FedEx Stock Signal: Can The Price Action Delivery Continue?

Long Trade Idea

Enter your long position between $274.98 (the intra-day low of its last bearish candlestick) and $285.49 (yesterday’s intra-day high).

Market Index Analysis

- FedEx (FDX) is a member of the S&P 100 and the S&P 500.

- Both indices formed a bearish chart pattern with rising downside catalysts.

- The Bull Bear Power Indicator of the S&P 500 is bullish, but shows a negative divergence, and does not support the recent uptrend.

Market Sentiment Analysis

While equity markets rallied yesterday after the Federal Reserve announced its widely expected 25-basis-point interest rate cut with a hawkish forward-looking statement, and only one expected reduction in 2026 for now, futures are plunging this morning. The central bank noted the inflationary effects of tariffs, raising the bar for future cuts. Adding to bearish sentiment is Oracle’s plunge after reporting disappointing earnings, fueling AI concerns. Earnings from Broadcom, Costco, and Lululemon are also due today.

FedEx Fundamental Analysis

FedEx is a transportation, e-commerce, and business services conglomerate with over 210,00 motorized vehicles.

So, why am I bullish on FDX ahead of next week’s earnings report?

I expect FedEx to beat earnings on the top and bottom line next week, driven by its ongoing cost-cutting initiatives, adding to last quarter’s $200 million in transformation-related savings, its strong delivery performance amid the rapidly expanding e-commerce sector, and the spin-off of its FedEx Freight unit. Despite its 27%+ rally following its last earnings report, shares remain undervalued, but I expect the growth trajectory to slow.

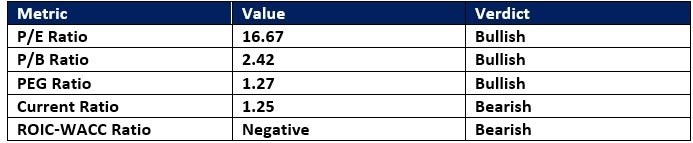

FedEx Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 16.67 makes FDX an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 29.21.

The average analyst price target for FDX is 279.29. It shows that price action has overshot its average target, but I see it moving to the top of the forecast range above 340.00.

FedEx Technical Analysis

Today’s FDX Signal

(Click on image to enlarge)

FedEx Price Chart

- The FDX D1 chart shows price action inside a bullish price channel.

- It also shows price action challenging its ascending 0.0% Fibonacci Retracement Fan level for a breakout.

- The Bull Bear Power Indicator has been bullish since mid-October, but a negative divergence suggests short-term turbulence ahead.

- The average bullish trading volumes are higher than the average bearish trading volumes.

- FDX rallied with the S&P 500 Index, a bullish confirmation.

My Call on FedEx

I am taking a long position in FDX between $274.98 and $285.49. While I see short-term volatility, I remain bullish on its cost-cutting program to weather revenue woes, deliver margin expansion, and an earnings beat, with an upbeat outlook next week amid an expected solid holiday shipping season.

- FDX Entry Level: Between $274.98 and $285.49

- FDX Take Profit: Between $334.65 and $345.00

- FDX Stop Loss: Between $250.09 and $259.79

- Risk/Reward Ratio: 2.40

More By This Author:

EUR/USD Forex Signal: Weakly Bearish Sequence

Weekly Forex Forecast – USD/CAD, USD/MXN, S&P 500 Index, Silver

GBP/USD Forex Signal: Looking Bullish

Risk Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more