Follow-Through

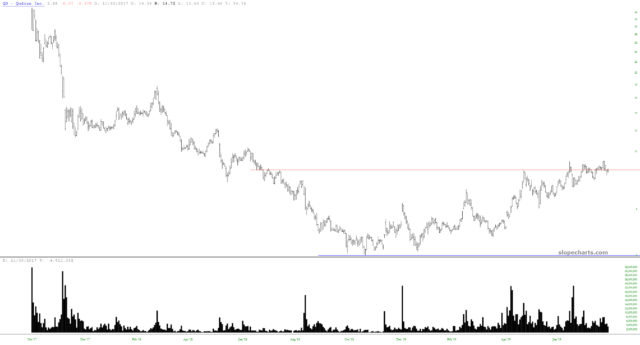

Since the fun of plunging markets has abated, for now, time for a little object lesson about follow-through in stocks. Below is a chart of Qudian (QD) with the more recent history removed. At the time, I pointed it out as an intriguing long possibility. Its pattern completed, and the volume strengthened during the breakout. Both good signs.

(Click on image to enlarge)

However, look at what happened after the breakout. The price stalled and then slunk back into the range again. In other words, the pattern did complete, and the price broke out, but it was completely tepid, and prices slipped right back into the pattern zone, thus creating a failed bullish breakout. Although the stock made another attempt to break out, it didn’t even make it back to its horizontal, and it completely slumped afterward.

(Click on image to enlarge)

The lesson being: follow-through matters whether it is a long or a short position. That’s why I am religious about keeping my stop-loss prices fresh. As a price moves, you want to meet a happy middle ground in which you are protecting profits and simultaneously avoiding losses. The QD trade would have been a loser, but abandoning the idea when prices began making their way back under the horizontal would have made sure the loss stayed small.

Disclaimer: This is not meant to be a recommendation to buy or to sell securities nor an offer to buy or sell securities. Before selling or buying any stock or other investment you should consult ...

more