Figma Drops 56% Since Going Public: Hold Or Fold The Stock?

Image: Bigstock

Key Takeaways

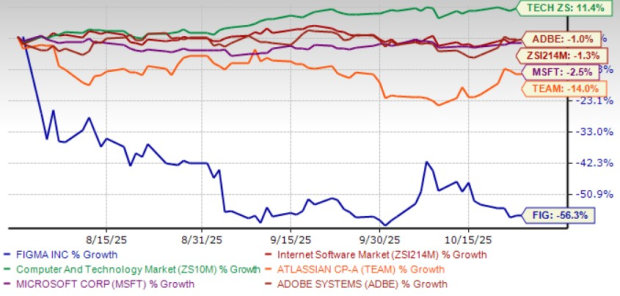

- Figma shares have fallen 56.3% since July 31, underperforming the sector and industry peers.

- The company launched four new products, including Figma Make and Figma Buzz, to boost growth.

- Q3 revenue guidance shows 33% growth, signaling a slowdown from the previous quarter's 41%.

Figma (FIG - Free Report) shares have declined 56.3% since it started trading publicly on July 31. The shares have underperformed the Zacks Computer and Technology sector’s return of 11.4% and the Zacks Internet Software industry’s decline of 1.3% over the same time frame.

Figma’s underperformance can be attributed to modest growth prospects. The company’s investments in AI-powered products like Figma Make are expected to hurt margin expansion in the near-term.

So, what should investors do with the stock? Let’s find out.

Figma’s Innovative Portfolio to Boost Prospects

Figma’s prospects are expected to benefit from an innovative portfolio. At its annual Config conference, the company launched four new products — Figma Make, Figma Draw, Figma Sites, and Figma Buzz — doubling its product offerings. Figma also launched the Dev Mode MCP server, which speeds up developer workflows by bringing context from Figma Design into any surface that consumes MCP.

Figma Make is the company’s new prompt-to-code product that allows designers to use an existing Figma design or natural language to create a fully functional prototype. Figma Make enables its users to edit, download, or export the actual code behind the prototype. The product also allows for multiplayer editing. The product helps designers build working apps and publish them directly to the web. Figma Make now helps in bringing ideas to working apps much faster.

Figma Draw offers more than 20 new tools like textures, effects, and improved vector editing. Figma Buzz helps brand and marketing teams build assets at scale using the design teams libraries and brand graphics in Figma.

Dev Mode MCP server is a nice addition for developers who accounted for 30% of Figma’s monthly active users in the second quarter of 2025. Dev Mode MCP server speeds up developer workflows by bringing context from design systems into LLM-generated code.

The company has been adding new features to boost user engagement. Figma has added improvements that make it easier and more reliable to navigate files with a keyboard or screen reader. The company made the Figma app available in ChatGPT, and it will be able to recommend and create AI-generated FigJam diagrams based on user conversations. A new feature now allows users to copy any design from a Figma Make preview to the design canvas.

The new set of features is expected to boost Figma’s clientele. The company had 11,906 paid customers with more than $10,000 in annual recurring revenues (ARR) as of June 30, 2025, and 1,119 paid customers with more than $100,000 in ARR as of June 30, 2025.

Figma’s Q3 Guidance Reflects Declining Growth Rate

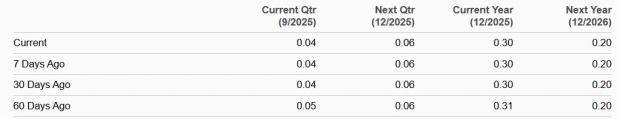

The company now expects third-quarter 2025 revenues between $263 million and $265 million, which suggests 33% year-over-year growth at the midpoint but slower than the 41% growth reported in the second quarter of 2025. The Zacks Consensus Estimate for third-quarter 2025 revenues is pegged at $263.9 million. The consensus mark for earnings is pegged at 4 cents per share, unchanged over the past 30 days.

Consensus Estimate Trend

Image Source: Zacks Investment Research

For 2025, revenues are expected between $1.021 billion and $1.025 billion, which suggests 37% year-over-year growth at the midpoint. The company expects operating income between $88 million and $98 million.

The Zacks Consensus Estimate for 2025 revenues is pegged at $1.02 billion. The consensus mark for earnings is pegged at 30 cents per share, unchanged over the past 30 days.

Figma, Inc. Price and Consensus

Image Source: Zacks Investment Research | Figma, Inc. Quote

Here's Why Investors Should Avoid Figma Now

Figma has underperformed its close peers, including the likes of Adobe (ADBE - Free Report), Microsoft (MSFT - Free Report), and Atlassian (TEAM - Free Report) since July 31. Shares of Atlassian, Adobe, and Microsoft dropped 14%, 1%, and 2.5%, respectively.

Figma Stock Underperforms Peers

Image Source: Zacks Investment Research

Figma faces tough competition from well-established players like Adobe, Microsoft, and Atlassian, as these companies boast of a growing AI-powered revenue base. Adobe’s Firefly and Microsoft Copilot have been playing a crucial role in driving their respective top-line growth and profitability. Atlassian’s focus on adding generative AI features to some of its collaboration software is likely to drive the top line. In comparison, Figma’s AI initiatives are in a much nascent stage.

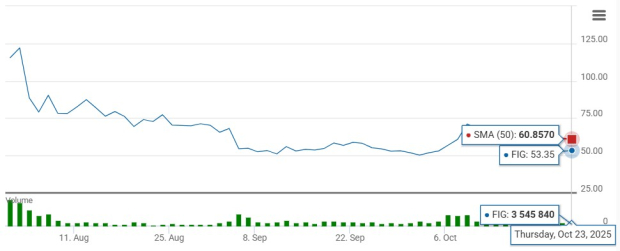

Figma shares also appear to be overvalued, as suggested by a Value Score of F. Figma stock has recently been trading below the 50-day moving average, indicating a bearish trend.

Figma Stock Trades Below 50-Day SMA

Image Source: Zacks Investment Research

Figma currently has a Zacks Rank #4 (Sell) rating, which implies investors should avoid the stock right now.

More By This Author:

Year-End Rally Odds Increase: Stocks To Watch5 Stocks To Add To Your Portfolio From The Prospering P&C Insurance Industry

4 Top-Ranked Technology Stocks Set To Beat Q3 Earnings Expectations

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more