market for 20 years, though with the smallest average annual return since 1960.

Source: Kevin Malone

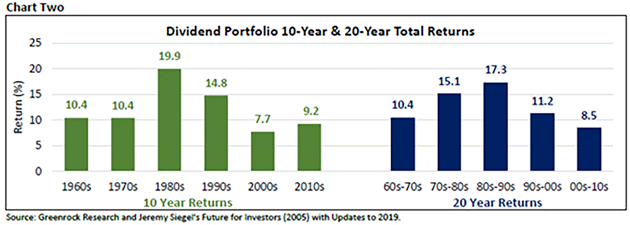

Kevin then shows what a dividend-focused strategy would have returned over the same periods. This uses Jeremy Siegel’s data, taking the 100 highest-paying dividend stocks in the S&P 500 and rebalancing every year.

Source: Kevin Malone

I can show you any number of dividend strategies, both US and foreign, that have significantly outperformed with below-market volatility.

So, if your advisor has you in a historically proven active strategy, there is no reason to move to the sidelines. Let me go further: There are other active stock market strategies that I would expect to do quite well, just as they did in the first decade.

A diversified portfolio of hedge funds significantly outperformed in the first decade. Not so much this last decade. There are two strategies to go into in this text today. Suffice it to say, I think the 2020's will once again be the decade of active management. The 2020's are going to be about rifle shots, not the shotgun approach of index funds.

This will be a decade to focus on absolute returns as opposed to relative returns. Passive index investing is a relative return strategy and I think it will be a very poor choice in the coming years. As my dad used to say, every dog has its day. Passive investing had the last decade. Active investing is getting ready to take the lead.

As I said last week, while I’m bearish on passive index funds, my own portfolio is almost fully invested. I own individual stocks, carefully selected with a long-time horizon. That’s my choice, but you and your advisor need to do your own due diligence and decision-making. In my own portfolio, I admit the irony in that I am somewhat buy-and-hold. I tend to make very specific and targeted investments, and then hold them. Some are for income and some are for growth.

And even as I am saying that I think the stock market is going down, the risk profile and aggressiveness of my own portfolio is probably more than it’s ever been. I find plenty of things to be very optimistic about.

In every bear market, there are individual positions that do well. Time will tell whether my own personal convictions will prove profitable. But you cannot look at my personal investment portfolio and call me bearish. I am extraordinarily bullish, just not on passive index funds. In a few weeks, if compliance permits, I’m going to write about my personal investment philosophy and positions. There are plenty of opportunities, though admittedly more for accredited investors than those with less than $1 million, but also some for those still accumulating portfolios.

I don’t know how to be clearer. Take your profits from passive investing. Taking profits is not alarmist. It used to be considered wise advice. As my friend Dennis Gartman used to sign off, “Good Luck and Good Trading.”