Fifth Third Bancorp: A "Super Regional" Bank In The Making After Comerica Buy

Image Source: Pixabay

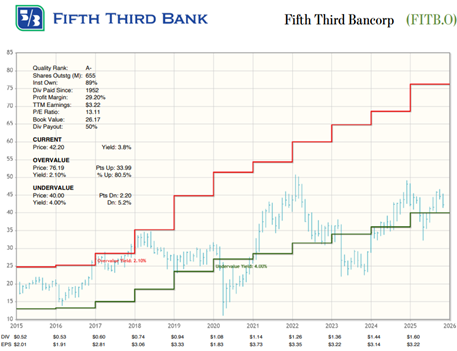

Fifth Third Bancorp (FITB) operates as a diversified financial services company, providing a wide range of financial products and services across three main segments: Commercial Banking, Consumer and Small Business Banking, and Wealth & Asset Management, highlights Kelley Wright, editor of IQ Trends.

The Commercial Banking segment offers credit intermediation, cash management, and financial services, including lending and depository products for business, government, and professional customers. The Consumer and Small Banking segment caters to individuals and small businesses with various deposit and loan products, including home equity loans, credit cards, and residential mortgages.

Additionally, the Wealth & Asset Management segment provides wealth management services to individuals, companies, and non-profit organizations, offering retail brokerage and broker-dealer services. Fifth Third Bancorp has over 1,000 branches and $210 billion in assets, with a significant presence in Ohio, Kentucky, Indiana, Michigan, Illinois, Florida, and the Carolinas.

The company provides value through its strong regional presence, particularly in the Midwest and Southeast US, and its emphasis on innovative digital banking solutions. The bank’s strategic investments in technology and branch expansions, particularly in the Southeast, enhance its competitive positioning.

Plus, its acquisition of Comerica is expected to improve its financial strength and enhance its capital ratios. It will also create a “super regional bank” with increased assets and geographic reach – and its strategic branch expansion in the Southeast is anticipated to support significant deposit growth, leveraging the region’s favorable demographic trends.

The ROIC, FCFY, and P/EBV are 6%, 6%, and 1.2 respectively. Economic Earnings are -$1.84 vs $3.22 reported. Economic Book Value = $35.73 per share.

About the Author

Kelley Wright entered the financial services industry in 1984 as a stock broker, first with a private investment boutique in La Jolla and later with Dean Witter Reynolds. In 1990, he left the retail side of the industry for private portfolio management. In 2002, Mr. Wright succeeded Geraldine Weiss as the managing editor of the Investment Quality Trends newsletter as well as the chief investment officer and portfolio manager for IQ Trends Private Client.

His commentaries have been published in Barron's, Forbes, BusinessWeek, Dow Jones MarketWatch, The Economist, and many other business and financial periodicals. Mr. Wright is an active speaker at trade shows and investment conferences, and is a frequent guest and contributor to radio and CNBC. He is the author of Dividends Still Don't Lie, which was published in February, 2010, by John Wiley & Sons, Inc.

More By This Author:

AI: No, This Is Not A Replay Of The Dot-Com BubbleCCL: After Another Great Quarter, Give This Cruise Line Stock A Look

SPY: Four Strategies For A Market Where Retail Investors Are "All In"