Finding Great Stocks To Buy For Thanksgiving And Beyond Using ROE

Image Source: Pixabay

The bulls appear to be in control of the market heading into Thanksgiving and possibly the end of 2023 and beyond. The S&P 500 and the Nasdaq are trading solidly above their 50-day and 200-day moving averages, and many of the bears have been flushed out of their positions.

Some of those same bears likely don’t want to get caught on the wrong side of a potential rally up toward new all-time highs in the coming months.

Wall Street was already betting that the Fed is done raising rates and will begin cutting in the back half of 2024. That sentiment was building even before Walmart and others said recently that U.S. consumers are flashing signs of weakness.

This means that more money will likely keep flowing into stocks in December and for the foreseeable future as interest rates keep slipping.

Let’s explore how to find ‘Strong Buy’ stocks with proven records of efficiently generating profits that investors might want to buy to close out November and 2023.

ROE

Return on Equity or ROE helps investors understand if a firm’s executives are creating assets with investors’ cash or burning it. ROE shows a company’s ability to turn assets into profits. Put another way, this vital metric measures the profits made for each dollar of shareholder equity.

ROE is calculated as net income/shareholder's equity. For example: if $0.10 of assets are created for each $1 of shareholder equity that would equal a ROE of 10%.

Overall, Return on Equity is a great item to use regardless of what type of investor you are since it provides insight into management’s ability to create value and keep costs under control. Plus, if ROE slips, it can alert us to potential problems.

With all that said, let’s take a look at this screen’s parameters and see the companies proving they can return value to shareholders instead of churning through their cash…

• Zacks Rank equal to 1

The Zacks Rank looks at upward earnings estimate revisions, among other metrics, in order to find companies that are projected to see their earnings get stronger. In fact, beginning with a Zacks Rank #1 can be a great starting point because it boasts an average annual return of over 25% per year during the last 30 years.

• Price greater than or equal to 5

Today we ruled out any stocks that are trading for less than $5 a share because they can be more volatile and speculative.

• Price/Sales Ratio less than or equal to 1

On top of that, we are looking for a low price-to-sales ratio. Today we went with 1 or below as this range is usually thought to provide better value since investors pay less for each unit of sales.

• % (Broker) Rating Strong Buy equal to 100 (%)

In this screen, we decided to go with companies that brokers are fully on board with since ratings are typically skewed strongly toward ‘buy’ and ‘strong buy.’

• ROE greater than or equal to 10

Lastly, but most importantly for today’s screen, we got rid of any companies with a Return on Equity of less than 10 because the median ROE value for all of the stocks in the Zacks Universe is under 10.

Here are two of the 13 stocks that made it through today’s screen…

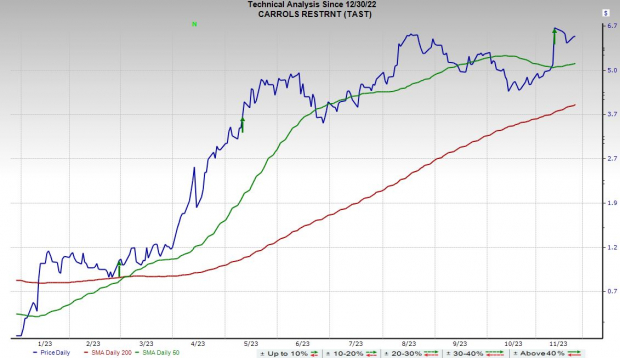

Carrols Restaurant Group (TAST)

Carrols Restaurant Group is one of the largest restaurant franchisees in the U.S., with a portfolio that consists of Burger King and Popeyes. TAST currently operates over 1,000 Burger King restaurants across over 20 states and 62 Popeyes locations in six states. Carrols crushed our adjusted earnings estimate by 130% on November 9 and boosted its guidance, driven by strong comparable sales growth and improved margins.

Carrols Restaurant’s earnings revisions have surged since its release and its most recent/most accurate estimate came in well above consensus for FY23 and FY24 to help it land a Zacks Rank #1 (Strong Buy). TAST is projected to post solid top and bottom-line growth both this year and next. Plus, its ROE is at 15% vs. its highly-ranked industry’s average of 3.9%.

Image Source: Zacks Investment Research

TAST stock has soared 360% in the last 12 months, yet it still trades 44% below its average Zacks price target. Carrols Restaurant is trading at 16.3X forward 12-month earnings vs. the Restaurant industry’s 23.2X. And all three brokerage recommendations Zacks has are “Strong Buys.”

EMCOR Group, Inc. (EME)

EMCOR Group is in the critical infrastructure systems business. EMCOR helps its customers throughout the lifecycle of various projects such as electrical, lighting, air conditioning, heating, security, power generation, and beyond, from planning and installing to operating, maintaining, and protecting. EMCOR is exposed to growth across a broad range of the economy since a variety of businesses and other entities utilize EMCOR.

EMCOR posted record quarterly revenue and earnings in Q3, topping our bottom line estimate by double-digits for the fourth period running at the end of October. EMCOR boosted its earnings outlook once again to help it grab a Zacks Rank #1 (Strong Buy), and it is projected to grow its revenue and earnings in a big way this year, with more to come in 2024.

Image Source: Zacks Investment Research

EME shares have climbed 38% during the last year vs. its industry’s 5%. The recent success is part of a 450% surge over the last 10 years to blow away its industry’s 110% and the S&P 500’s 160%. On top of that, its ROE sits at 26% vs. the Zacks Building Products - Heavy Construction industry’s 9.5% average. And EMCOR currently trades 18% below its own 10-year highs at 17.0X forward earnings.

More By This Author:

Buy This Large-cap Tech Stock Now And Hold Forever?Bull of the Day: Vertiv Holdings Co

Buy These 3 Retail Stocks Now And Hold Forever?

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more