Fleetmatics (FLTX): Growth At A Reasonable Price Following 30% Correction

Fleetmatics (FLTX) is a leading provider of SaaS-based fleet management solutions in North America capitalizing on major trends including SaaS, IoT, Mobility and Big Data with an estimated $45B TAM. FLTX sees growth in extending its penetration in North American SaaS-based fleet management solutions, expanding internationally, and cross selling additional features and applications to its rapidly growing customer base. FLTX software addresses challenges in the transport industry such as high fuel costs, excessive vehicle wear, suboptimal routing, unsafe driving, wasteful vehicle idling and more. FLTX offers the type of software that is becoming a necessity with its ability to boost profits for its customers, offering a 7:1 return on investment in just 4.6 days for a company with a 16-vehicle fleet. FLTX mostly serves smaller businesses, but does serve select enterprises as well.

FLTX shares trade just 20.2X Earnings, 5.6X Sales, 5.3X Book, 32.3X FCF and 3.8X FY17 EV/Sales, attractive valuation for its strong growth profile. FLTX estimates a 15% CAGR through 2019, currently 17% penetration of a 54M addressable vehicle market and expecting an eventual total addressable market of 94M vehicles. In 2015, FLTX added 10,000 customers, a 40% increase. FLTX also can deliver consistent results with 90%+ revenue visibility, no customer concentration, and 20%+ of new subscriptions sold into the installed base. EBITDA margins have risen nicely to 33.8% in 2015 from 23.6% in 2011, and the company sees room for further margin expansion. FLTX growth has normalized a bit, growing above 30% annually from 2013 to 2015, and now expected to be 20$ in FY16, 17.6% in FY17, and 15% in FY18. FLTX projects to earning $2.44/share in FY18, nearly a 55% jump from FY15 levels. FLTX has lofty goals, expecting to have a subscriber base of 1.2M by 2020, and the Company has also noted it is willing to do tuck-in acquisitions to bolster growth.

Analysts have an average target of $50 on FLTX with 9 Buys, 3 Holds, and 5 Sells. On 5-25 Pacific Crest upgraded FLTX to Overweight with a $54 target.

Short interest in FLTX is at 11.25% of its float, but has steadily been declining throughout the year. Institutional ownership jumped 4.14% in Q1 filings with 24 funds with new positions, 82 adding, 36 closing out, and 58 reducing.

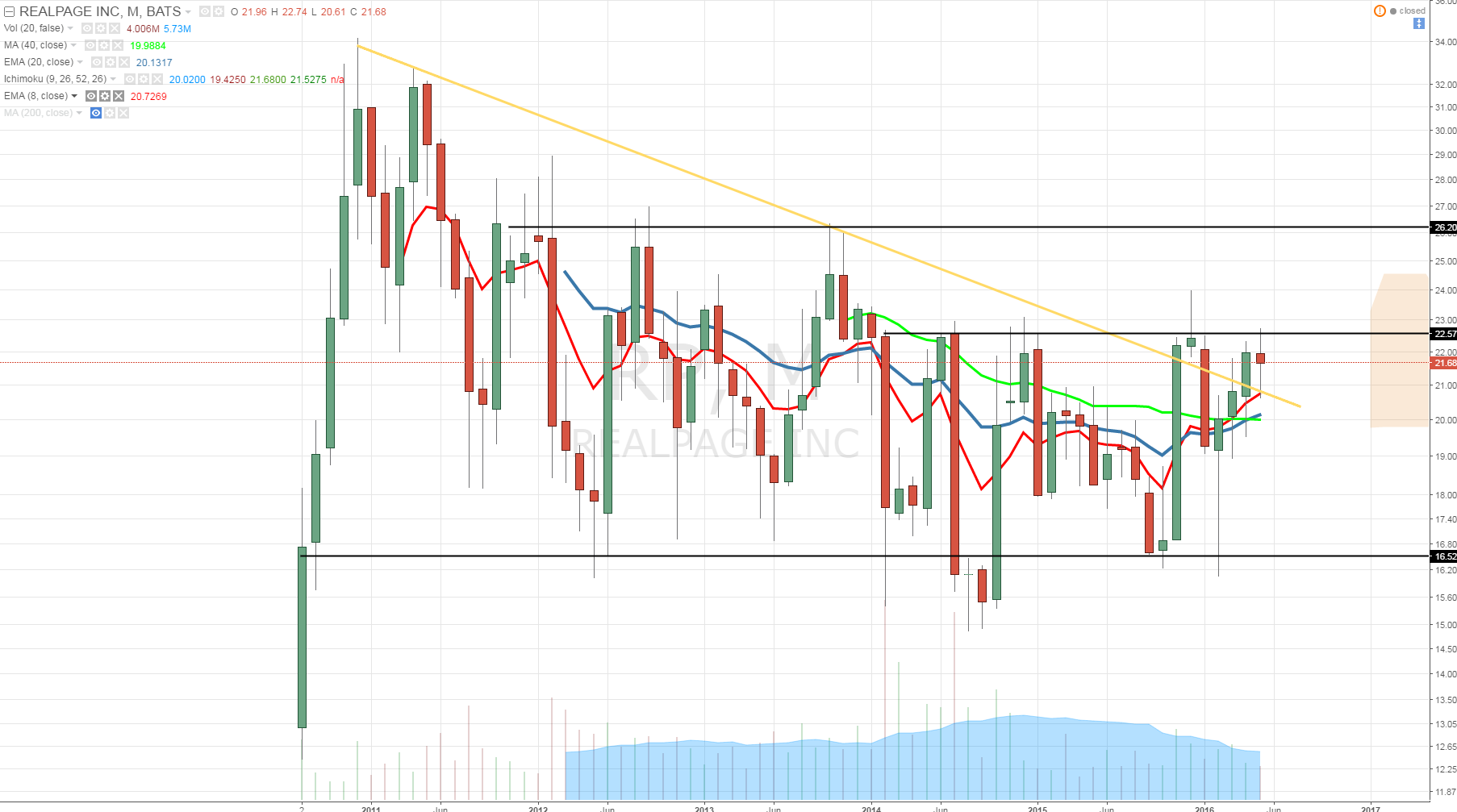

On the chart FLTX shares bottomed at $34.25 earlier in 2016 with a double bottom, a perfect touch of its 76% Fibonacci Retracement, and now shares moving out of a $34.50/$41.50 basing range, the measured move targets $48.50 with weekly MACD crossing bullish and weekly RSI climbing back above the 50 level, regaining its momentum status.

In conclusion, FLTX offers a compelling long term growth opportunity at an attractive valuation while also having an expanding addressable market, a differentiated product, and industry leading margin profile. At current prices shares have at least 30% upside, and with a new CEO set to come in on January 1, 2017, it’s a growth niche SaaS name that could attract M&A attention.

Not Investment Advice or Recommendation Any descriptions "to buy", "to sell", "long", "short" or any other trade related terminology should not be seen as a ...

more

The recent upgrade of the stock is definitely an encouraging sign, and the stock jumped another 4% yesterday showing the stock still has momentum, it remains to be seen where it will go from here. The stock is down around 11% year to date. Next earnings will be reported around Aug 4th-8th. One to keep an eye on.