Finance Sector Provides Flying Start To Q3 Earnings Season

Image Source: Unsplash

- For the 99 S&P 500 members that have reported Q3 results, total earnings are up +13.7% from the same period last year on +8.2% higher revenues, with 86.9% beating EPS estimates and 81.8% beating revenue estimates. The proportion of these 99 index members beating both EPS and revenue estimates is 75.8%.

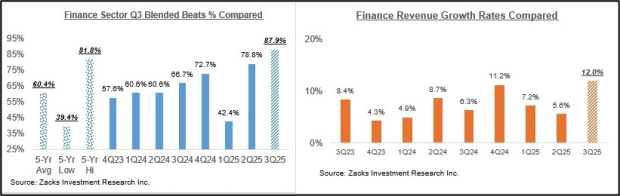

- For the Finance sector, we now have Q3 results from 54.5% of the sector’s total market capitalization in the S&P 500 index. Total earnings for these Finance sector companies are up +23.0% from the same period last year on +12.0% higher revenues, with 97.0% beating EPS estimates and 87.9% beating revenue estimates.

- The Finance sector’s Q3 earnings performance is tracking significantly above what we have seen from the sector in other recent periods, both in terms of the earnings and revenue growth pace as well as the beats percentages. In fact, the sector’s Q3 revenue beats percentage of 87.9% is the highest for this group of companies over the preceding 20-quarter period.

- The above-average beats percentages at this stage of the Q3 reporting cycle are notable in light of the favorable revisions trend that was in place ahead of the start of this earnings season. In other words, actual Finance sector results came in ahead of expectations that had already moved up before these results came in.

Strong Start to the Q3 Earnings Season

American Express (AXP - Free Report) became the latest Finance player to beat Q3 earnings and revenue estimates, also offering positive, reassuring commentary on the health of the consumer and the broader economy. The American Express results followed similar results and commentary from the likes of JPMorgan (JPM - Free Report), Citigroup (C - Free Report), Wells Fargo (WFC - Free Report), and others.

The economic read-through from these bank results is reassuring and positive, notwithstanding worries about non-bank lenders following a few bankruptcies. Consumer spending and household financials remain stable on the back of a labor market that remains very strong. There are signs of improving credit demand, and delinquencies are off their highs, references to ‘cockroaches’ notwithstanding.

Importantly, the capital markets business has finally started showing results, after many quarters of management teams describing improving deal pipelines. We are still at low levels relative to history. But given the favorable regulatory and monetary policy backdrop, it is reasonable to get excited about the sector’s Wall Street business.

For the 54.5% of the sector’s market capitalization that have reported Q3 results, total earnings and revenues are up +23.0% and +12.0%, respectively, and 97.0% are beating EPS estimates and 87.9% are beating revenue estimates. The proportion of these Finance sector companies beating both EPS and revenue estimates is 87.9%.

The comparison charts below show the Q3 revenue growth rates and blended beats percentages for these companies.

Image Source: Zacks Investment Research

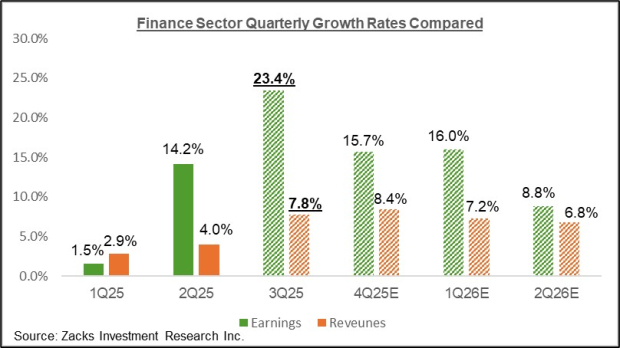

For the Zacks Finance sector as a whole, Q3 earnings are expected to increase by +23.4% from the same period last year on +7.8% higher revenues, as the chart below shows.

Image Source: Zacks Investment Research

The Earnings Big Picture

Positive Q3 results and reassuring management commentary from these banks are helping sustain the favorable revisions trend that has been in place lately.

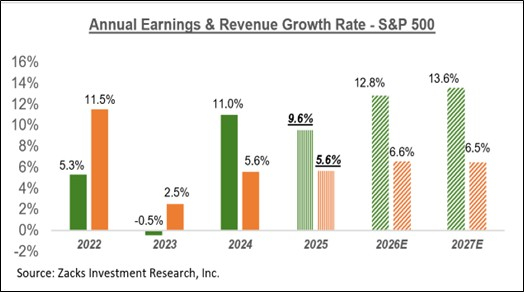

For 2025 Q3, the expectation is for earnings growth of +7.3% on +6.7% revenue gains. We have consistently shown in this space how Q3 estimates have steadily increased since the quarter began.

The chart below shows expectations for 2025 Q3 in terms of what was achieved in the preceding four periods and what is currently expected for the next three quarters.

Image Source: Zacks Investment Research

The chart below shows the overall earnings picture for the S&P 500 index on an annual basis.

Image Source: Zacks Investment Research

The aforementioned favorable revisions trend validates the market’s rebound from the April lows. However, the trend can only be sustained if Q3 earnings results and management guidance for Q4 and beyond confirm it.

More By This Author:

Q3 Earnings Season Starts Positively: A Closer LookWill The Q3 Earnings Season Prove Positive For The Market?

Q3 Earnings Season Setup Remains Favorable: What To Know