Ford’s Ride-The-Brakes Strategy Is Hard To Steer

Image Source: Unsplash

Ford Motor boss Jim Farley is getting used to owning up to shortcomings. The Detroit automaker turned in a disappointing third quarter, one of a few blemishing an otherwise roaring Motor City recovery from the pandemic. Like arch-nemesis General Motors, Ford has trimmed plans to chase electric leader Tesla. Unlike GM, the shift leaves it stuck in neutral. Falling back on a profitable gas-guzzler business is appealing – but recent results on Monday show that it’s a hostage to fortune.

There was plenty of horsepower on the top line, with revenue of $46 billion beating analysts’ expectations, according to Visible Alpha. The problem, as Farley admitted, is that this income ran off the road on its way to the bottom line. Operating profit at Ford’s combustion-engine unit came in 11% below estimates. The company blamed warranty costs – which also tanked profit in the second quarter – and supply chain snags. Add in a $1 billion charge for the scrapped development of an electric SUV, and net income tumbled by a quarter from last year. The stock promptly dropped 9% on Tuesday.

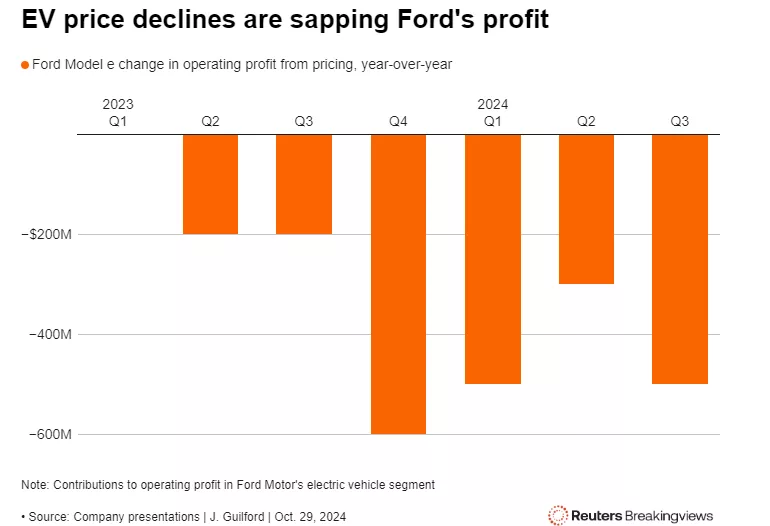

Problems in its old business come amid a slowdown in its new one. After gaining an early lead over GM in electric, Ford opened the books, breaking out battery-powered segment Model e. The losses are steep, reaching nearly $4 billion thus far this year. And unlike with gasoline cars, its EV prices are collapsing, offsetting cost-saving measures.

In response, Ford has cancelled investments and scrapped production targets for Model e. Farley says that he’s learned better than to jump in too quickly on hopes of profit later. GM, though, is moving ahead: after rolling out new battery technology and ramping up production, it now holds the number-two slot behind Tesla in U.S. electric sales.

Meanwhile, the $41 billion company’s combustion-engine business is supposed to be the dependable fall-back. But inventory is climbing and Ford’s U.S. sales are running well behind its rate in 2018, the last “normal” year. From a quarter scuppered by a lack of blue Ford nameplates to recent repair issues, the company has shown that the “safe” path for Detroit can be blocked by non-stop execution issues.

At least the auto sector isn’t slumping. Ford reckons it would be on track for record operating profit this year were it not for detours. And GM keeps charging ahead. If U.S. car buyers ever do pull back or suddenly shift to electric, however, the problems will compound rapidly.

Context News

Ford Motor said on Oct. 28 that it generated over $46 billion in revenue in the three months ending in September, up 5% year-over-year and above analysts’ expectations, according to Visible Alpha data. Net profit fell 25% to $900 million, in part because of a $1 billion write-off related to the canceled development of a three-row electric SUV. Operating profit at Ford Blue, its consumer internal-combustion-engine vehicle unit, was $1.6 billion, roughly 11% below analyst estimates, despite higher-than-expected revenue. At Ford Pro, its commercial van and services segment, operating profit of $1.8 billion similarly missed estimates by 8%. Losses at electric-car unit Model e of $1.2 billion came in 9% lighter than expected. Ford narrowed its guidance for the full year, saying that it expected to generate $10 billion in operating profit, compared to a prior range of up to $12 billion.

More By This Author:

S&P 500 Earnings Dashboard 24Q3 - Wednesday, Oct. 30Russell 2000 Q3 2024 Earnings Preview: Earnings Growth Moderates When Health Care Is Excluded

S&P 500 Earnings Dashboard 24Q3 - Tuesday, Oct. 29

Disclaimer: This article is for information purposes only and does not constitute any investment advice.

The views expressed are the views of the author, not necessarily those of Refinitiv ...

more