Fed’s Policy Uncertainty Weighs On Tech As Inflation Fears Return

The drop in US stocks in recent days as renewed concern swirled on Wall Street over the Fed’s interest rate policy path and whether policymakers will enact another hike this year.

A series of economic data points this week, including fewer-than-expected jobless claims and IMS service PMI, contributed to fears that the strong labor market may make the Federal Reserve think twice about relaxing its tight monetary policy stance.

Weekly jobless claims came in at 216,000, versus the 230,000 expected, while second-quarter labor costs rose more than anticipated.

October WTI crude oil contracts touched an intraday $88.08 per barrel, the highest price since 15 November 2022. Higher oil prices were one of the main reasons that caused inflation to rise in 2022.

Combined with the recent uptick in energy prices, a better jobs market will boost the need for the Fed to act. Traders hope the Fed will be on hold for the rest of the year, but we may have one or two more rate hikes to come.

The likelihood that inflation numbers will remain stubbornly high for a while could mean more interest rate increases, former St. Louis Federal Reserve President James Bullard said Thursday.

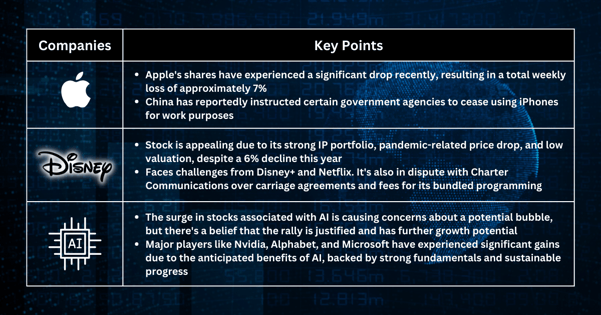

Apple: China’s potential move may harm its share in the near term

Shares of Apple (AAPL) fell hard in the past days, extending this week's losses to roughly 7%.

According to some news, China has ordered officials at some government agencies to stop using iPhones at work. Meanwhile, the company is gearing up for an annual promotional event next week. And a new Huawei phone is gaining notice in China.

Apple's influence on the S&P 500's IT sector could indirectly be affected if China's action is confirmed.

Disney: Valuation looks attractive in the long term

Disney (DIS) is the most compelling stock in Media: an IP powerhouse down on its luck at a COVID price and historically low multiple. The stock has declined about 6% this year as the company faces Disney+ subscriber losses, headwinds from a decreased ad budget, and streaming competition with Netflix’s new ad tier.

Disney has also recently been at odds with Charter Communications after the two companies failed to reach a new carriage agreement, partly driven by the fees Disney seeks for its bundle programming. Disney-owned channels include ABC, ESPN, and FX. The company also owns a majority stake in Hulu.

AI: Bubble yet to burst

The growing popularity of stocks tied to artificial intelligence has fuelled fears of a bubble, but we believe the rally has been justified and has more room to run.

The anticipated AI gains boosted major players like Nvidia (NVDA), Alphabet (GOOGL), and Microsoft (MSFT) in a strong rally this year. The rapid progress, even though seen as unsustainable by some, is backed by strong underlying fundamentals.

Current valuations in the technology sector are not as stretched as in previous bubble periods, and the ‘early winners’ that have enjoyed outstanding returns have exceptional balance sheets and returns on investment.

More By This Author:

Market Anticipation Grows: Analyzing The Upcoming US CPI Data Release And Its ImplicationsStocks Pick Of The Week - Stock Market Faces Murky September Outlook Amid Heightened Uncertainties

US Jobs Report Says Fed Will Hold This Month, Will That Help Stocks?

Disclaimer: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. ...

more