Fed Speakers, Bank Stress Tests, Micron Earnings

Photo by Joshua Sortino on Unsplash

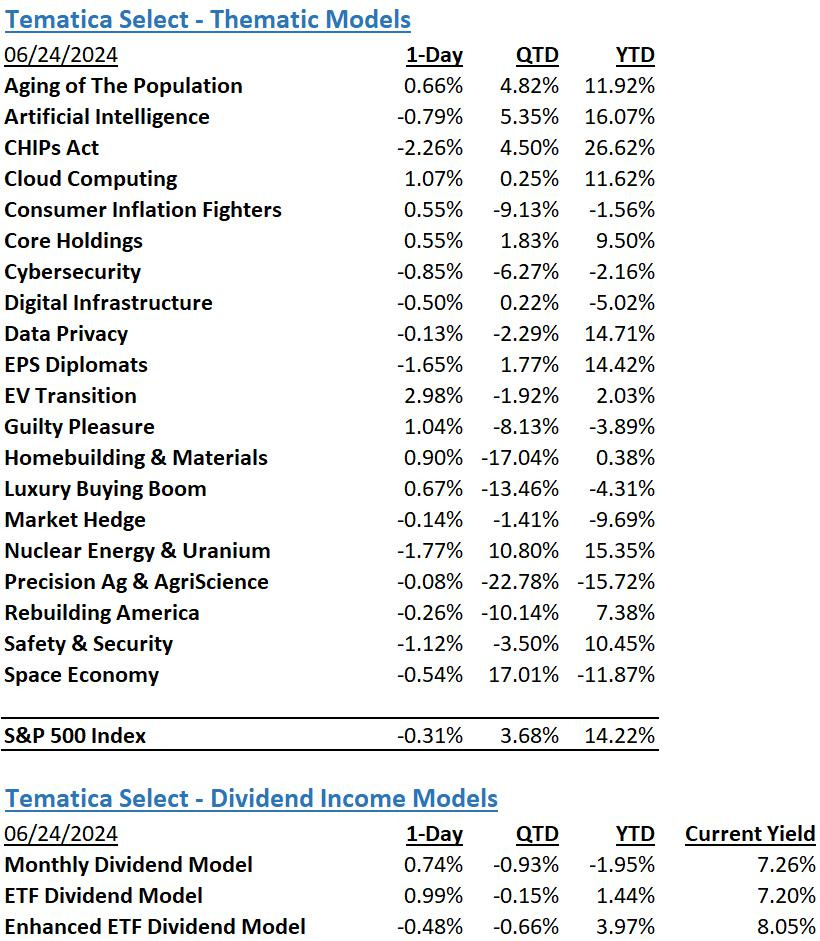

Coming off the Nasdaq Composite’s worst day in the last few months, Nasdaq futures point to a higher open this morning as do those for the S&P 500. Some of that lift is due to the pre-market rebound in Nvidia (NVDA) shares following their double-digit slide in recent days. But even after that recent fall, NVDA shares are still up considerably year-to-date, helping power our EPS Diplomats model and having a positive effect on our Digital Infrastructure and AI models as well. The arguable silver lining for NVDA’s move lower is it pulled both the Nasdaq Composite out of overbought territory and did the same for the S&P 500 but to a more modest degree.

Other than June Consumer Confidence out at 10 AM ET today and May New Home Sales tomorrow at 10 AM ET, the market will likely take its cues from the latest parade of Fed speakers as it gets ready to close the books on the current quarter. Even though rolling GDP forecasts like that published by the Atlanta Fed do not incorporate last week’s June Flash PMI data from S&P Global, it found the US economy growing above trend, more jobs being added and further progress on inflation. This, along with the May CPI and PPI data, suggest we’re going to hear Fed speakers this week say that yes, signs are encouraging but we will still need to see more progress.

As we discussed in yesterday’s The Week Ahead video, this sets up Friday’s May PCE Price Index data as a focal point in what is a pretty dull market week outside of earnings from FedEx (FDX), Micron (MU), and Nike (NKE). Comments and guidance from Micron after Wednesday’s market close, are a potential catalyst for NVDA shares as well as those tied to the PC, data center, and smartphone markets.

Before we get to that report and its implications, folks invested in or closely watching banks and related financial companies are waiting for the Fed to publish the results for its latest round of bank stress tests late Wednesday afternoon. Under the "stress test" exercise, the Fed tests big banks' balance sheets against a hypothetical scenario of a severe economic downturn, the elements of which change annually. The scenarios change each year but this year it will likely include a slump in the commercial real estate market and a global stock market shock. Once the findings of these stress tests are known, banks and related companies have made new dividend announcements and in some cases updated share repurchase programs.

More By This Author:

NFIB & Inflation, Mulling Apple IntelligenceECB Rate Cut, Nvidia Stock Split, May Employment Report

Nvidia Delivers, Flash May PMI And Inflation Comments Up Next

Disclosure: None.