Fiverr: Explosive Momentum And Massive Potential

Fiverr (FVRR) is in the right place at the right time. The company is a major beneficiary from the gig economy and the work from home trends, and it has enormous potential for growth in the years ahead. The business is firing on all cylinders, and it still has room to deliver big returns from its current size.

A Smart Business Model

Fiverr is a global online marketplace for freelancers in creative industries. Buyers can typically go to Fiverr in search of logo designs, website building, video editors, article writers, and so forth.

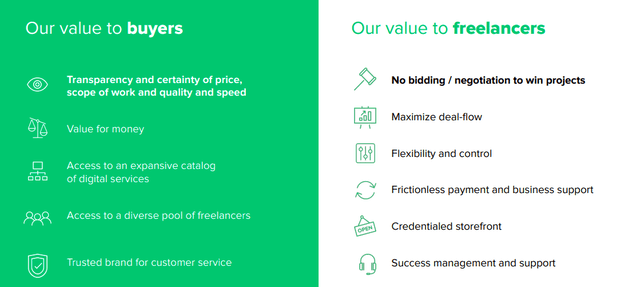

The company has pioneered the Service-as-a-Product (“SaaP”) model to create an on-demand, e-commerce-like experience that makes working with freelancers easy and straightforward. The benefits to both buyers and sellers are substantial in comparison with the old offline model.

(Click on image to enlarge)

Source: Fiverr

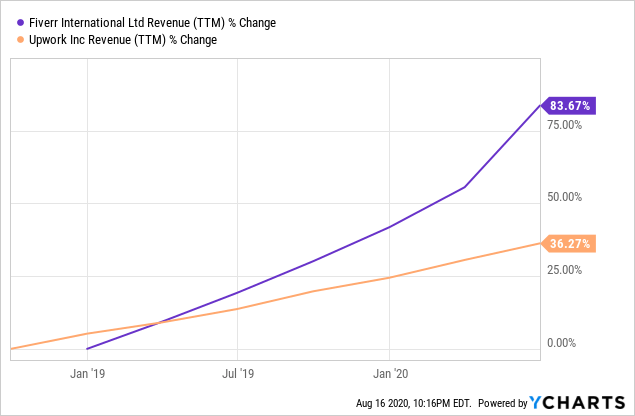

Other similar platforms such as Upwork (UPWK) mostly price the transactions by the hour, which generates more uncertainty for buyers and more complications overall. Upwork is also focused mostly on corporate buyers, while Fiverr is more oriented towards small businesses, entrepreneurs, and self-employed professionals. Fiverr's approach seems to be the most effective one, as the company is significantly outgrowing its main competitor.

(Click on image to enlarge)

Data by YCharts

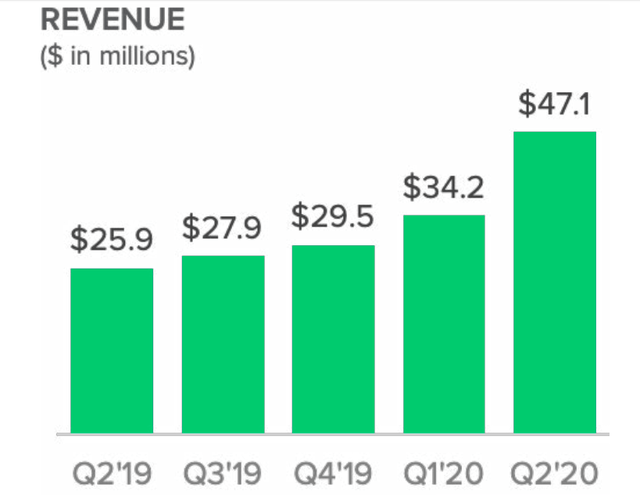

The numbers for the second quarter of 2020 are truly impressive, with Fiverr reporting an acceleration in demand and expanding profitability levels. Revenue during the quarter reached $47.13 million, surpassing analyst's expectations by $10.59 million and growing by 82% year over year. The number represents an explosive acceleration versus a 44% increase in revenue during the first quarter of 2020.

(Click on image to enlarge)

Source: Fiverr

The revenue growth rate was the fastest one the company has seen since 2012, and performance was quite healthy across the board

- Active buyers as of June 30, 2020, grew to 2.8 million, an increase of 28% year over year and marking a new record for the company.

- Spend per buyer reached $184 versus $157 an increase of 18% year over year.

- Gross margin increased to 83.1% of revenue, an increase of 360 basis points.

- Fiverr reached profitability on an adjusted EBITDA basis during the quarter, significantly ahead of schedule.

