FedEx Soars After Boosting Earnings Forecast Amid Aggressive Cost-Cutting

Image Source: Unspash

After a seemingly endless stretch of dismal earnings reports which hammered the stock of the global logistics giant over the past year, moments ago FedEx (FDX) finally redeemed itself when it reported fiscal Q3 results that were mediocre, but provided guidance that blew away consensus expectations out of the water.

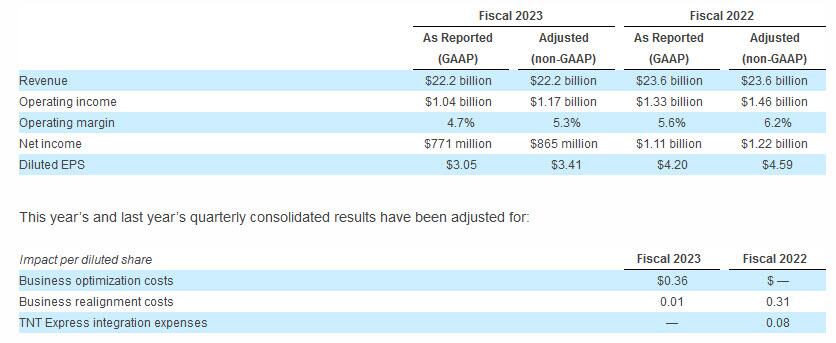

For Q3 the company reported results that beat on the bottom line but missed on the top and that uniformly dropped from a year ago:

- Adjusted EPS $3.41, beating estimate $2.71, but down from $4.59 Y/Y

- Revenue $22.2 billion, missing estimate $22.67 billion, and down from $23.6 billion Y/Y

- Adjusted operating income $1.17 billion, beating estimate $986.2 million, down from $1.46 billion Y/Y

- Adjusted operating margin 5.3%, beating estimate 4.4%, down from 6.2% Y/Y

“We’ve continued to move with urgency to improve efficiency, and our cost actions are taking hold, driving an improved outlook,” Chief Executive Officer Raj Subramaniam said in the statement.

Some more details from the quarter:

-

Third quarter results were negatively affected by continued demand weakness, particularly at FedEx Express. In addition, operating income was negatively affected by the effects of global inflation, partially offset by U.S. domestic yield improvement and cost-reduction actions.

-

FedEx Ground operating results improved, primarily due to an 11% increase in revenue per package and cost-reduction actions. These factors were partially offset by lower package volume, higher infrastructure costs and increased other operating expenses.

-

FedEx Freight operating results improved, driven by an 11% increase in revenue per shipment and a gain on the sale of a facility, partially offset by decreased shipments.

-

FedEx Express operating results declined due to lower global volumes, partially offset by a 3% increase in revenue per package. FedEx Express continues to implement volume-related and structural cost-reduction actions to mitigate the negative effect of ongoing demand weakness.

Although demand has softened, FedEx has been able to maintain robust pricing, especially for ground deliveries, and had announced a general rate increase of 6.9% for this year, the largest such increase in its history.

But what really helped push FedEx stock higher after hours was its boost of its adjusted EPS forecast for the full year; the guidance beat the average analyst estimate.

-

Sees adjusted EPS $14.60 to $15.20, saw $13 to $14, estimate $13.57

-

Still sees capital expenditure $5.9 billion, estimate $5.91 billion

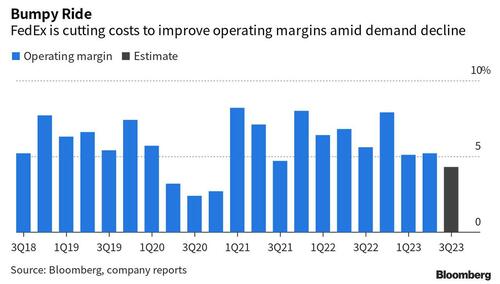

Behind the boost is the ongoing implementation of the company's cost-cutting plan which is starting to kick in, helping make up for a decline in package volume.

CEO Subramaniam has sought to cut costs and strengthen operations in response to weaker package volume as people return to stores and spend on more services following the pandemic. He previously ordered savings of up to $3.7 billion from its original annual spending plan, including shedding 10% of top management jobs.

While the cuts have been across the board, the brunt of them have fallen to Express, the company’s largest unit. The courier has reduced flights and parked older planes as customers shift more cargo back to ships after supply-chain snags have eased. Volumes have also dropped at the Ground unit and FedEx Freight, the company’s trucking company.

Shares of the company rose as much as 9.5% in post-market trading in New York.

(Click on image to enlarge)

The stock gained 18% this year through Thursday’s close, well ahead of the S&P 500 Index’s increase, and i snow back at its highest since August.

More By This Author:

PacWest CFO 'Sold Puts' In 'Show Of Confidence' Last Week

FDIC Seeks Help To Restart Sale Of Silicon Valley Bank After First Attempt Falters

Goldman Raises China 2023 GDP Growth Forecast To 6.0% From 5.5%

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more