Major global trends such as remote work and digital transformation are powerful tailwinds for Fiverr right now, and the company is also benefitting from a well-executed strategy for long-term growth.

Fiverr is promoting its platform in non-English languages lately, and it is seeing encouraging demand growth in Germany, Austria, and France, with these 3 markets growing at three-digit percentage growth rates last quarter.

Fiverr is also seeing its existing user cohorts expand their spending level over the past few months as they turn to its marketplace when they need digitizing their business and more services through remote arrangements.

Management accelerated investments in buyer acquisition last quarter due to increased effectiveness in performance marketing. There was a double impact on that front, more money invested and bigger returns for each dollar invested in growth marketing.

Massive Growth Opportunities

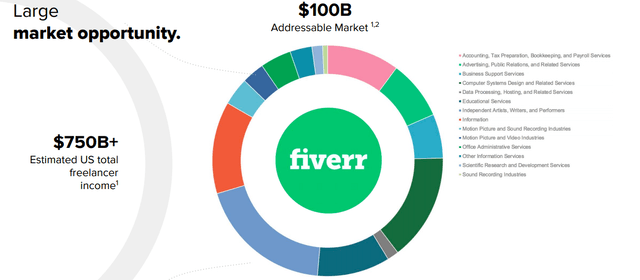

The size of the total addressable market is very hard to quantify because Fiverr operates in a wide variety of categories, including logo design, translations, game development, and podcast marketing, for example. However, it is easy to see that the company is barely scratching the tip of the iceberg when it comes to its long-term opportunities.

Management considers that the size of the U.S. freelancer market is currently above $750 billion, and the categories currently relevant to Fiverr are around $100 billion. International markets are not included in this calculation.

(Click on image to enlarge)

Source: Fiver

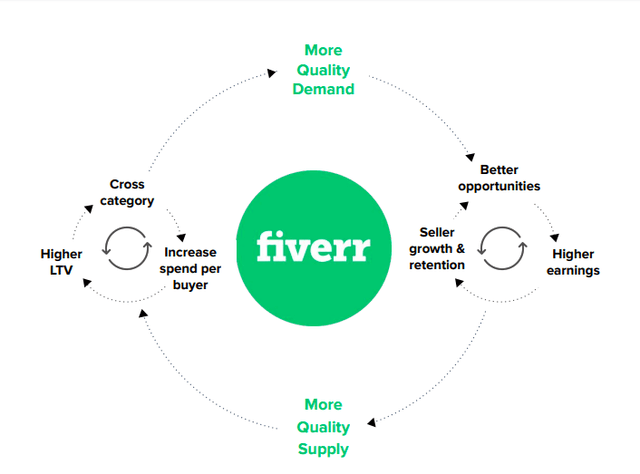

The pandemic has clearly produced an acceleration in demand for Fiverr, and the company is benefitting from a powerful flywheel effect as it gains size over time. More buyers and sellers create better opportunities for both sides, so the platform becomes more valuable as it gains more size over time. Winners tend to keep on winning in these kinds of businesses, and Fiverr looks like a clear winner.

(Click on image to enlarge)

Source: Fiver

Risk And Reward Going Forward

Success attracts competition in the business world. Fiverr has done a solid job at differentiating itself from Upwork and outgrowing its main competitor over time, but this story is far from over. In fact, it seems to be barely getting started. The company could need to face new entrants into the sector, not only among smaller players but also among large corporations such as Microsoft's (MSFT) LinkedIn in the future.

Fiverr already has an established brand and a large network of buyers and sellers creating strong network effects for the platform, but the competitive risk cannot be disregarded for a company that operates in such a dynamic space.

Fiverr has an unusually elevated take rate of 25%, which is considerably higher than the take rates for other online platforms. The fact that the business is booming in spite of these elevated rates shows that Fiverr is providing a lot of value to its users. But still, sooner or later the company may face some pressure to reduce those rates.

Growing volume can more than compensate for declining take rates, and Fiverr is also expanding into categories with higher prices, which could buffer any pressures even more. But still, this is a relevant area to keep an eye on.

The stock is not cheap by any means, trading at a price to sales ratio around 15 for 2021. But Fiverr still has a market cap value of only $3.77 billion, and it is relatively small in comparison to its market opportunity. Valuation could be a risk in the short term, but over the long term, the stock is still offering enormous room for appreciation if management keeps executing well.

Disclosure: I am/we are long FVRR.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more

Fiverr is a great company but there is no quality control on their site. Total crapshoot as to what you may get. And a lot of hidden costs. It was much better in its earlier years.